Form 104pn - Part-Year Resident/nonresident Tax Calculation Schedule - 2000

ADVERTISEMENT

-

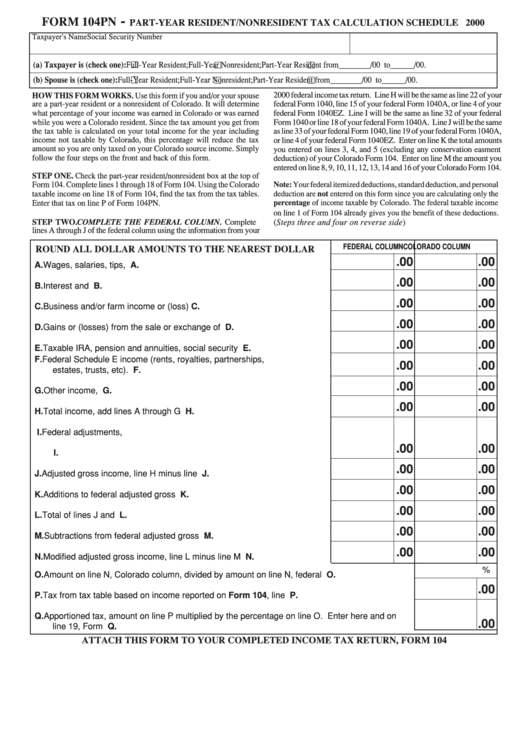

FORM 104PN

PART-YEAR RESIDENT/NONRESIDENT TAX CALCULATION SCHEDULE 2000

Taxpayer's Name

Social Security Number

(a) Taxpayer is (check one):

Full-Year Resident;

Full-Year Nonresident;

Part-Year Resident from ________ /00 to ______ /00.

(b) Spouse is (check one):

Full-Year Resident;

Full-Year Nonresident;

Part-Year Resident from ________ /00 to ______ /00.

2000 federal income tax return. Line H will be the same as line 22 of your

HOW THIS FORM WORKS. Use this form if you and/or your spouse

are a part-year resident or a nonresident of Colorado. It will determine

federal Form 1040, line 15 of your federal Form 1040A, or line 4 of your

what percentage of your income was earned in Colorado or was earned

federal Form 1040EZ. Line I will be the same as line 32 of your federal

while you were a Colorado resident. Since the tax amount you get from

Form 1040 or line 18 of your federal Form 1040A. Line J will be the same

the tax table is calculated on your total income for the year including

as line 33 of your federal Form 1040, line 19 of your federal Form 1040A,

income not taxable by Colorado, this percentage will reduce the tax

or line 4 of your federal Form 1040EZ. Enter on line K the total amounts

amount so you are only taxed on your Colorado source income. Simply

you entered on lines 3, 4, and 5 (excluding any conservation easment

follow the four steps on the front and back of this form.

deduction) of your Colorado Form 104. Enter on line M the amount you

entered on line 8, 9, 10, 11, 12, 13, 14 and 16 of your Colorado Form 104.

STEP ONE. Check the part-year resident/nonresident box at the top of

Form 104. Complete lines 1 through 18 of Form 104. Using the Colorado

Note: Your federal itemized deductions, standard deduction, and personal

taxable income on line 18 of Form 104, find the tax from the tax tables.

deduction are not entered on this form since you are calculating only the

percentage of income taxable by Colorado. The federal taxable income

Enter that tax on line P of Form 104PN.

on line 1 of Form 104 already gives you the benefit of these deductions.

STEP TWO. COMPLETE THE FEDERAL COLUMN. Complete

(Steps three and four on reverse side)

lines A through J of the federal column using the information from your

FEDERAL COLUMN

COLORADO COLUMN

ROUND ALL DOLLAR AMOUNTS TO THE NEAREST DOLLAR

.00

.00

A.

Wages, salaries, tips, etc. ................................................................. A.

.00

.00

B.

Interest and dividends ....................................................................... B.

.00

.00

C.

Business and/or farm income or (loss) .............................................. C.

.00

.00

D.

Gains or (losses) from the sale or exchange of assets ..................... D.

.00

.00

E.

Taxable IRA, pension and annuities, social security .......................... E.

F.

Federal Schedule E income (rents, royalties, partnerships,

.00

.00

estates, trusts, etc). ............................................................................ F.

.00

.00

G.

Other income, list .............................................................................. G.

.00

.00

H.

Total income, add lines A through G ................................................. H.

I.

Federal adjustments, list .......................................................................

.00

.00

............................................................................................................. I.

.00

.00

J.

Adjusted gross income, line H minus line I ......................................... J.

.00

.00

K.

Additions to federal adjusted gross income ....................................... K.

.00

.00

L.

Total of lines J and K .......................................................................... L.

.00

.00

M. Subtractions from federal adjusted gross income ............................. M.

.00

.00

N.

Modified adjusted gross income, line L minus line M ........................ N.

%

O.

Amount on line N, Colorado column, divided by amount on line N, federal column ............... O.

.00

P.

Tax from tax table based on income reported on Form 104, line 18 ..................................... P.

Q.

Apportioned tax, amount on line P multiplied by the percentage on line O. Enter here and on

.00

line 19, Form 104 ................................................................................................................... Q.

ATTACH THIS FORM TO YOUR COMPLETED INCOME TAX RETURN, FORM 104

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2