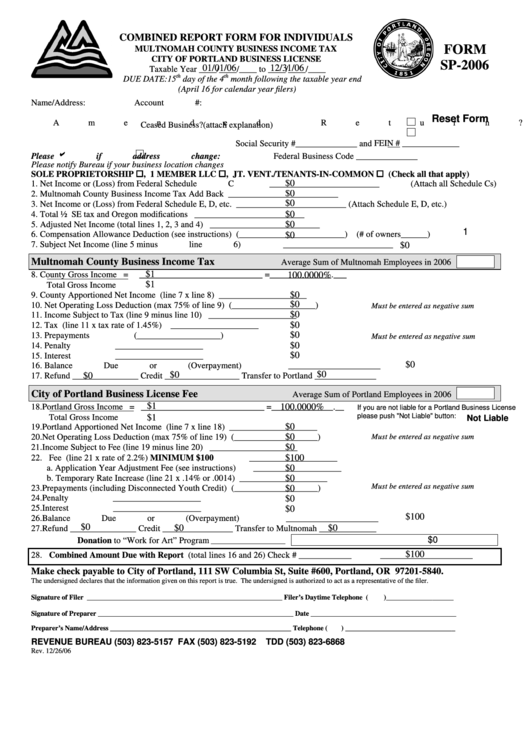

COMBINED REPORT FORM FOR INDIVIDUALS

FORM

MULTNOMAH COUNTY BUSINESS INCOME TAX

CITY OF PORTLAND BUSINESS LICENSE

SP-2006

01/01/06

12/31/06

Taxable Year ____/____/____ to ____/____/____

th

th

DUE DATE:15

day of the 4

month following the taxable year end

(April 16 for calendar year filers)

Name/Address:

Account #:

Reset Form

Amended Return?

Ceased Business?

(attach explanation)

Social Security #______________ and FEIN # _____________

b

Please

if address change:

Federal Business Code ______________

Please notify Bureau if your business location changes

SOLE PROPRIETORSHIP

, 1 MEMBER LLC

, JT. VENT./TENANTS-IN-COMMON

(Check all that apply)

$0

1. Net Income or (Loss) from Federal Schedule C

_________________________ (Attach all Schedule Cs)

$0

2. Multnomah County Business Income Tax Add Back

_________________________

$0

3. Net Income or (Loss) from Federal Schedule E, D, etc.

_________________________ (Attach Schedule E, D, etc.)

$0

4. Total ½ SE tax and Oregon modifications

_________________________

$0

5. Adjusted Net Income (total lines 1, 2, 3 and 4)

_________________________

1

6. Compensation Allowance Deduction (see instructions)

(________________________)

$0

(# of owners______)

$0

7. Subject Net Income (line 5 minus line 6)

_________________________

Multnomah County Business Income Tax

Average Sum of Multnomah Employees in 2006

$1

8.

County Gross Income =

____________________________ =______________.___

100.0000%

$1

Total Gross Income

$0

9. County Apportioned Net Income (line 7 x line 8)

____________________

$0

10. Net Operating Loss Deduction (max 75% of line 9)

(___________________)

Must be entered as negative sum

$0

11. Income Subject to Tax (line 9 minus line 10)

____________________

$0

12. Tax (line 11 x tax rate of 1.45%)

____________________

$0

13. Prepayments

(___________________)

Must be entered as negative sum

$0

14. Penalty

____________________

$0

15. Interest

____________________

$0

16. Balance Due or (Overpayment)

_____________________

$0

$0

$0

17. Refund _______________ Credit _________________ Transfer to Portland ______________

City of Portland Business License Fee

Average Sum of Portland Employees in 2006

$1

100.0000%

18. Portland Gross Income = ____________________________ =______________.__

If you are not liable for a Portland Business License

please push "Not Liable" button:

Total Gross Income

$1

Not Liable

$0

19. Portland Apportioned Net Income (line 7 x line 18)

____________________

$0

Must be entered as negative sum

20. Net Operating Loss Deduction (max 75% of line 19)

(___________________)

$0

21. Income Subject to Fee (line 19 minus line 20)

____________________

$100

22. Fee (line 21 x rate of 2.2%) MINIMUM $100

____________________

$0

a. Application Year Adjustment Fee (see instructions)

____________________

$0

b. Temporary Rate Increase (line 21 x .14% or .0014)

____________________

Must be entered as negative sum

$0

23. Prepayments (including Disconnected Youth Credit)

(___________________)

$0

24. Penalty

____________________

25. Interest

____________________

$0

$100

26. Balance Due or (Overpayment)

_____________________

$0

$0

$0

27. Refund _______________ Credit ________________ Transfer to Multnomah _____________

$0

Donation to “Work for Art” Program

_____________________

$100

28. Combined Amount Due with Report (total lines 16 and 26) Check # ____________

_____________________

Make check payable to City of Portland, 111 SW Columbia St, Suite #600, Portland, OR 97201-5840.

The undersigned declares that the information given on this report is true. The undersigned is authorized to act as a representative of the filer.

Signature of Filer _______________________________________________________ Filer’s Daytime Telephone (

)___________________

Signature of Preparer _______________________________________________________ Date _________________________________________

Preparer’s Name/Address ___________________________________________________ Telephone (

) _______________________________

REVENUE BUREAU (503) 823-5157

FAX (503) 823-5192

TDD (503) 823-6868

Rev. 12/26/06

1

1