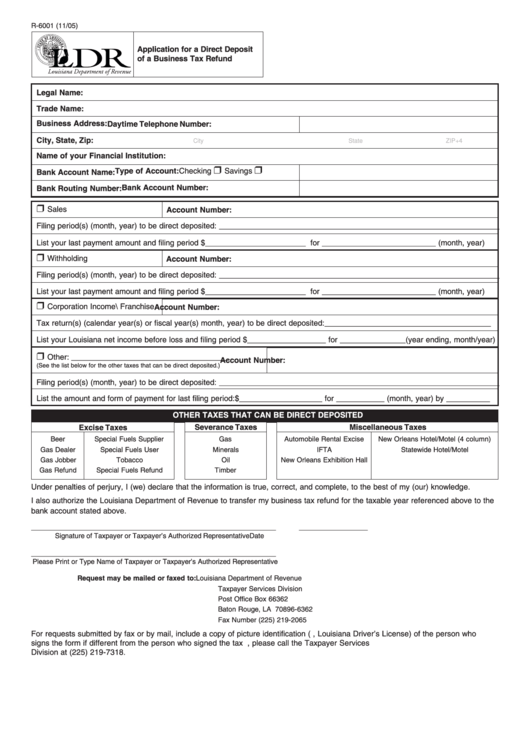

R-6001 (11/05)

Application for a Direct Deposit

of a Business Tax Refund

Legal Name:

Trade Name:

Business Address:

Daytime Telephone Number:

City, State, Zip:

City

State

ZIP+4

Name of your Financial Institution:

❒

❒

Type of Account: Checking

Savings

Bank Account Name:

Bank Account Number:

Bank Routing Number:

❒

Sales

Account Number:

Filing period(s) (month, year) to be direct deposited: ________________________________________________________________

List your last payment amount and filing period $_______________________ for __________________________ (month, year)

❒

Withholding

Account Number:

Filing period(s) (month, year) to be direct deposited: ________________________________________________________________

List your last payment amount and filing period $_______________________ for __________________________ (month, year)

❒

Corporation Income\ Franchise

Account Number:

Tax return(s) (calendar year(s) or fiscal year(s) month, year) to be direct deposited: ______________________________________

List your Louisiana net income before loss and filing period $__________________ for _______________(year ending, month/year)

❒

Other: ____________________________________

Account Number:

(See the list below for the other taxes that can be direct deposited.)

Filing period(s) (month, year) to be direct deposited: ________________________________________________________________

List the amount and form of payment for last filing period: $___________________ for ___________ (month, year) by __________

OTHER TAXES THAT CAN BE DIRECT DEPOSITED

Excise Taxes

Severance Taxes

Miscellaneous Taxes

Beer

Special Fuels Supplier

Gas

Automobile Rental Excise

New Orleans Hotel/Motel (4 column)

Gas Dealer

Special Fuels User

Minerals

IFTA

Statewide Hotel/Motel

Gas Jobber

Tobacco

Oil

New Orleans Exhibition Hall

Gas Refund

Special Fuels Refund

Timber

Under penalties of perjury, I (we) declare that the information is true, correct, and complete, to the best of my (our) knowledge.

I also authorize the Louisiana Department of Revenue to transfer my business tax refund for the taxable year referenced above to the

bank account stated above.

_________________________________________________________

________________

Signature of Taxpayer or Taxpayer’s Authorized Representative

Date

_________________________________________________________

Please Print or Type Name of Taxpayer or Taxpayer’s Authorized Representative

Request may be mailed or faxed to:

Louisiana Department of Revenue

Taxpayer Services Division

Post Office Box 66362

Baton Rouge, LA 70896-6362

Fax Number (225) 219-2065

For requests submitted by fax or by mail, include a copy of picture identification (e.g., Louisiana Driver’s License) of the person who

signs the form if different from the person who signed the tax returns. For additional information, please call the Taxpayer Services

Division at (225) 219-7318.

1

1