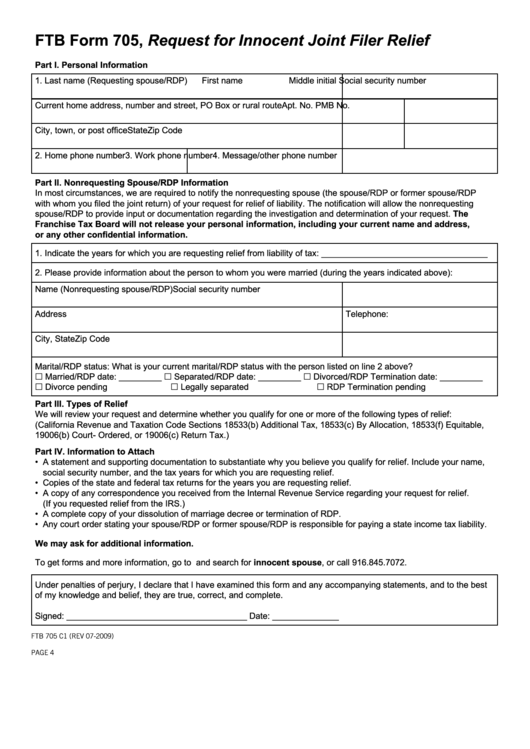

FTB Form 705, Request for Innocent Joint Filer Relief

Part I. Personal Information

1. Last name (Requesting spouse/RDP)

First name

Middle initial

Social security number

Current home address, number and street, PO Box or rural route

Apt. No.

PMB No.

City, town, or post office

State

Zip Code

2. Home phone number

3. Work phone number

4. Message/other phone number

Part II. Nonrequesting Spouse/RDP Information

In most circumstances, we are required to notify the nonrequesting spouse (the spouse/RDP or former spouse/RDP

with whom you filed the joint return) of your request for relief of liability. The notification will allow the nonrequesting

spouse/RDP to provide input or documentation regarding the investigation and determination of your request. The

Franchise Tax Board will not release your personal information, including your current name and address,

or any other confidential information.

1. Indicate the years for which you are requesting relief from liability of tax: ___________________________________

2. Please provide information about the person to whom you were married (during the years indicated above):

Name (Nonrequesting spouse/RDP)

Social security number

Address

Telephone:

City, State

Zip Code

Marital/RDP status: What is your current marital/RDP status with the person listed on line 2 above?

Married/RDP date: _________ Separated/RDP date: _________ Divorced/RDP Termination date: _________

Divorce pending

Legally separated

RDP Termination pending

Part III. Types of Relief

We will review your request and determine whether you qualify for one or more of the following types of relief:

(California Revenue and Taxation Code Sections 18533(b) Additional Tax, 18533(c) By Allocation, 18533(f) Equitable,

19006(b) Court- Ordered, or 19006(c) Return Tax.)

Part IV. Information to Attach

•

A statement and supporting documentation to substantiate why you believe you qualify for relief. Include your name,

social security number, and the tax years for which you are requesting relief.

•

Copies of the state and federal tax returns for the years you are requesting relief.

•

A copy of any correspondence you received from the Internal Revenue Service regarding your request for relief.

(If you requested relief from the IRS.)

•

A complete copy of your dissolution of marriage decree or termination of RDP.

•

Any court order stating your spouse/RDP or former spouse/RDP is responsible for paying a state income tax liability.

We may ask for additional information.

To get forms and more information, go to ftb.ca.gov and search for innocent spouse, or call 916.845.7072.

Under penalties of perjury, I declare that I have examined this form and any accompanying statements, and to the best

of my knowledge and belief, they are true, correct, and complete.

Signed: ______________________________________ Date: ______________

FTB 705 C1 (REV 07-2009)

PAGE 4

1

1