Form Fynpt - Fiscal Year Net Profits Tax

ADVERTISEMENT

DO NOT STAP LE THIS RETURN

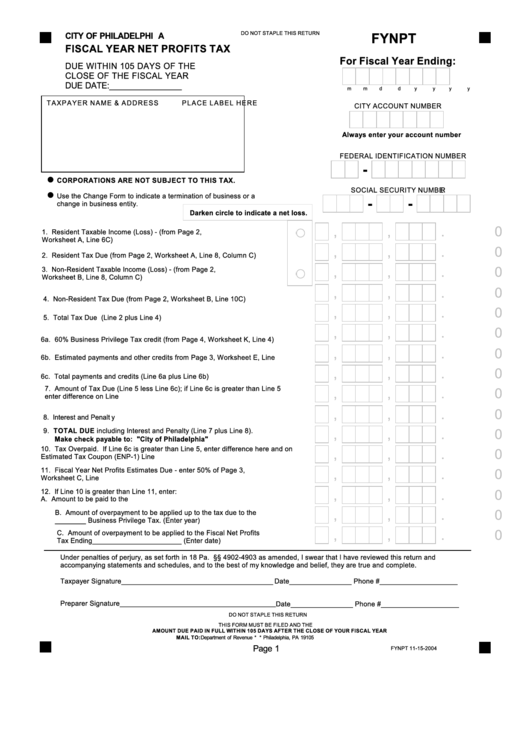

FYNPT

CITY OF PHILADELPHIA

FISCAL YEAR NET PROFITS TAX

For Fiscal Year Ending:

DUE WITHIN 105 DAYS OF THE

CLOSE OF THE FISCAL YEAR

DUE DATE:________________

m

m

d

d

y

y

y

y

TA XPA Y ER NA ME & A DDRESS

PLA CE LA BEL HERE

CITY ACCOUNT NUMBER

Always enter your account number

FEDERA L IDENTIFICA TION NUMB ER

-

CORPORATIONS ARE NOT SUBJE CT TO THIS TAX.

SOCIA L SECURITY NUMB ER

Use the Change Form to indicate a termination of business or a

-

-

change in business entity.

Darken circle to indicate a net loss.

,

,

. 0 0

1. Resident Taxable Income (Loss) - (from Page 2,

Worksheet A , Line 6C)................ ............... .............................. ............... .1.

,

,

. 0 0

2. Resident Tax Due (from Page 2, Worksheet A , Line 8, Column C)...........2.

,

,

. 0 0

3. Non-Resident Taxable Income (Loss) - (from P age 2,

Worksheet B, Line 8, Column C)............. ............... ............... ............... ....3.

,

,

. 0 0

4. Non-Resident Tax Due (from Page 2, Worksheet B, Line 10C).................. .............4.

,

,

. 0 0

5. Total Tax Due (Line 2 plus Line 4)................... ............... ............... ............... .........5.

,

,

. 0 0

6a. 60% Business Privilege Tax credit (from P age 4, Worksheet K, Line 4)...............6a.

,

,

. 0 0

6b. Estimated payments and other credits from P age 3, Worksheet E, Line 4........ ...6b.

,

,

. 0 0

6c. Total payments and credits (Line 6a plus Line 6b)...............................................6c.

7. A mount of Tax Due (Line 5 less Line 6c); if Line 6c is greater than Line 5

,

,

. 0 0

enter dif ference on Line 10............. ............... ............... ............... ............... ...........7.

,

,

. 0 0

8. Interest and Penalty.................. .............................................................................8.

9. TOTAL DUE including Interest and Penalty (Line 7 plus Line 8).

,

,

. 0 0

M ake check payable to: "City of Philadelphia".................... ............... .............9.

10. Tax Overpaid. If Line 6c is greater than Line 5, enter difference here and on

,

,

. 0 0

Estimated Tax Coupon (ENP-1) Line 2..................... ............... ............... .............10.

11. Fiscal Y ear Net Profits Estimates Due - enter 50% of Page 3,

,

,

. 0 0

W orksheet C, Line 3...................................................................... ............... .......11.

12. If Line 10 is greater than Line 11, enter:

,

,

. 0 0

A . A mount to be paid to the taxpayer........................... ............... ............... ......12A .

,

,

. 0 0

B. A mount of overpayment to be applied up to the tax due to the

________ Business Privilege Tax. (Enter year)............... ............... ..............12B .

,

,

. 0 0

C. Amount of overpayment to be applied to the Fiscal Net Profits

Tax Ending_______________________ (Enter date)...................... .............12C.

Under penalties of perjury, as set forth in 18 Pa. C.S . §§ 4902-4903 as amended, I swear that I have reviewed this return and

accompanying statements and schedules, and to the best of my knowledge and belief , they are true and complete.

Taxpayer Signature_______________________________________

Date________________ Phone #____________________

Preparer Signature________________________________________ Date________________ Phone #____________________

DO NOT STAP LE THIS RETURN

THIS FORM MUST BE FILED AND THE

AMOUNT DUE PAID IN FULL WITHIN 105 DAYS AFTER THE CLOSE OF YOUR FISCAL YEAR

MAIL TO: Department of Reven ue * P.O. Box 1529 * Philadelphia, PA 19105

Page 1

FYNPT 11 -15-2004

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1