Form Dr 1102 - Account Change Or Closure Form - Colorado - 2004

ADVERTISEMENT

DR 1102 (09/17/04)

COLORADO DEPARTMENT OF REVENUE

ACCOUNT CHANGE OR CLOSURE FORM INSTRUCTIONS

THE ACCOUNT CHANGE OR CLOSURE FORM MUST BE USED TO NOTIFY THE DEPARTMENT OF NAME/ADDRESS

CHANGES, OR TO NOTIFY THE DEPARTMENT THAT YOU ARE NO LONGER LIABLE FOR COLORADO SALES TAX,

WITHHOLDING TAX, RETAILER'S USE TAX, OR TRADE NAME.

CHANGE IN OWNERSHIP

If there has been a change in ownership and you are the new owner, you must request a Colorado Business Registration

(CR 0100) for a new account to be established.

F.E.I.N.

This is your federal employer's identification number. If the F.E.I.N. space on the Account Change or Closure form is blank,

please enter your number. If the number printed is not correct, please make any necessary changes.

NOTE: A new F.E.I.N. will require a new Department of Revenue Account. Please fill out a Colorado Business

Registration Form (CR 0100).

CHANGE OF NAME/ADDRESS

Use the right hand block to change any portion of your name/address. Mail the completed form to the Department of Rev-

enue and continue to file the returns in your booklet. If you are changing a corporate name, you must include the Amended

Articles of Incorporation from the Secretary of State's Office.

NOTE: If you relocated to a new address in a different city and/or county, the sales tax rates are likely to be different from

your previous location and there may be other types of taxes at the new location (for example, RTD, local taxes,

etc.). You would need to file two sales tax returns - one for the previous location and one for the new location. For

example, if you file a monthly return and on the 15th moved from El Paso County to Douglas County, you would

need to file one return for sales tax activity that occurred while still in El Paso County and a second return for sales

tax activity in Douglas County.

IMPORTANT

DO NOT make changes to the name and address on your returns after you have notified the Department on the Account

Change or Closure Form.

DATE OF CLOSURE

Check the appropriate tax type box and indicate the date your account should be closed . This box should be checked

ONLY if:

1. Your business was sold or discontinued.

2. You are no longer liable for the tax indicated.

3. The structure of your business changed and a new Federal Employer's I.D. Number (F.E.I.N.) was issued.

4. Your corporation merged into another corporation.

Mail the completed forms to: Department of Revenue

Registration Control Section

1375 Sherman Street

✁

Denver, CO 80261-0009

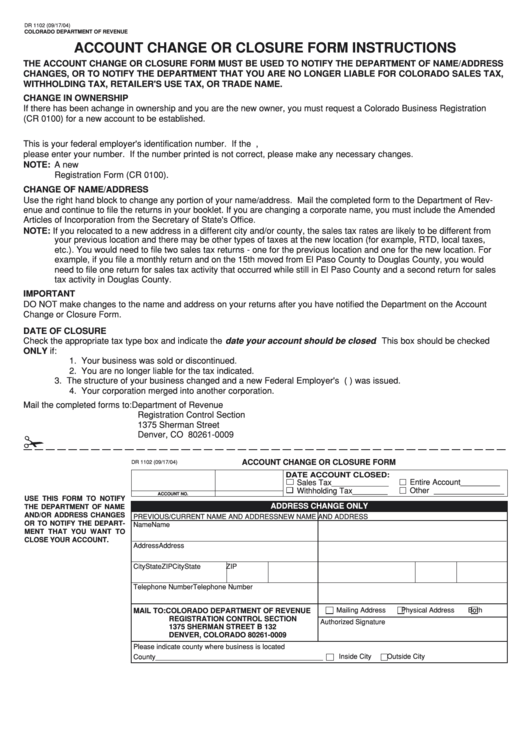

ACCOUNT CHANGE OR CLOSURE FORM

DR 1102 (09/17/04)

DATE ACCOUNT CLOSED:

Entire Account _________

Sales Tax _____________

Withholding Tax ________

Other ________________

ACCOUNT NO.

F.E.I.N./SSN

USE THIS FORM TO NOTIFY

ADDRESS CHANGE ONLY

THE DEPARTMENT OF NAME

AND/OR ADDRESS CHANGES

PREVIOUS/CURRENT NAME AND ADDRESS

NEW NAME AND ADDRESS

OR TO NOTIFY THE DEPART-

Name

Name

MENT THAT YOU WANT TO

CLOSE YOUR ACCOUNT.

Address

Address

City

State

ZIP

City

State

ZIP

Telephone Number

Telephone Number

Mailing Address

Physical Address

Both

MAIL TO: COLORADO DEPARTMENT OF REVENUE

REGISTRATION CONTROL SECTION

Authorized Signature

1375 SHERMAN STREET B 132

DENVER, COLORADO 80261-0009

Please indicate county where business is located

Inside City

Outside City

County___________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1