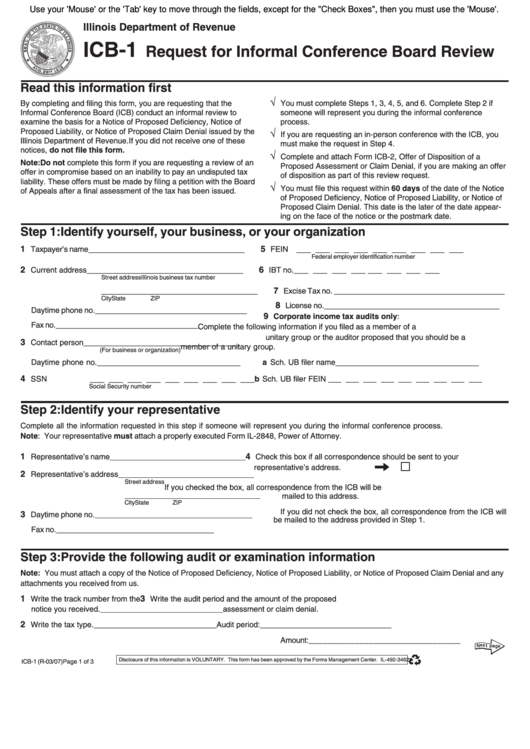

Use your 'Mouse' or the 'Tab' key to move through the fields, except for the "Check Boxes", then you must use the 'Mouse'.

Illinois Department of Revenue

ICB-1

Request for Informal Conference Board Review

Read this information first

√

You must complete Steps 1, 3, 4, 5, and 6. Complete Step 2 if

By completing and filing this form, you are requesting that the

someone will represent you during the informal conference

Informal Conference Board (ICB) conduct an informal review to

examine the basis for a Notice of Proposed Deficiency, Notice of

process.

√

Proposed Liability, or Notice of Proposed Claim Denial issued by the

If you are requesting an in-person conference with the ICB, you

Illinois Department of Revenue. If you did not receive one of these

must make the request in Step 4.

notices, do not file this form.

√

Complete and attach Form ICB-2, Offer of Disposition of a

Note: Do not complete this form if you are requesting a review of an

Proposed Assessment or Claim Denial, if you are making an offer

offer in compromise based on an inability to pay an undisputed tax

of disposition as part of this review request.

liability. These offers must be made by filing a petition with the Board

√

You must file this request within 60 days of the date of the Notice

of Appeals after a final assessment of the tax has been issued.

of Proposed Deficiency, Notice of Proposed Liability, or Notice of

Proposed Claim Denial. This date is the later of the date appear-

ing on the face of the notice or the postmark date.

Step 1: Identify yourself, your business, or your organization

1

_________________________________

5

___ ___ ___ ___ ___ ___ ___ ___ ___

Taxpayer’s name

FEIN

Federal employer identification number

2

_________________________________

6

___ ___ ___ ___ ___ ___ ___ ___

Current address

IBT no.

Street address

Illinois business tax number

_________________________________

7

____________________________________

Excise Tax no.

City

State

ZIP

8

_____________________________________

License no.

________________________________

Daytime phone no.

9

Corporate income tax audits only:

______________________________

Fax no.

Complete the following information if you filed as a member of a

unitary group or the auditor proposed that you should be a

3

_________________________________

Contact person

member of a unitary group.

(For business or organization)

________________________________

________________________________

Daytime phone no.

a Sch. UB filer name

4

___ ___ ___ ___ ___ ___ ___ ___ ___

SSN

b Sch. UB filer FEIN ___ ___ ___ ___ ___ ___ ___ ___ ___

Social Security number

Step 2: Identify your representative

Complete all the information requested in this step if someone will represent you during the informal conference process.

Note: Your representative must attach a properly executed Form IL-2848, Power of Attorney.

1

4

Representative’s name

_______________________________

Check this box if all correspondence should be sent to your

representative’s address.

2

Representative’s address _______________________________

Street address

If you checked the box, all correspondence from the ICB will be

_______________________________

mailed to this address.

City

State

ZIP

If you did not check the box, all correspondence from the ICB will

3

Daytime phone no. ____________________________________

be mailed to the address provided in Step 1.

Fax no.

____________________________________

Step 3: Provide the following audit or examination information

Note: You must attach a copy of the Notice of Proposed Deficiency, Notice of Proposed Liability, or Notice of Proposed Claim Denial and any

attachments you received from us.

1

3

Write the track number from the

Write the audit period and the amount of the proposed

notice you received.

____________________________

assessment or claim denial.

2

Write the tax type.

____________________________

Audit period: ______________________________

Amount:_________________________________

Disclosure of this information is VOLUNTARY. This form has been approved by the Forms Management Center. IL-492-3462

ICB-1 (R-03/07)

Page 1 of 3

1

1 2

2