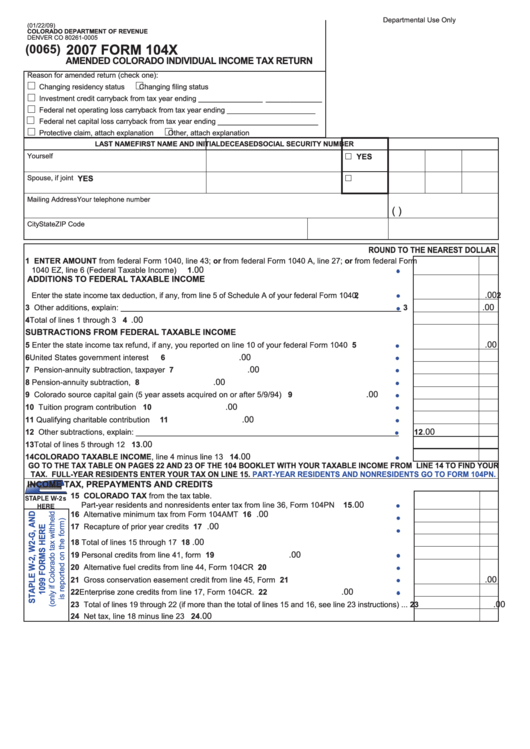

Form 104x - Amended Colorado Individual Income Tax Return - 2007

ADVERTISEMENT

Departmental Use Only

(01/22/09)

cOLORADO DEPARtMEnt OF REvEnuE

DENVER CO 80261-0005

(0065)

2007 FORM 104X

AMEnDED cOLORADO inDiviDuAL incOME tAX REtuRn

Reason for amended return (check one):

Changing residency status

Changing filing status

Investment credit carryback from tax year ending ______________________________

Federal net operating loss carryback from tax year ending ______________________

Federal net capital loss carryback from tax year ending _________________________

Protective claim, attach explanation

Other, attach explanation

LAst nAME

FiRst nAME AnD initiAL

DEcEAsED

sOciAL sEcuRitY nuMbER

Yourself

YEs

Spouse, if joint

YEs

Mailing Address

Your telephone number

(

)

City

State

ZIP Code

ROunD tO thE nEAREst DOLLAR

1 EntER AMOunt from federal Form 1040, line 43; or from federal Form 1040 A, line 27; or from federal Form

.00

1040 EZ, line 6 (Federal Taxable Income) .....................................................................................................

1

ADDitiOns tO FEDERAL tAXAbLE incOME

.00

2 Enter the state income tax deduction, if any, from line 5 of Schedule A of your federal Form 1040, ..................

2

.00

3 Other additions, explain: ________________________________________________________________

3

.00

4 Total of lines 1 through 3 .................................................................................................................................. 4

subtRActiOns FROM FEDERAL tAXAbLE incOME

.00

5 Enter the state income tax refund, if any, you reported on line 10 of your federal Form 1040 ......................

5

.00

6 United States government interest ................................................................................................................

6

.00

7 Pension-annuity subtraction, taxpayer ..........................................................................................................

7

.00

8 Pension-annuity subtraction, spouse.............................................................................................................

8

.00

9 Colorado source capital gain (5 year assets acquired on or after 5/9/94) ....................................................

9

.00

10 Tuition program contribution .......................................................................................................................

10

.00

11 Qualifying charitable contribution ................................................................................................................

11

.00

12 Other subtractions, explain: ____________________________________________________________

12

.00

13 Total of lines 5 through 12 ............................................................................................................................. 13

.00

14 cOLORADO tAXAbLE incOME, line 4 minus line 13 ..............................................................................

14

GO tO thE tAX tAbLE On PAGEs 22 AnD 23 OF thE 104 bOOKLEt With YOuR tAXAbLE incOME FROM LinE 14 tO FinD YOuR

tAX. FuLL-YEAR REsiDEnts EntER YOuR tAX On LinE 15.

PARt-YEAR REsiDEnts AnD nOnREsiDEnts GO tO FORM 104Pn.

incOME tAX, PREPAYMEnts AnD cREDits

15 cOLORADO tAX from the tax table.

.00

Part-year residents and nonresidents enter tax from line 36, Form 104PN ...........................

15

.00

16 Alternative minimum tax from Form 104AMT .......................................................................... 16

.00

17 Recapture of prior year credits ................................................................................................ 17

.00

18 Total of lines 15 through 17 ....................................................................................................... 18

.00

19 Personal credits from line 41, form 104CR.............................................................................. 19

20 Alternative fuel credits from line 44, Form 104CR ................................................................... 20

.00

21 Gross conservation easement credit from line 45, Form 104CR............................................. 21

.00

22 Enterprise zone credits from line 17, Form 104CR. ................................................................ 22

.00

23 Total of lines 19 through 22 (if more than the total of lines 15 and 16, see line 23 instructions) ... 23

.00

24 Net tax, line 18 minus line 23 .................................................................................................... 24

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2