Reset Form

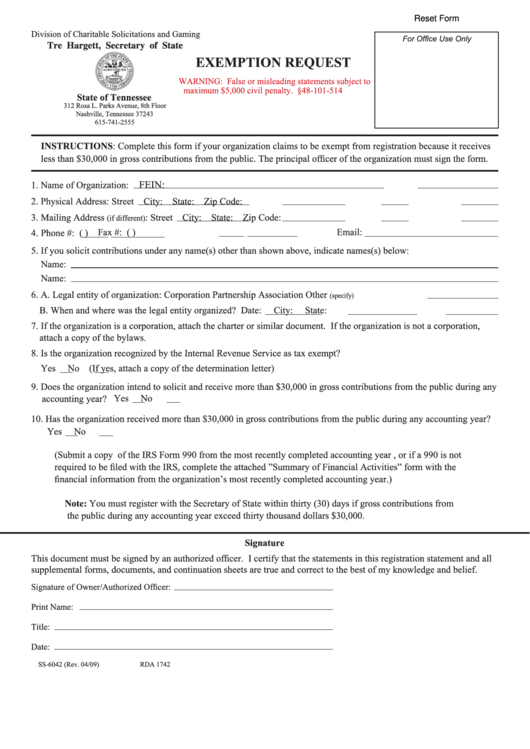

Division of Charitable Solicitations and Gaming

For Office Use Only

Tre Hargett, Secretary of State

EXEMPTION REQUEST

WARNING: False or misleading statements subject to

maximum $5,000 civil penalty. T.C.A. §48-101-514

State of Tennessee

312 Rosa L. Parks Avenue, 8th Floor

Nashville, Tennessee 37243

615-741-2555

INSTRUCTIONS: Complete this form if your organization claims to be exempt from registration because it receives

less than $30,000 in gross contributions from the public. The principal officer of the organization must sign the form.

FEIN:

1. Name of Organization:

2. Physical Address: Street

City:

State:

Zip Code:

3. Mailing Address

: Street

City:

State:

Zip Code:

(if different)

Fax #: (

)

Email:

Phone #: (

)

4.

5. If you solicit contributions under any name(s) other than shown above, indicate names(s) below:

Name:

Name:

6. A. Legal entity of organization:

Corporation

Partnership

Association

Other

(specify)

B. When and where was the legal entity organized? Date:

City:

State:

7. If the organization is a corporation, attach the charter or similar document. If the organization is not a corporation,

attach a copy of the bylaws.

8. Is the organization recognized by the Internal Revenue Service as tax exempt?

Yes

No

(If yes, attach a copy of the determination letter)

9. Does the organization intend to solicit and receive more than $30,000 in gross contributions from the public during any

Yes

No

accounting year?

10. Has the organization received more than $30,000 in gross contributions from the public during any accounting year?

Yes

No

(Submit a copy of the IRS Form 990 from the most recently completed accounting year , or if a 990 is not

required to be filed with the IRS, complete the attached ”Summary of Financial Activities” form with the

financial information from the organization’s most recently completed accounting year.)

Note: You must register with the Secretary of State within thirty (30) days if gross contributions from

the public during any accounting year exceed thirty thousand dollars $30,000.

Signature

This document must be signed by an authorized officer. I certify that the statements in this registration statement and all

supplemental forms, documents, and continuation sheets are true and correct to the best of my knowledge and belief.

Signature of Owner/Authorized Officer:

Print Name:

Title:

Date:

SS-6042 (Rev. 04/09)

RDA 1742

1

1