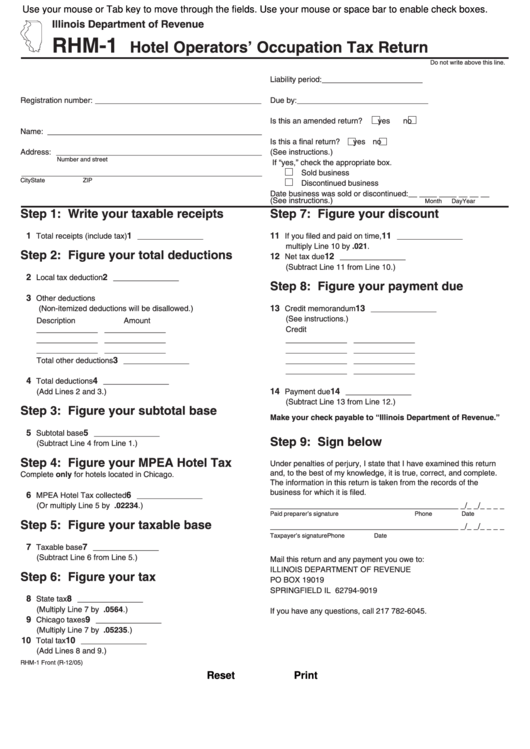

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

RHM-1

Hotel Operators’ Occupation Tax Return

Do not write above this line.

Liability period: _______________________

Registration number: ______________________________________

Due by: ______________________________

Is this an amended return?

yes

no

Name: _________________________________________________

Is this a final return?

yes

no

Address: _______________________________________________

(See instructions.)

Number and street

If “yes,” check the appropriate box.

_______________________________________________________

Sold business

City

State

ZIP

Discontinued business

Date business was sold or discontinued:

__ __ __ __ __ __ __ __

(See instructions.)

Month

Day

Year

Step 1: Write your taxable receipts

Step 7: Figure your discount

1

1

11

11

Total receipts (include tax)

_______________

If you filed and paid on time,

_______________

multiply Line 10 by .021.

Step 2: Figure your total deductions

12

12

Net tax due

_______________

(Subtract Line 11 from Line 10.)

2

2

Local tax deduction

_______________

Step 8: Figure your payment due

3

Other deductions

13

13

(Non-itemized deductions will be disallowed.)

Credit memorandum

_______________

(See instructions.)

Description

Amount

______________ ______________

Credit no.

Credit amount

______________ ______________

______________ ______________

______________ ______________

______________ ______________

3

Total other deductions

_______________

______________ ______________

______________ ______________

4

4

Total deductions

_______________

14

14

(Add Lines 2 and 3.)

Payment due

_______________

(Subtract Line 13 from Line 12.)

Step 3: Figure your subtotal base

Make your check payable to “Illinois Department of Revenue.”

5

5

Subtotal base

_______________

Step 9: Sign below

(Subtract Line 4 from Line 1.)

Step 4: Figure your MPEA Hotel Tax

Under penalties of perjury, I state that I have examined this return

and, to the best of my knowledge, it is true, correct, and complete.

Complete only for hotels located in Chicago.

The information in this return is taken from the records of the

business for which it is filed.

6

6

MPEA Hotel Tax collected

_______________

(Or multiply Line 5 by .02234.)

__________________________________________ _ _/_ _/_ _ _ _

Paid preparer’s signature

Phone

Date

Step 5: Figure your taxable base

__________________________________________ _ _/_ _/_ _ _ _

Taxpayer’s signature

Phone

Date

7

7

Taxable base

_______________

(Subtract Line 6 from Line 5.)

Mail this return and any payment you owe to:

ILLINOIS DEPARTMENT OF REVENUE

Step 6: Figure your tax

PO BOX 19019

SPRINGFIELD IL 62794-9019

8

8

State tax

_______________

(Multiply Line 7 by .0564.)

If you have any questions, call 217 782-6045.

9

9

Chicago taxes

_______________

(Multiply Line 7 by .05235.)

10

10

Total tax

_______________

(Add Lines 8 and 9.)

RHM-1 Front (R-12/05)

Reset

Print

1

1