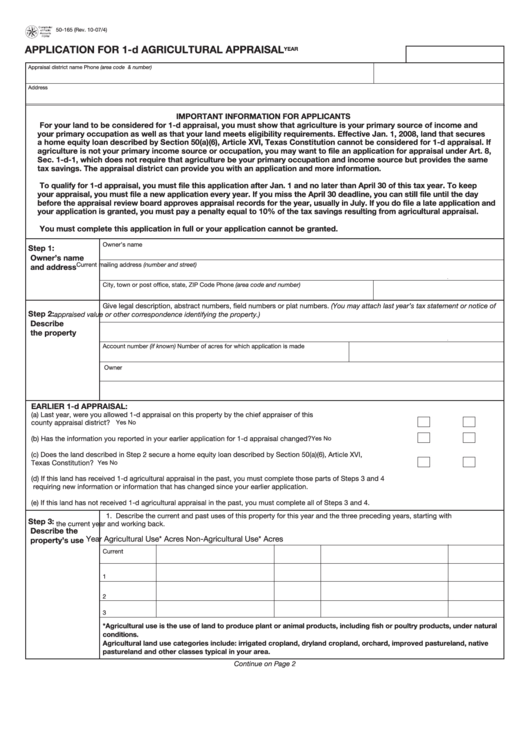

50-165 (Rev. 10-07/4)

APPLICATION FOR 1-d AGRICULTURAL APPRAISAL

YEAR

Appraisal district name

Phone (area code & number)

Address

IMPORTANT INFORMATION FOR APPLICANTS

For your land to be considered for 1-d appraisal, you must show that agriculture is your primary source of income and

your primary occupation as well as that your land meets eligibility requirements. Effective Jan. 1, 2008, land that secures

a home equity loan described by Section 50(a)(6), Article XVI, Texas Constitution cannot be considered for 1-d appraisal. If

agriculture is not your primary income source or occupation, you may want to file an application for appraisal under Art. 8,

Sec. 1-d-1, which does not require that agriculture be your primary occupation and income source but provides the same

tax savings. The appraisal district can provide you with an application and more information.

To qualify for 1-d appraisal, you must file this application after Jan. 1 and no later than April 30 of this tax year. To keep

your appraisal, you must file a new application every year. If you miss the April 30 deadline, you can still file until the day

before the appraisal review board approves appraisal records for the year, usually in July. If you do file a late application and

your application is granted, you must pay a penalty equal to 10% of the tax savings resulting from agricultural appraisal.

You must complete this application in full or your application cannot be granted.

Owner’s name

Step 1:

Owner’s name

Current mailing address (number and street)

and address

City, town or post office, state, ZIP Code

Phone (area code and number)

Give legal description, abstract numbers, field numbers or plat numbers. (You may attach last year’s tax statement or notice of

Step 2:

appraised value or other correspondence identifying the property.)

Describe

the property

Account number (if known)

Number of acres for which application is made

Owner

EARLIER 1-d APPRAISAL:

(a)

Last year, were you allowed 1-d appraisal on this property by the chief appraiser of this

county appraisal district? ................................................................................................................................................

Yes

No

(b)

Has the information you reported in your earlier application for 1-d appraisal changed? .............................................

Yes

No

(c)

Does the land described in Step 2 secure a home equity loan described by Section 50(a)(6), Article XVI,

Texas Constitution? ..........................................................................................................................................................

Yes

No

(d)

If this land has received 1-d agricultural appraisal in the past, you must complete those parts of Steps 3 and 4

requiring new information or information that has changed since your earlier application.

(e)

If this land has not received 1-d agricultural appraisal in the past, you must complete all of Steps 3 and 4.

1. Describe the current and past uses of this property for this year and the three preceding years, starting with

Step 3:

the current year and working back.

Describe the

Year

Agricultural Use*

Acres

Non-Agricultural Use*

Acres

property’s use

Current

1

2

3

*Agricultural use is the use of land to produce plant or animal products, including fish or poultry products, under natural

conditions.

Agricultural land use categories include: irrigated cropland, dryland cropland, orchard, improved pastureland, native

pastureland and other classes typical in your area.

Continue on Page 2

1

1 2

2