Form Ar941pt - State Of Arkansas Pass Through Entity Withholding Report - 2007

ADVERTISEMENT

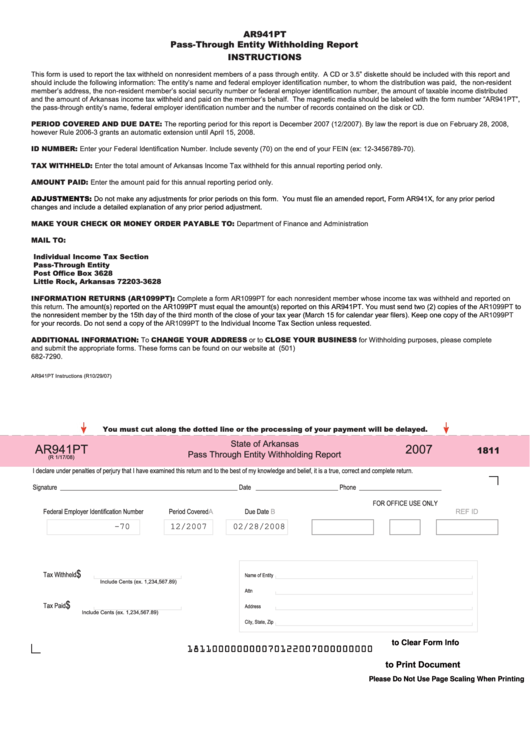

AR941PT

Pass-Through Entity Withholding Report

INSTRUCTIONS

This form is used to report the tax withheld on nonresident members of a pass through entity. A CD or 3.5” diskette should be included with this report and

should include the following information: The entity’s name and federal employer identification number, to whom the distribution was paid, the non-resident

member’s address, the non-resident member’s social security number or federal employer identification number, the amount of taxable income distributed

and the amount of Arkansas income tax withheld and paid on the member’s behalf. The magnetic media should be labeled with the form number “AR941PT”,

the pass-through entity’s name, federal employer identification number and the number of records contained on the disk or CD.

PERIOD COVERED AND DUE DATE: The reporting period for this report is December 2007 (12/2007). By law the report is due on February 28, 2008,

however Rule 2006-3 grants an automatic extension until April 15, 2008.

ID NUMBER: Enter your Federal Identification Number. Include seventy (70) on the end of your FEIN (ex: 12-3456789-70).

TAX WITHHELD: Enter the total amount of Arkansas Income Tax withheld for this annual reporting period only.

AMOUNT PAID: Enter the amount paid for this annual reporting period only.

ADJUSTMENTS: Do not make any adjustments for prior periods on this form. You must file an amended report, Form AR941X, for any prior period

changes and include a detailed explanation of any prior period adjustment.

MAKE YOUR CHECK OR MONEY ORDER PAYABLE TO: Department of Finance and Administration

MAIL TO:

Individual Income Tax Section

Pass-Through Entity

Post Office Box 3628

Little Rock, Arkansas 72203-3628

INFORMATION RETURNS (AR1099PT): Complete a form AR1099PT for each nonresident member whose income tax was withheld and reported on

this return.

The amount(s) reported on the AR1099PT must equal the amount(s) reported on this AR941PT. You must send two (2) copies of the

AR1099PT

to

the nonresident member by the 15th day of the third month of the close of your tax year (March 15 for calendar year filers). Keep one copy of the

AR1099PT

for your records. Do not send a copy of the

AR1099PT

to the Individual Income Tax Section unless requested.

ADDITIONAL INFORMATION: To CHANGE YOUR ADDRESS or to CLOSE YOUR BUSINESS for Withholding purposes, please complete

and submit the appropriate forms. These forms can be found on our website at or they will be mailed to you by contacting (501)

682-7290.

AR941PT Instructions (R10/29/07)

You must cut along the dotted line or the processing of your payment will be delayed.

State of Arkansas

AR941PT

2007

1811

Pass Through Entity Withholding Report

(R 1/17/08)

I declare under penalties of perjury that I have examined this return and to the best of my knowledge and belief, it is a true, correct and complete return.

Signature

________________________________________________________

Date __________________________

Phone __________________________

FOR OFFICE USE ONLY

Federal Employer Identification Number

Period Covered

Due Date

A

B

REF ID

-70

12/2007

02/28/2008

$

Tax Withheld

Name of Entity

Include Cents (ex. 1,234,567.89)

Attn

$

Tax Paid

Address

Include Cents (ex. 1,234,567.89)

City, State, Zip

Click Here to Clear Form Info

181100000000070122007000000000

Click Here to Print Document

Please Do Not Use Page Scaling When Printing

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1