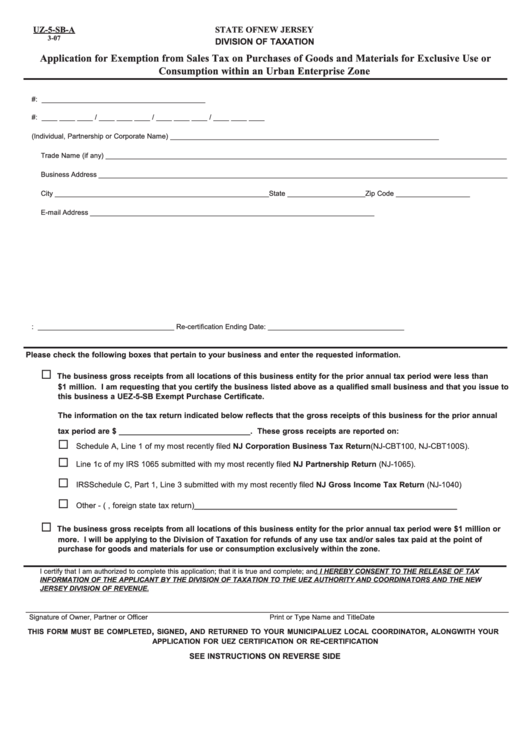

UZ-5-SB-A

STATE OF NEW JERSEY

3-07

DIVISION OF TAXATION

Application for Exemption from Sales Tax on Purchases of Goods and Materials for Exclusive Use or

Consumption within an Urban Enterprise Zone

1. Federal Employer I.D.#: __________________________________________

2. NJ Taxpayer ID #: ____ ____ ____ / ____ ____ ____ / ____ ____ ____ / ____ ____ ____

3. Name of Business (Individual, Partnership or Corporate Name) _____________________________________________________________________

Trade Name (if any) _______________________________________________________________________________________________________

Business Address _________________________________________________________________________________________________________

City _______________________________________________________

State ____________________

Zip Code ___________________

E-mail Address _________________________________________________________________________

4. Contact Name _________________________________________________________________________

5. Contact Telephone Number _______________________________________________________________

6. Contact E-mail Address __________________________________________________________________

7. Principal Product or Service ______________________________________________________________

8. UEZ File Number ______________________________________________________________________

9. Re-certification Beginning Date: ___________________________________ Re-certification Ending Date: ___________________________________

Please check the following boxes that pertain to your business and enter the requested information.

The business gross receipts from all locations of this business entity for the prior annual tax period were less than

$1 million. I am requesting that you certify the business listed above as a qualified small business and that you issue to

this business a UEZ-5-SB Exempt Purchase Certificate.

The information on the tax return indicated below reflects that the gross receipts of this business for the prior annual

tax period are $ ______________________________. These gross receipts are reported on:

Schedule A, Line 1 of my most recently filed NJ Corporation Business Tax Return (NJ-CBT100, NJ-CBT100S).

Line 1c of my IRS 1065 submitted with my most recently filed NJ Partnership Return (NJ-1065).

IRS Schedule C, Part 1, Line 3 submitted with my most recently filed NJ Gross Income Tax Return (NJ-1040)

Other - (e.g., foreign state tax return) ____________________________________________________________

The business gross receipts from all locations of this business entity for the prior annual tax period were $1 million or

more. I will be applying to the Division of Taxation for refunds of any use tax and/or sales tax paid at the point of

purchase for goods and materials for use or consumption exclusively within the zone.

I certify that I am authorized to complete this application; that it is true and complete; and I HEREBY CONSENT TO THE RELEASE OF TAX

INFORMATION OF THE APPLICANT BY THE DIVISION OF TAXATION TO THE UEZ AUTHORITY AND COORDINATORS AND THE NEW

JERSEY DIVISION OF REVENUE.

____________________________________________________________________________________________________________________________

Signature of Owner, Partner or Officer

Print or Type Name and Title

Date

,

,

,

THIS FORM MUST BE COMPLETED

SIGNED

AND RETURNED TO YOUR MUNICIPAL UEZ LOCAL COORDINATOR

ALONG WITH YOUR

-

APPLICATION FOR UEZ CERTIFICATION OR RE

CERTIFICATION

SEE INSTRUCTIONS ON REVERSE SIDE

1

1 2

2