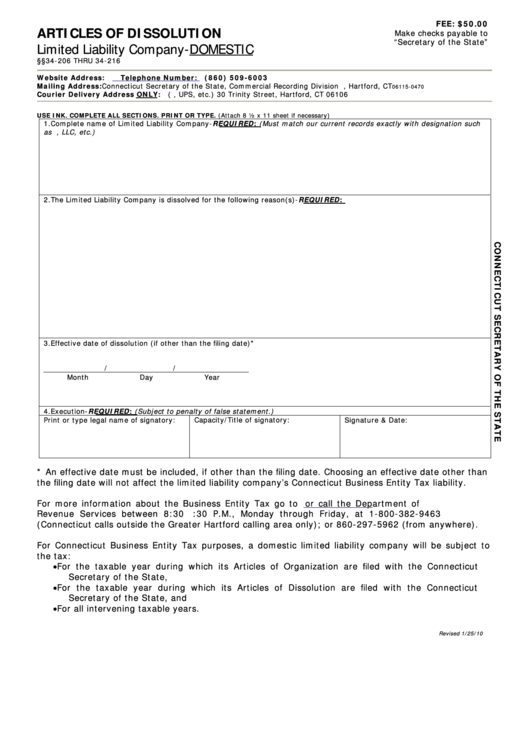

Articles Of Dissolution - Limited Liability Company - Domestic - Connecticut Secretary Of The State

ADVERTISEMENT

FEE: $50.00

ARTICLES OF DISSOLUTION

Make checks payable to

“Secretary of the State”

Limited Liability Company-DOMESTIC

C.G.S. §§34-206 THRU 34-216

Website Address:

Telephone Number: (860) 509-6003

Mailing Address:

Connecticut Secretary of the State, Commercial Recording Division P.O. Box 150470, Hartford, CT

06115-0470

Courier Delivery Address ONLY: (i.e. FedEx, UPS, etc.) 30 Trinity Street, Hartford, CT 06106

USE INK. COMPLETE ALL SECTIONS. PRINT OR TYPE. (Attach 8 ½ x 11 sheet if necessary)

1.

Complete name of Limited Liability Company-REQUIRED: (Must match our current records exactly with designation such

as L.L.C., LLC, etc.)

2.

The Limited Liability Company is dissolved for the following reason(s)-REQUIRED:

3.

Effective date of dissolution (if other than the filing date)*

/

/

Month

Day

Year

4.

Execution-REQUIRED: (Subject to penalty of false statement.)

Print or type legal name of signatory:

Capacity/Title of signatory:

Signature & Date:

* An effective date must be included, if other than the filing date. Choosing an effective date other than

the filing date will not affect the limited liability company’s Connecticut Business Entity Tax liability.

For more information about the Business Entity Tax go to

or call the Department of

Revenue Services between 8:30 A.M. and 4:30 P.M., Monday through Friday, at 1-800-382-9463

(Connecticut calls outside the Greater Hartford calling area only); or 860-297-5962 (from anywhere).

For Connecticut Business Entity Tax purposes, a domestic limited liability company will be subject to

the tax:

•

For the taxable year during which its Articles of Organization are filed with the Connecticut

Secretary of the State,

•

For the taxable year during which its Articles of Dissolution are filed with the Connecticut

Secretary of the State, and

•

For all intervening taxable years.

Revised 1/25/10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1