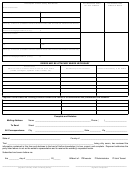

Form L-9 Nr - Affidavit Form Of Non-Resident Decedent Requesting Real Property Tax Waiver(S) With Instructions Page 2

ADVERTISEMENT

INSTRUCTIONS

Form L-9 NR is an affidavit executed by the executor, administrator, or joint tenant (when an executor or administrator has

not been appointed). This form is used to request an inheritance tax waiver for real property located in New Jersey which

was held by a non-resident decedent. This form can be used only when all beneficiaries of the entire estate, no matter

where the assets of the estate are located, are Class "A" beneficiaries or charities (N.J.S.A. 54:34-4d). Class "A"

beneficiaries include spouse/ civil union partner on or after 2/19/07, children, grandchildren, legally adopted

children and their children, step-children (not step-grandchildren), parents, grandparents, and domestic partner on

or after 7/10/04.

If this form is not fully and properly completed and/or it does not have the required attachments, it will be returned.

Answer all questions.

Attach a copy of the decedent's death certificate.

Attach a copy of letters testamentary or letters of administration.

Attach a copy of the decedent's will, codicils, and any trust agreements.

Attach a copy of the first two pages of the decedent's last full year's Federal income tax return.

Attach a copy of the deed for the NJ realty and provide the assessed and market values on the decedent's date of

death. If the realty was held by multiple owners, state the names of the owners and their relationship to the

decedent.

List all beneficiaries who shared in the estate either by will, intestacy, trust, or operation of law. Also list all

beneficiaries who were recipients of transfers intended to take effect at the decedent's death and transfers made

within three years of the decedent's death. State their relationship to the decedent and their interest in the estate.

In the case of a surviving spouse/civil union partner or domestic partner, submit a copy of the appropriate certificate

establishing the relationship.

This form is not a tax waiver and is not to be filed with the County Clerk.

This complete form and attachments should be forwarded to the NJ Division of Taxation, Inheritance and Estate Tax,

PO Box 249, Trenton, NJ 08695-0249.

Additional information pertaining to the use of Form L-9 NR may be obtained by calling the Inheritance and Estate Tax

section at 609-292-5033.

THIS FORM MAY BE REPRODUCED IN ITS ENTIRETY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4