(10/18/11)

Vendor ID

—

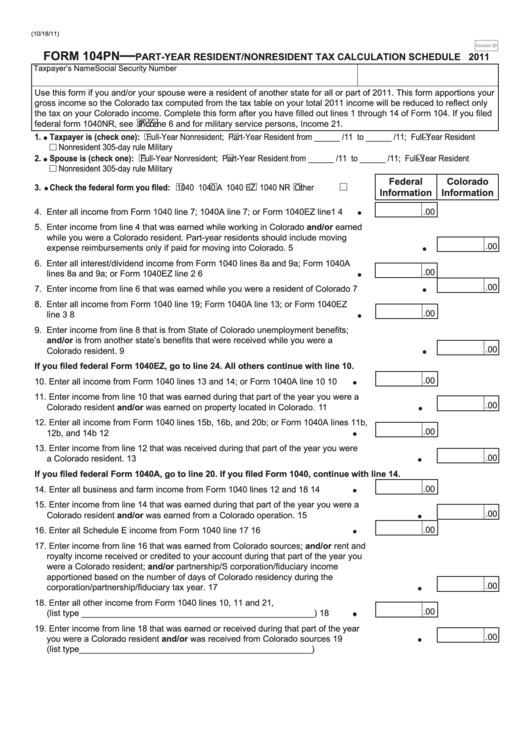

FORM 104PN

PART-YEAR RESIDENT/NONRESIDENT TAX CALCULATION SCHEDULE 2011

Taxpayer’s Name

Social Security Number

Use this form if you and/or your spouse were a resident of another state for all or part of 2011. This form apportions your

gross income so the Colorado tax computed from the tax table on your total 2011 income will be reduced to reflect only

the tax on your Colorado income. Complete this form after you have filled out lines 1 through 14 of Form 104. If you filed

federal form 1040NR, see

Income 6 and for military service persons, Income 21.

1. Taxpayer is (check one):

Full-Year Nonresident;

Part-Year Resident from ______ /11 to ______ /11;

Full-Year Resident

Nonresident 305-day rule Military

2. Spouse is (check one):

Full-Year Nonresident;

Part-Year Resident from ______ /11 to ______ /11;

Full-Year Resident

Nonresident 305-day rule Military

Federal

Colorado

3. Check the federal form you filed:

1040

1040 A

1040 EZ

1040 NR

Other

Information

Information

4. Enter all income from Form 1040 line 7; 1040A line 7; or Form 1040EZ line1 ....... 4

.00

5. Enter income from line 4 that was earned while working in Colorado and/or earned

while you were a Colorado resident. Part-year residents should include moving

.00

expense reimbursements only if paid for moving into Colorado. ....................................................... 5

6. Enter all interest/dividend income from Form 1040 lines 8a and 9a; Form 1040A

.00

lines 8a and 9a; or Form 1040EZ line 2 .................................................................. 6

.00

7. Enter income from line 6 that was earned while you were a resident of Colorado ............................ 7

8. Enter all income from Form 1040 line 19; Form 1040A line 13; or Form 1040EZ

.00

line 3 ....................................................................................................................... 8

9. Enter income from line 8 that is from State of Colorado unemployment benefits;

and/or is from another state’s benefits that were received while you were a

.00

Colorado resident. .............................................................................................................................. 9

If you filed federal Form 1040EZ, go to line 24. All others continue with line 10.

.00

10. Enter all income from Form 1040 lines 13 and 14; or Form 1040A line 10 ........... 10

11. Enter income from line 10 that was earned during that part of the year you were a

.00

Colorado resident and/or was earned on property located in Colorado. .......................................... 11

12. Enter all income from Form 1040 lines 15b, 16b, and 20b; or Form 1040A lines 11b,

.00

12b, and 14b ......................................................................................................... 12

13. Enter income from line 12 that was received during that part of the year you were

.00

a Colorado resident. ......................................................................................................................... 13

If you filed federal Form 1040A, go to line 20. If you filed Form 1040, continue with line 14.

.00

14. Enter all business and farm income from Form 1040 lines 12 and 18 .................. 14

15. Enter income from line 14 that was earned during that part of the year you were a

.00

Colorado resident and/or was earned from a Colorado operation. ................................................. 15

.00

16. Enter all Schedule E income from Form 1040 line 17 ........................................... 16

17. Enter income from line 16 that was earned from Colorado sources; and/or rent and

royalty income received or credited to your account during that part of the year you

were a Colorado resident; and/or partnership/S corporation/fiduciary income

apportioned based on the number of days of Colorado residency during the

.00

corporation/partnership/fiduciary tax year. ....................................................................................... 17

18. Enter all other income from Form 1040 lines 10, 11 and 21,

.00

(list type _________________________________________________) ............ 18

19. Enter income from line 18 that was earned or received during that part of the year

.00

you were a Colorado resident and/or was received from Colorado sources ................................... 19

(list type_________________________________________________)

1

1 2

2