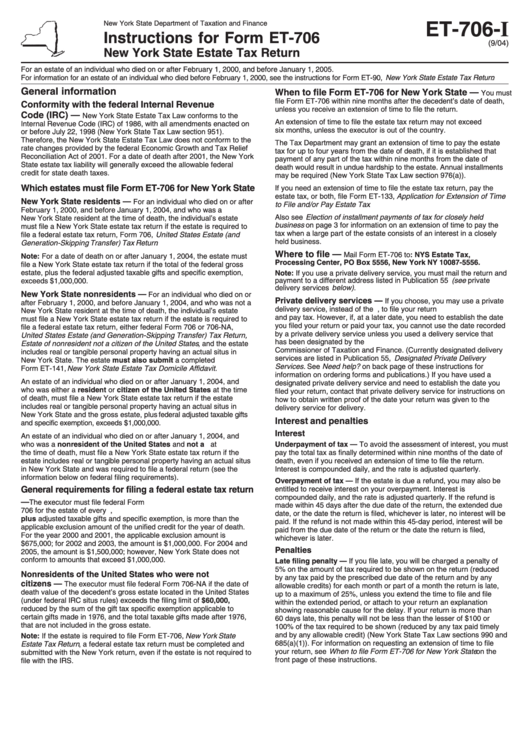

Instructions For Form Et-706 - New York State Estate Tax Return

ADVERTISEMENT

New York State Department of Taxation and Finance

ET-706- I

Instructions for Form ET-706

(9/04)

New York State Estate Tax Return

For an estate of an individual who died on or after February 1, 2000, and before January 1, 2005.

For information for an estate of an individual who died before February 1, 2000, see the instructions for Form ET-90, New York State Estate Tax Return .

General information

When to file Form ET-706 for New York State —

You must

file Form ET-706 within nine months after the decedent’s date of death,

Conformity with the federal Internal Revenue

unless you receive an extension of time to file the return.

Code (IRC) —

New York State Estate Tax Law conforms to the

An extension of time to file the estate tax return may not exceed

Internal Revenue Code (IRC) of 1986, with all amendments enacted on

six months, unless the executor is out of the country.

or before July 22, 1998 (New York State Tax Law section 951).

Therefore, the New York State Estate Tax Law does not conform to the

The Tax Department may grant an extension of time to pay the estate

rate changes provided by the federal Economic Growth and Tax Relief

tax for up to four years from the date of death, if it is established that

Reconciliation Act of 2001. For a date of death after 2001, the New York

payment of any part of the tax within nine months from the date of

State estate tax liability will generally exceed the allowable federal

death would result in undue hardship to the estate. Annual installments

credit for state death taxes.

may be required (New York State Tax Law section 976(a)).

Which estates must file Form ET-706 for New York State

If you need an extension of time to file the estate tax return, pay the

estate tax, or both, file Form ET-133, Application for Extension of Time

New York State residents —

For an individual who died on or after

to File and/or Pay Estate Tax .

February 1, 2000, and before January 1, 2004, and who was a

Also see Election of installment payments of tax for closely held

New York State resident at the time of death, the individual’s estate

business on page 3 for information on an extension of time to pay the

must file a New York State estate tax return if the estate is required to

tax when a large part of the estate consists of an interest in a closely

file a federal estate tax return, Form 706, United States Estate (and

held business.

Generation-Skipping Transfer) Tax Return .

Where to file —

Mail Form ET-706 to: NYS Estate Tax,

Note: For a date of death on or after January 1, 2004, the estate must

Processing Center, PO Box 5556, New York NY 10087-5556.

file a New York State estate tax return if the total of the federal gross

estate, plus the federal adjusted taxable gifts and specific exemption,

Note: If you use a private delivery service, you must mail the return and

payment to a different address listed in Publication 55 (see private

exceeds $1,000,000.

delivery services below) .

