Pay Your Taxes by Credit Card

You can use your Discover/NOVUS, VISA, MasterCard or American Ex-

electronically, click on the “Register Now” link and follow the directions

press card to pay your income taxes. You can make the credit card

that appear.

payments either by visiting tax.ohio.gov on the Internet and clicking on

1. Amount you are paying (round to the nearest whole dollar)

the Ohio “I-File” link or by calling 1-800-2PAY-TAX (1-800-272-9829).

0 0

$

,

.

Whether you visit our Web site or pay by telephone, Official Payments

Corporation will be providing the credit card services. Official Payments

2. Your school district number

Corporation charges a convenience fee equal to 2.5% of the tax due.

Official Payments Corporation will bill your credit card account for this

convenience fee. The state of Ohio and your school district do not

3. Your Social Security number

receive any portion of this fee.

When will my payment be posted? Your payment will be effective the

date you charge it.

4. The first three letters of your last name

What happens if I change my mind? If you pay your tax liability by

credit card and you subsequently reverse the credit card transaction, you

may be subject to penalties, interest and other fees imposed by the Ohio

5. Your spouse’s Social Security number (only if joint return)

Department of Taxation for nonpayment or late payment of your tax liabil-

ity.

Whom should I call if I have a problem with my credit card pay-

6. The first three letters of your spouse’s last name (only if joint return)

ment? Call Official Payments Corporation toll-free at 1-866-621-4109.

How do I use my credit card and my telephone to pay my Ohio

income tax? Once you have determined how much you owe, follow the

7. The taxable year for which you are paying

steps below:

2 0 0 7

Have your Discover/NOVUS, VISA, MasterCard or American Express

card ready;

8. Telephone number

Complete lines 1 through 11 on this page;

(

)

Use your touch-tone telephone to call toll-free 1-800-2PAY-TAX or

1-800-272-9829. When prompted, enter (i) the letters OHIO or (ii) the

9. Your credit card number

numbers 6446 (for Ohio) or (iii) your ZIP code; then follow the re-

corded instructions.

How do I use my credit card and the Internet to pay my Ohio

10. Credit card expiration date (MM/YY)

income tax? Once you have determined how much you owe (see line 15

/

on Ohio form SD 100), follow the steps below:

Have your Discover/NOVUS, VISA, MasterCard or American Express

11. ZIP code for address where your credit card bills are sent

card ready;

Complete lines 1 through 11 on this page;

Go to tax.ohio.gov and select the “I-File” link. Click on the “Ohio

12. At the end of your call or Internet visit you will be given a payment

ePayment” link. Then click on the “Begin/Resume Filing” link. If you have

confirmation number. Write it here and keep it for your records.

previously registered either to file electronically or to pay electroni-

cally, click on the “ePayment” link and follow the directions that appear.

Keep the top half of this page

If you have not previously registered to file electronically and to pay

for your records.

Please detach here.

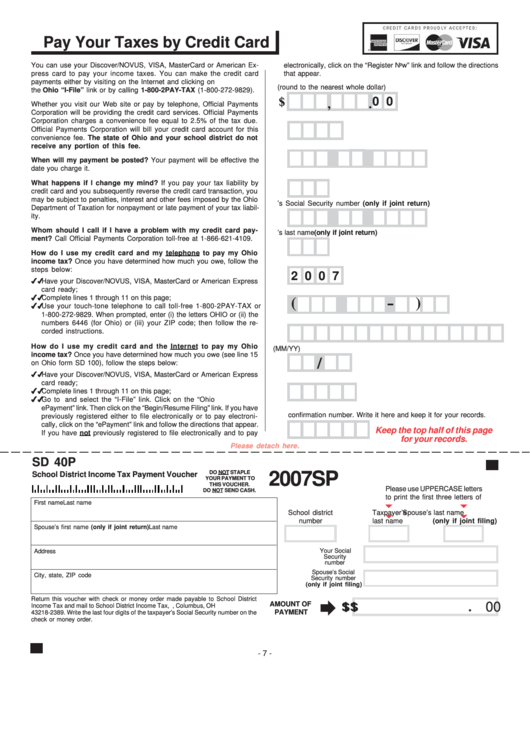

SD 40P

Reset Form

DO NOT STAPLE

2007SP

School District Income Tax Payment Voucher

YOUR PAYMENT TO

THIS VOUCHER.

Please use UPPERCASE letters

DO NOT SEND CASH.

to print the first three letters of

First name

M.I.

Last name

School district

Taxpayer’s

Spouse’s last name

number

last name

(only if joint filing)

Spouse’s first name (only if joint return)

M.I.

Last name

Your Social

Address

Security

number

Spouse’s Social

City, state, ZIP code

Security number

(only if joint filing)

Return this voucher with check or money order made payable to School District

AMOUNT OF

$ $ $ $ $

0

0

Income Tax and mail to School District Income Tax, P.O. Box 182389, Columbus, OH

PAYMENT

43218-2389. Write the last four digits of the taxpayer’s Social Security number on the

check or money order.

- 7 -

1

1