Form Cec Virginia Cigarette Export Credit Computation Schedule

ADVERTISEMENT

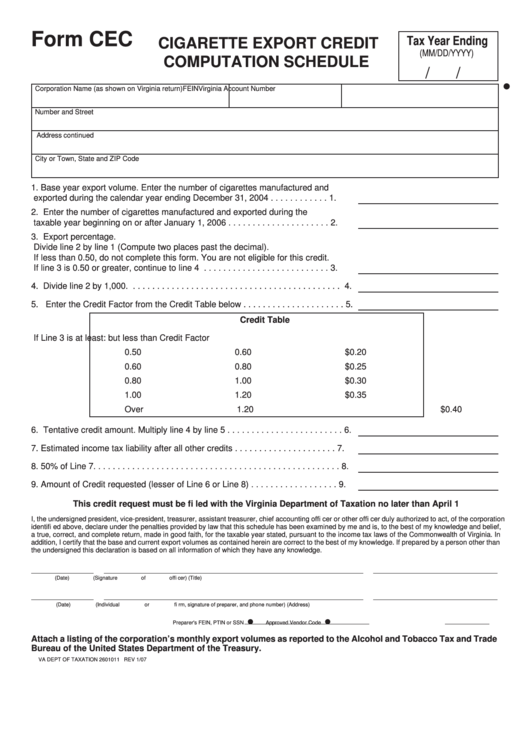

Form CEC

Tax Year Ending

CIGARETTE EXPORT CREDIT

(MM/DD/YYYY)

COMPUTATION SCHEDULE

/

/

v

Corporation Name (as shown on Virginia return)

FEIN

Virginia Account Number

Number and Street

Address continued

City or Town, State and ZIP Code

1. Base year export volume. Enter the number of cigarettes manufactured and

exported during the calendar year ending December 31, 2004 . . . . . . . . . . . . 1.

2. Enter the number of cigarettes manufactured and exported during the

taxable year beginning on or after January 1, 2006 . . . . . . . . . . . . . . . . . . . . . 2.

3. Export percentage.

Divide line 2 by line 1 (Compute two places past the decimal).

If less than 0.50, do not complete this form. You are not eligible for this credit.

If line 3 is 0.50 or greater, continue to line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. Divide line 2 by 1,000. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

5. Enter the Credit Factor from the Credit Table below . . . . . . . . . . . . . . . . . . . . . 5.

Credit Table

If Line 3 is at least:

but less than

Credit Factor

0.50

0.60

$0.20

0.60

0.80

$0.25

0.80

1.00

$0.30

1.00

1.20

$0.35

Over 1.20

$0.40

6. Tentative credit amount. Multiply line 4 by line 5 . . . . . . . . . . . . . . . . . . . . . . . . 6.

7. Estimated income tax liability after all other credits . . . . . . . . . . . . . . . . . . . . . 7.

8. 50% of Line 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

9. Amount of Credit requested (lesser of Line 6 or Line 8) . . . . . . . . . . . . . . . . . . 9.

This credit request must be fi led with the Virginia Department of Taxation no later than April 1

I, the undersigned president, vice-president, treasurer, assistant treasurer, chief accounting offi cer or other offi cer duly authorized to act, of the corporation

identifi ed above, declare under the penalties provided by law that this schedule has been examined by me and is, to the best of my knowledge and belief,

a true, correct, and complete return, made in good faith, for the taxable year stated, pursuant to the income tax laws of the Commonwealth of Virginia. In

addition, I certify that the base and current export volumes as contained herein are correct to the best of my knowledge. If prepared by a person other than

the undersigned this declaration is based on all information of which they have any knowledge.

(Date)

(Signature of offi cer)

(Title)

(Date)

(Individual or fi rm, signature of preparer, and phone number)

(Address)

w

w

Preparer's FEIN, PTIN or SSN

Approved Vendor Code

Attach a listing of the corporation’s monthly export volumes as reported to the Alcohol and Tobacco Tax and Trade

Bureau of the United States Department of the Treasury.

VA DEPT OF TAXATION 2601011 REV 1/07

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2