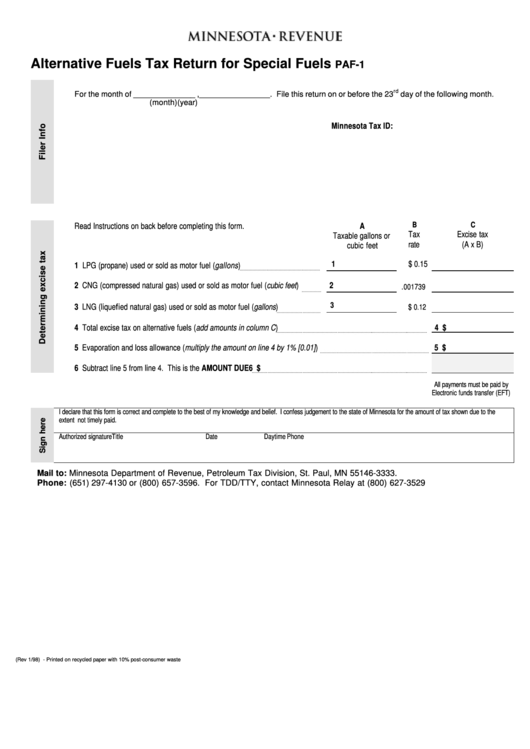

Paf-1 Alternative Fuels Tax Return For Special Fuels - Minnesota

ADVERTISEMENT

Alternative Fuels Tax Return for Special Fuels

PAF-1

rd

For the month of ______________ ,________________. File this return on or before the 23

day of the following month.

(month)

(year)

Minnesota Tax ID:

B

C

Read Instructions on back before completing this form.

A

Tax

Excise tax

Taxable gallons or

rate

(A x B)

cubic feet

1

$ 0.15

1 LPG (propane) used or sold as motor fuel (gallons)

2 CNG (compressed natural gas) used or sold as motor fuel (cubic feet)

2

.001739

3

3 LNG (liquefied natural gas) used or sold as motor fuel (gallons)

$ 0.12

4 Total excise tax on alternative fuels (add amounts in column C)

4 $

5 Evaporation and loss allowance (multiply the amount on line 4 by 1% [0.01])

5 $

6 Subtract line 5 from line 4. This is the AMOUNT DUE

6 $

All payments must be paid by

Electronic funds transfer (EFT)

I declare that this form is correct and complete to the best of my knowledge and belief. I confess judgement to the state of Minnesota for the amount of tax shown due to the

extent not timely paid.

Authorized signature

Title

Date

Daytime Phone

Mail to: Minnesota Department of Revenue, Petroleum Tax Division, St. Paul, MN 55146-3333.

Phone: (651) 297-4130 or (800) 657-3596. For TDD/TTY, contact Minnesota Relay at (800) 627-3529

(Rev 1/98) - Printed on recycled paper with 10% post-consumer waste

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1