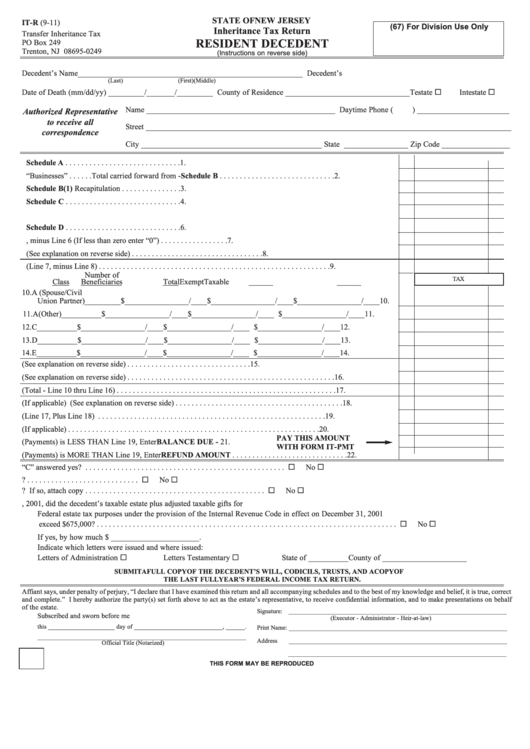

STATE OF NEW JERSEY

IT-R (9-11)

(67) For Division Use Only

Inheritance Tax Return

Transfer Inheritance Tax

RESIDENT DECEDENT

PO Box 249

Trenton, NJ 08695-0249

(Instructions on reverse side)

Decedent’s Name________________________________________________________ Decedent’s S.S. No. ____________/__________/____________

(Last)

(First)

(Middle)

Date of Death (mm/dd/yy) _________/_______/_________ County of Residence _______________________________

Testate

Intestate

Name _______________________________________________ Daytime Phone (

) _______________________

Authorized Representative

to receive all

Street ___________________________________________________________________________________________

correspondence

City _____________________________________________ State ________________ Zip Code _________________

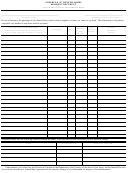

1. Real Property . . . . . . . . . . . . . . . . Total carried forward from - Schedule A . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2. Closely Held “Businesses” . . . . . . Total carried forward from - Schedule B . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. All Other Personal Property . . . . . Total carried forward from - Schedule B(1) Recapitulation . . . . . . . . . . . . . . .

3.

4. Transfers . . . . . . . . . . . . . . . . . . . . Total carried forward from - Schedule C . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Gross Estate . . . . . . . . . . . . . . . . . Total Lines 1 thru 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Deductions . . . . . . . . . . . . . . . . . . Total carried forward from - Schedule D . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7. Net Estate . . . . . . . . . . . . . . . . . . . Total - Line 5, minus Line 6 (If less than zero enter “0”) . . . . . . . . . . . . . . . . .

7.

8. Contingent Amount Included in Line 7 (See explanation on reverse side) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9. Balance of Estate (Line 7, minus Line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

Number of

TAX

Class

Beneficiaries

Total

Exempt

Taxable

10. A (Spouse/Civil

Union Partner)_________

$________________/____ $________________/____ $________________/____

10.

11. A (Other)

__________ $________________/____ $________________/____ $________________/____

11.

12.

C

__________ $________________/____ $________________/____ $________________/____

12.

13.

D

__________ $________________/____ $________________/____ $________________/____

13.

14.

E

__________ $________________/____ $________________/____ $________________/____

14.

15. Compromise Tax Due on Line 8 Amount (See explanation on reverse side) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

16. Contingent Tax (See explanation on reverse side) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

17. Total Tax Due (Total - Line 10 thru Line 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.

18. Interest Due (If applicable) (See explanation on reverse side) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.

19. Total Amount Due (Line 17, Plus Line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19.

20. Payment on Account (If applicable) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20.

PAY THIS AMOUNT

21. If Line 20 (Payments) is LESS THAN Line 19, Enter BALANCE DUE -

21.

WITH FORM IT-PMT

22. If Line 20 (Payments) is MORE THAN Line 19, Enter REFUND AMOUNT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22.

23. Are any questions in Schedule “C” answered yes? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23.

Yes

No

24. Have or will you file or are you required to file a Federal Estate Tax Return? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24.

Yes

No

25. Has or will any disclaimer been filed? If so, attach copy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25.

Yes

No

26. If the decedent died after December 31, 2001, did the decedent’s taxable estate plus adjusted taxable gifts for

Federal estate tax purposes under the provision of the Internal Revenue Code in effect on December 31, 2001

exceed $675,000? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26.

Yes

No

If yes, by how much $ ______________________.

Indicate which letters were issued and where issued:

Letters of Administration

Letters Testamentary

State of __________

County of _____________________

SUBMIT A FULL COPY OF THE DECEDENT’S WILL, CODICILS, TRUSTS, AND A COPY OF

THE LAST FULL YEAR’S FEDERAL INCOME TAX RETURN.

Affiant says, under penalty of perjury, “I declare that I have examined this return and all accompanying schedules and to the best of my knowledge and belief, it is true, correct

and complete.” I hereby authorize the party(s) set forth above to act as the estate’s representative, to receive confidential information, and to make presentations on behalf

of the estate.

Signature: _____________________________________________________________________

Subscribed and sworn before me

(Executor - Administrator - Heir-at-law)

this _____________________ day of ____________________________, ______.

Print Name: _____________________________________________________________________

__________________________________________________________________

Address

_____________________________________________________________________

Official Title (Notarized)

_____________________________________________________________________

THIS FORM MAY BE REPRODUCED

1

1