Form S-1040x - Amended Individual Income Tax Return - Springfield

ADVERTISEMENT

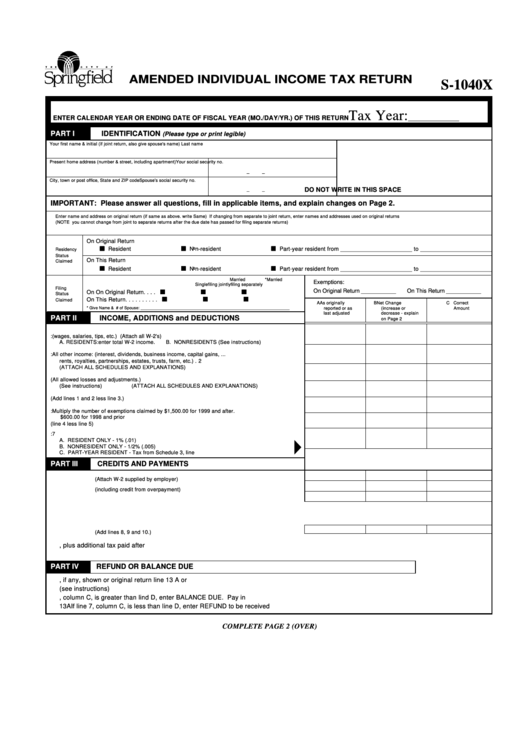

AMENDED INDIVIDUAL INCOME TAX RETURN

S-1040X

Tax Year:

ENTER CALENDAR YEAR OR ENDING DATE OF FISCAL YEAR (MO./DAY/YR.) OF THIS RETURN

______________

PART I

IDENTIFICATION

(Please type or print legible)

Your first name & initial (if joint return, also give spouse's name)

Last name

Present home address (number & street, including apartment)

Your social security no.

_

_

City, town or post office, State and ZIP code

Spouse's social security no.

DO NOT WRITE IN THIS SPACE

_

_

IMPORTANT: Please answer all questions, fill in applicable items, and explain changes on Page 2.

Enter name and address on original return (if same as above. write Same) If changing from separate to joint return, enter names and addresses used on original returns

(NOTE you cannot change from joint to separate returns after the due date has passed for filing separate returns)

On Original Return

Resident

Non-resident

Part-year resident from ______________________ to ______________________

Residency

Status

On This Return

Claimed

Resident

Non-resident

Part-year resident from ______________________ to ______________________

Married

*Married

Exemptions:

Single

filing jointly

filing separately

Filing

On Original Return ___________

On This Return ___________

On On Original Return . . . .

Status

On This Return . . . . . . . . . .

Claimed

A As originally

B Net Change

C Correct

* Give Name & S.S. # of Spouse: __________________________________________________________________

reported or as

(increase or

Amount

last adjusted

decrease - explain

PART II

INCOME, ADDITIONS and DEDUCTIONS

on Page 2

1. TOTAL W-2 INCOME: (wages, salaries, tips, etc.) (Attach all W-2's)

A. RESIDENTS: enter total W-2 income.

B. NONRESIDENTS (See instructions) ...................... 1

2. ADDITIONS TO INCOME: All other income: (interest, dividends, business income, capital gains, ...

rents, royalties, partnerships, estates, trusts, farm, etc.) .................................................................... 2

(ATTACH ALL SCHEDULES AND EXPLANATIONS)

3. SUBTRACTIONS FROM INCOME (All allowed losses and adjustments.).......................................... 3

(See instructions)

(ATTACH ALL SCHEDULES AND EXPLANATIONS)

4. ADJUSTED INCOME (Add lines 1 and 2 less line 3.)......................................................................... 4

5. EXEMPTIONS: Multiply the number of exemptions claimed by $1,500.00 for 1999 and after.

$600.00 for 1998 and prior years ...................................................................................................... 5

6. TAXABLE INCOME (line 4 less line 5) ............................................................................................... 6

7. TAX - Multiply amount on line 6 by one of the following:

7

A. RESIDENT ONLY - 1% (.01) ......................................................................................................

B. NONRESIDENT ONLY - 1/2% (.005)..........................................................................................

C. PART-YEAR RESIDENT - Tax from Schedule 3, line 1 ..............................................................

PART III

CREDITS AND PAYMENTS

8.

SPRINGFIELD tax withheld (Attach W-2 supplied by employer)........................... 8

9.

Estimate payments (including credit from overpayment) ...................................... 9

10. Credits for income tax paid to another Michigan municipality or by a partnership. 10

11. TOTAL PAYMENT AND CREDITS (Add lines 8, 9 and 10.) ................................. 11

A.

Amount paid with original return, plus additional tax paid after filing .............................................................................. A. _________________

B.

Total credits and payments. Add lines 11 and 12 of column C ...................................................................................... B. _________________

PART IV

REFUND OR BALANCE DUE

C.

Refund, if any, shown or original return line 13 A or B ................................................................................................... C. _________________

D.

Enter the difference between lines B and C (see instructions) ....................................................................................... D. _________________

12. If line 7, column C, is greater than lind D, enter BALANCE DUE. Pay in full ................................................................. 12. _________________

13A If line 7, column C, is less than line D, enter REFUND to be received ........................................................................... 13A ________________

COMPLETE PAGE 2 (OVER)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2