New York State nonresidents —

For an individual who died on or

Private delivery services —

If you choose, you may use a private

after February 1, 2000, and before January 1, 2004, and who was not a

delivery service, instead of the U.S. Postal Service, to file your return

New York State resident at the time of death, the individual’s estate

and pay tax. However, if, at a later date, you need to establish the date

must file a New York State estate tax return if the estate is required to

you filed your return or paid your tax, you cannot use the date recorded

file a federal estate tax return, either federal Form 706 or 706-NA,

by a private delivery service unless you used a delivery service that

United States Estate (and Generation-Skipping Transfer) Tax Return,

has been designated by the U.S. Secretary of the Treasury or the

Estate of nonresident not a citizen of the United States , and the estate

Commissioner of Taxation and Finance. (Currently designated delivery

includes real or tangible personal property having an actual situs in

services are listed in Publication 55, Designated Private Delivery

New York State. The estate must also submit a completed

Services. See Need help? on back page of these instructions for

Form ET-141, New York State Estate Tax Domicile Affidavit.

information on ordering forms and publications.) If you have used a

An estate of an individual who died on or after January 1, 2004, and

designated private delivery service and need to establish the date you

who was either a resident or citizen of the United States at the time

filed your return, contact that private delivery service for instructions on

of death, must file a New York State estate tax return if the estate

how to obtain written proof of the date your return was given to the

includes real or tangible personal property having an actual situs in

delivery service for delivery.

New York State and the gross estate, plus federal adjusted taxable gifts

Interest and penalties

and specific exemption, exceeds $1,000,000.

Interest

An estate of an individual who died on or after January 1, 2004, and

who was a nonresident of the United States and not a U.S. citizen at

Underpayment of tax — To avoid the assessment of interest, you must

the time of death, must file a New York State estate tax return if the

pay the total tax as finally determined within nine months of the date of

estate includes real or tangible personal property having an actual situs

death, even if you received an extension of time to file the return.

in New York State and was required to file a federal return (see the

Interest is compounded daily, and the rate is adjusted quarterly.

information below on federal filing requirements).

Overpayment of tax — If the estate is due a refund, you may also be

General requirements for filing a federal estate tax return

entitled to receive interest on your overpayment. Interest is

compounded daily, and the rate is adjusted quarterly. If the refund is

U.S. citizens and residents —

The executor must file federal Form

made within 45 days after the due date of the return, the extended due

706 for the estate of every U.S. citizen or resident whose gross estate,

date, or the date the return is filed, whichever is later, no interest will be

plus adjusted taxable gifts and specific exemption, is more than the

paid. If the refund is not made within this 45-day period, interest will be

applicable exclusion amount of the unified credit for the year of death.

paid from the due date of the return or the date the return is filed,

For the year 2000 and 2001, the applicable exclusion amount is

whichever is later.

$675,000; for 2002 and 2003, the amount is $1,000,000. For 2004 and

Penalties

2005, the amount is $1,500,000; however, New York State does not

conform to amounts that exceed $1,000,000.

Late filing penalty — If you file late, you will be charged a penalty of

5% on the amount of tax required to be shown on the return (reduced

Nonresidents of the United States who were not U.S.

by any tax paid by the prescribed due date of the return and by any

citizens —

The executor must file federal Form 706-NA if the date of

allowable credits) for each month or part of a month the return is late,

death value of the decedent’s gross estate located in the United States

up to a maximum of 25%, unless you extend the time to file and file

(under federal IRC situs rules) exceeds the filing limit of $60,000,

within the extended period, or attach to your return an explanation

reduced by the sum of the gift tax specific exemption applicable to

showing reasonable cause for the delay. If your return is more than

certain gifts made in 1976, and the total taxable gifts made after 1976,

60 days late, this penalty will not be less than the lesser of $100 or

that are not included in the gross estate.

100% of the tax required to be shown (reduced by any tax paid timely

and by any allowable credit) (New York State Tax Law sections 990 and

Note: If the estate is required to file Form ET-706, New York State

685(a)(1)). For information on requesting an extension of time to file

Estate Tax Return , a federal estate tax return must be completed and

your return, see When to file Form ET-706 for New York State on the

submitted with the New York return, even if the estate is not required to

front page of these instructions.

file with the IRS.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4