Employer'S Quarterly Return Of Occupation License Fee - City Of Auburn

ADVERTISEMENT

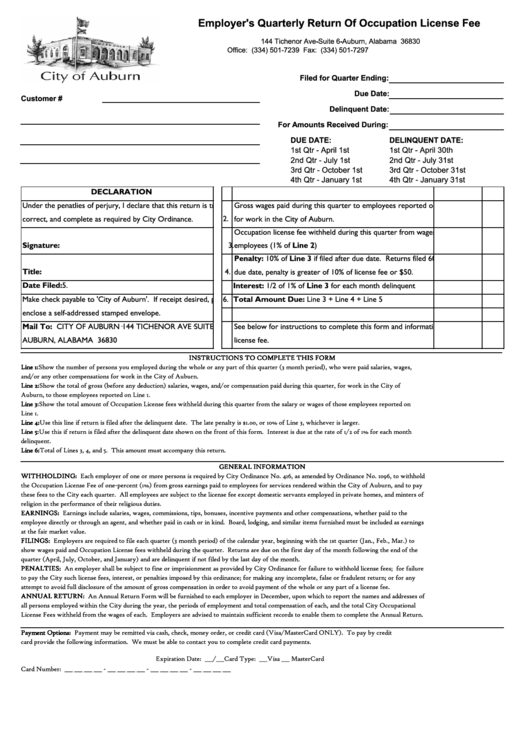

Employer's Quarterly Return Of Occupation License Fee

144 Tichenor Ave - Suite 6 - Auburn, Alabama 36830

Office: (334) 501-7239 Fax: (334) 501-7297

Filed for Quarter Ending:

Due Date:

Customer #

Delinquent Date:

For Amounts Received During:

DUE DATE:

DELINQUENT DATE:

1st Qtr - April 1st

1st Qtr - April 30th

2nd Qtr - July 1st

2nd Qtr - July 31st

3rd Qtr - October 1st

3rd Qtr - October 31st

4th Qtr - January 1st

4th Qtr - January 31st

DECLARATION

1. Number of taxable employees this quarter

Under the penatlies of perjury, I declare that this return is true,

Gross wages paid during this quarter to employees reported on Line 1

correct, and complete as required by City Ordinance.

2.

for work in the City of Auburn.

Occupation license fee withheld during this quarter from wages paid to

Signature:

3.

employees (1% of Line 2)

Penalty: 10% of Line 3 if filed after due date. Returns filed 60 days after

Title:

4.

due date, penalty is greater of 10% of license fee or $50.

Date Filed:

5. Interest: 1/2 of 1% of Line 3 for each month delinquent

Make check payable to 'City of Auburn'. If receipt desired, please

6. Total Amount Due: Line 3 + Line 4 + Line 5

enclose a self-addressed stamped envelope.

Mail To: CITY OF AUBURN·144 TICHENOR AVE·SUITE 6

See below for instructions to complete this form and information on

AUBURN, ALABAMA 36830

license fee.

INSTRUCTIONS TO COMPLETE THIS FORM

Line 1:

Show the number of persons you employed during the whole or any part of this quarter (3 month period), who were paid salaries, wages,

and/or any other compensations for work in the City of Auburn.

Line 2:

Show the total of gross (before any deduction) salaries, wages, and/or compensation paid during this quarter, for work in the City of

Auburn, to those employees reported on Line 1.

Line 3:

Show the total amount of Occupation License fees withheld during this quarter from the salary or wages of those employees reported on

Line 1.

Line 4:

Use this line if return is filed after the delinquent date. The late penalty is $1.00, or 10% of Line 3, whichever is larger.

Line 5:

Use this if return is filed after the delinquent date shown on the front of this form. Interest is due at the rate of 1/2 of 1% for each month

delinquent.

Line 6:

Total of Lines 3, 4, and 5. This amount must accompany this return.

GENERAL INFORMATION

WITHHOLDING: Each employer of one or more persons is required by City Ordinance No. 416, as amended by Ordinance No. 1096, to withhold

the Occupation License Fee of one-percent (1%) from gross earnings paid to employees for services rendered within the City of Auburn, and to pay

these fees to the City each quarter. All employees are subject to the license fee except domestic servants employed in private homes, and minters of

religion in the performance of their religious duties.

EARNINGS: Earnings include salaries, wages, commissions, tips, bonuses, incentive payments and other compensations, whether paid to the

employee directly or through an agent, and whether paid in cash or in kind. Board, lodging, and similar items furnished must be included as earnings

at the fair market value.

FILINGS: Employers are required to file each quarter (3 month period) of the calendar year, beginning with the 1st quarter (Jan., Feb., Mar.) to

show wages paid and Occupation License fees withheld during the quarter. Returns are due on the first day of the month following the end of the

quarter (April, July, October, and January) and are delinquent if not filed by the last day of the month.

PENALTIES: An employer shall be subject to fine or imprisionment as provided by City Ordinance for failure to withhold license fees; for failure

to pay the City such license fees, interest, or penalties imposed by this ordinance; for making any incomplete, false or fradulent return; or for any

attempt to avoid full disclosure of the amount of gross compensation in order to avoid payment of the whole or any part of a license fee.

ANNUAL RETURN: An Annual Return Form will be furnished to each employer in December, upon which to report the names and addresses of

all persons employed within the City during the year, the periods of employment and total compensation of each, and the total City Occupational

License Fees withheld from the wages of each. Employers are advised to maintain sufficient records to enable them to complete the Annual Return.

Payment Options: Payment may be remitted via cash, check, money order, or credit card (Visa/MasterCard ONLY). To pay by credit

card provide the following information. We must be able to contact you to complete credit card payments.

Card Type: ___Visa ___ MasterCard

Expiration Date: ___/___

Card Number: ___ ___ ___ ___ - ___ ___ ___ ___ - ___ ___ ___ ___ - ___ ___ ___ ___

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1