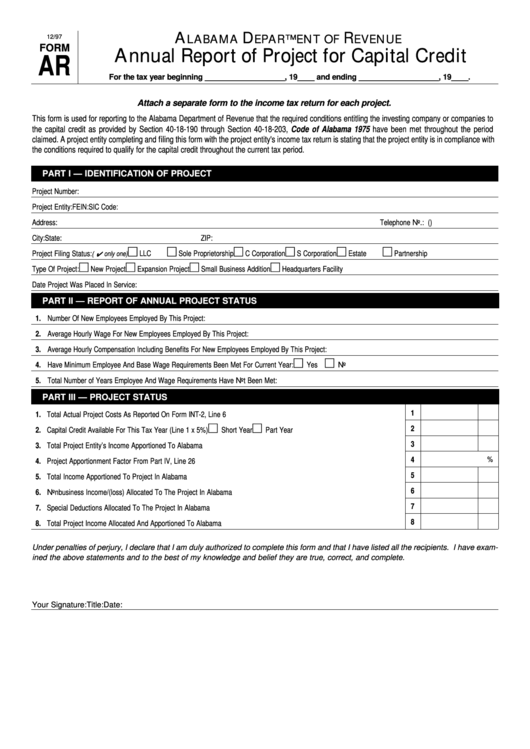

Form Ar 12/97 - Annual Report Of Project For Capital Credit - Alabama Department Of Revenue 2007

ADVERTISEMENT

A

D

R

12/97

LABAMA

EPARTMENT OF

EVENUE

FORM

Annual Report of Project for Capital Credit

AR

For the tax year beginning ___________________, 19____ and ending ___________________, 19____.

Attach a separate form to the income tax return for each project.

This form is used for reporting to the Alabama Department of Revenue that the required conditions entitling the investing company or companies to

the capital credit as provided by Section 40-18-190 through Section 40-18-203, Code of Alabama 1975 have been met throughout the period

claimed. A project entity completing and filing this form with the project entity's income tax return is stating that the project entity is in compliance with

the conditions required to qualify for the capital credit throughout the current tax period.

PART I — IDENTIFICATION OF PROJECT

Project Number:

Project Entity:

FEIN:

SIC Code:

Address:

Telephone No.: (

)

City:

State:

ZIP:

Project Filing Status:

LLC

Sole Proprietorship

C Corporation

S Corporation

Estate

Partnership

(

only one)

Type Of Project:

New Project

Expansion Project

Small Business Addition

Headquarters Facility

Date Project Was Placed In Service:

PART II — REPORT OF ANNUAL PROJECT STATUS

1. Number Of New Employees Employed By This Project:

2. Average Hourly Wage For New Employees Employed By This Project:

3. Average Hourly Compensation Including Benefits For New Employees Employed By This Project:

4. Have Minimum Employee And Base Wage Requirements Been Met For Current Year:

Yes

No

5. Total Number of Years Employee And Wage Requirements Have Not Been Met:

PART III — PROJECT STATUS

1

1. Total Actual Project Costs As Reported On Form INT-2, Line 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2. Capital Credit Available For This Tax Year (Line 1 x 5%)

Short Year

Part Year . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3. Total Project Entity’s Income Apportioned To Alabama. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

%

4. Project Apportionment Factor From Part IV, Line 26 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5. Total Income Apportioned To Project In Alabama . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6. Nonbusiness Income/(loss) Allocated To The Project In Alabama . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7. Special Deductions Allocated To The Project In Alabama . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8. Total Project Income Allocated And Apportioned To Alabama . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Under penalties of perjury, I declare that I am duly authorized to complete this form and that I have listed all the recipients. I have exam-

ined the above statements and to the best of my knowledge and belief they are true, correct, and complete.

Your Signature:

Title:

Date:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2