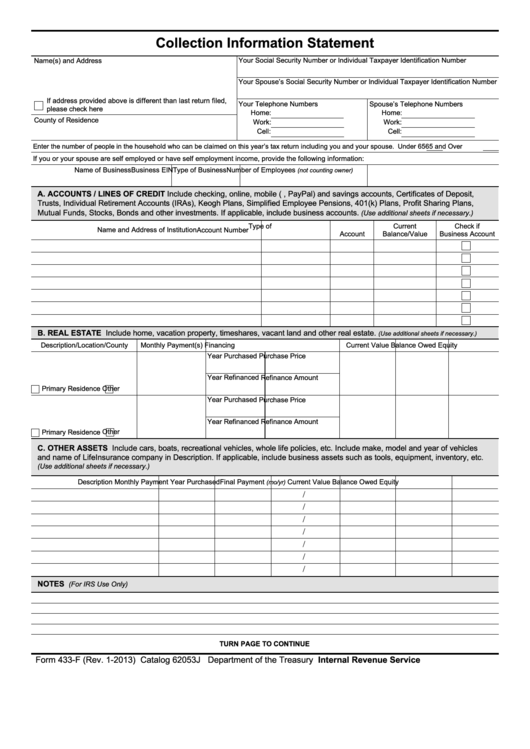

Collection Information Statement

Name(s) and Address

Your Social Security Number or Individual Taxpayer Identification Number

Your Spouse’s Social Security Number or Individual Taxpayer Identification Number

If address provided above is different than last return filed,

Your Telephone Numbers

Spouse’s Telephone Numbers

please check here

Home:

Home:

County of Residence

Work:

Work:

Cell:

Cell:

Enter the number of people in the household who can be claimed on this year’s tax return including you and your spouse. Under 65

65 and Over

If you or your spouse are self employed or have self employment income, provide the following information:

Type of Business

Name of Business

Business EIN

Number of Employees

(not counting owner)

A. ACCOUNTS / LINES OF CREDIT Include checking, online, mobile (e.g., PayPal) and savings accounts, Certificates of Deposit,

Trusts, Individual Retirement Accounts (IRAs), Keogh Plans, Simplified Employee Pensions, 401(k) Plans, Profit Sharing Plans,

Mutual Funds, Stocks, Bonds and other investments. If applicable, include business accounts.

(Use additional sheets if necessary.)

Type of

Current

Check if

Name and Address of Institution

Account Number

Account

Balance/Value

Business Account

B. REAL ESTATE Include home, vacation property, timeshares, vacant land and other real estate.

(Use additional sheets if necessary.)

Description/Location/County

Monthly Payment(s)

Financing

Current Value

Balance Owed

Equity

Year Purchased

Purchase Price

Year Refinanced

Refinance Amount

Primary Residence

Other

Year Purchased

Purchase Price

Year Refinanced

Refinance Amount

Other

Primary Residence

C. OTHER ASSETS Include cars, boats, recreational vehicles, whole life policies, etc. Include make, model and year of vehicles

and name of Life Insurance company in Description. If applicable, include business assets such as tools, equipment, inventory, etc.

(Use additional sheets if necessary.)

Description

Monthly Payment Year Purchased Final Payment

Current Value

Balance Owed

Equity

(mo/yr)

/

/

/

/

/

/

/

NOTES

(For IRS Use Only)

TURN PAGE TO CONTINUE

Form 433-F (Rev. 1-2013) Catalog 62053J Department of the Treasury Internal Revenue Service publish.no.irs.gov

1

1 2

2