RESET

PRINT

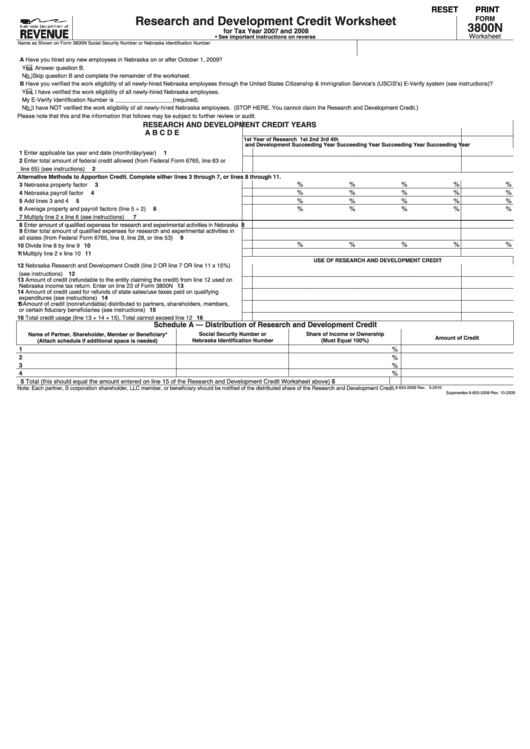

Research and Development Credit Worksheet

FORM

3800N

for Tax Year 2007 and 2008

Worksheet

• See important instructions on reverse

Name as Shown on Form 3800N

Social Security Number or Nebraska Identification Number

A Have you hired any new employees in Nebraska on or after October 1, 2009?

Yes . Answer question B .

No . Skip question B and complete the remainder of the worksheet .

B Have you verified the work eligibility of all newly-hired Nebraska employees through the United States Citizenship & Immigration Service’s (USCIS’s) E-Verify system (see instructions)?

Yes, I have verified the work eligibility of all newly-hired Nebraska employees .

My E-Verify Identification Number is __________________(required) .

No, I have NOT verified the work eligibility of all newly-hired Nebraska employees . (STOP HERE . You cannot claim the Research and Development Credit .)

Please note that this and the information that follows may be subject to further review or audit .

RESEARCH AND DEVELOPMENT CREDIT YEARS

A

B

C

D

E

1st Year of Research

1st

2nd

3rd

4th

and Development

Succeeding Year

Succeeding Year

Succeeding Year

Succeeding Year

1 Enter applicable tax year end date (month/day/year) . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Enter total amount of federal credit allowed (from Federal Form 6765, line 63 or

2

line 65) (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Alternative Methods to Apportion Credit. Complete either lines 3 through 7, or lines 8 through 11.

%

%

%

%

%

3 Nebraska property factor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

%

%

%

%

%

4 Nebraska payroll factor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

%

%

%

%

%

5 Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6 Average property and payroll factors (line 5 ÷ 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

%

%

%

%

%

7 Multiply line 2 x line 6 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Enter amount of qualified expenses for research and experimental activities in Nebraska

8

9 Enter total amount of qualified expenses for research and experimental activities in

all states (from Federal Form 6765, line 9, line 28, or line 53) . . . . . . . . . . . . . . . . . . .

9

%

%

%

%

%

10 Divide line 8 by line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 Multiply line 2 x line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

USE OF RESEARCH AND DEVELOPMENT CREDIT

12 Nebraska Research and Development Credit (line 2 OR line 7 OR line 11 x 15%)

(see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13 Amount of credit (refundable to the entity claiming the credit) from line 12 used on

Nebraska income tax return . Enter on line 23 of Form 3800N . . . . . . . . . . . . . . . . . . .

13

14 Amount of credit used for refunds of state sales/use taxes paid on qualifying

expenditures (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15 Amount of credit (nonrefundable) distributed to partners, shareholders, members,

15

or certain fiduciary beneficiaries (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . .

16 Total credit usage (line 13 + 14 + 15) . Total cannot exceed line 12 . . . . . . . . . . . . . . .

16

Schedule A — Distribution of Research and Development Credit

Name of Partner, Shareholder, Member or Beneficiary*

Social Security Number or

Share of Income or Ownership

Amount of Credit

(Attach schedule if additional space is needed)

Nebraska Identification Number

(Must Equal 100%)

1

%

2

%

3

%

4

%

5 Total (this should equal the amount entered on line 15 of the Research and Development Credit Worksheet above)

5

Note: Each partner, S corporation shareholder, LLC member, or beneficiary should be notified of the distributed share of the Research and Development Credit .

8-653-2009 Rev . 5-2010

Supersedes 8-653-2009 Rev . 10-2009

1

1