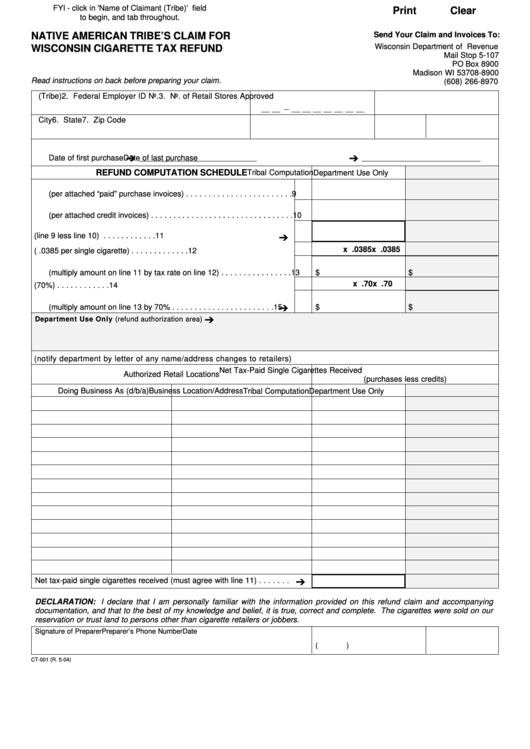

FYI - click in 'Name of Claimant (Tribe)' field

Print

Clear

to begin, and tab throughout.

NATIVE AMERICAN TRIBE’S CLAIM FOR

Send Your Claim and Invoices To:

Wisconsin Department of Revenue

WISCONSIN CIGARETTE TAX REFUND

Mail Stop 5-107

PO Box 8900

Madison WI 53708-8900

Read instructions on back before preparing your claim.

(608) 266-8970

1. Name of Claimant (Tribe)

2. Federal Employer ID No.

3. No. of Retail Stores Approved

4. Address

5. City

6. State

7. Zip Code

8. Dates of Cigarette Purchases Covered by this Refund Claim

➔

➔

Date of first purchase

Date of last purchase

REFUND COMPUTATION SCHEDULE

Tribal Computation

Department Use Only

9. Total tax-paid single cigarettes purchased

(per attached “paid” purchase invoices) . . . . . . . . . . . . . . . . . . . . . . . .

9

10. Number of tax-paid single cigarettes returned or shorted

(per attached credit invoices) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

➔

11. Net single cigarettes received (line 9 less line 10) . . . . . . . . . . . .

11

x .0385

x .0385

12. CIGARETTE TAX RATE ( .0385 per single cigarette) . . . . . . . . . . . . . 12

13. CIGARETTE TAX PAID

(multiply amount on line 11 by tax rate on line 12) . . . . . . . . . . . . . . . . 13

$

$

x .70

x .70

14. Allowable tribal cigarette tax refund percentage (70%) . . . . . . . . . . . . 14

15. TOTAL REFUND CLAIMED

➔

$

$

(multiply amount on line 13 by 70% . . . . . . . . . . . . . . . . . . . . . . .

15

➔

Department Use Only (refund authorization area)

16. Locations of Authorized Indian Retailers (notify department by letter of any name/address changes to retailers)

Net Tax-Paid Single Cigarettes Received

Authorized Retail Locations

(purchases less credits)

Doing Business As (d/b/a)

Business Location/Address

Tribal Computation

Department Use Only

➔

Net tax-paid single cigarettes received (must agree with line 11) . . . . . . .

DECLARATION: I declare that I am personally familiar with the information provided on this refund claim and accompanying

documentation, and that to the best of my knowledge and belief, it is true, correct and complete. The cigarettes were sold on our

reservation or trust land to persons other than cigarette retailers or jobbers.

Signature of Preparer

Preparer’s Phone Number

Date

(

)

CT-001 (R. 5-04)

1

1 2

2