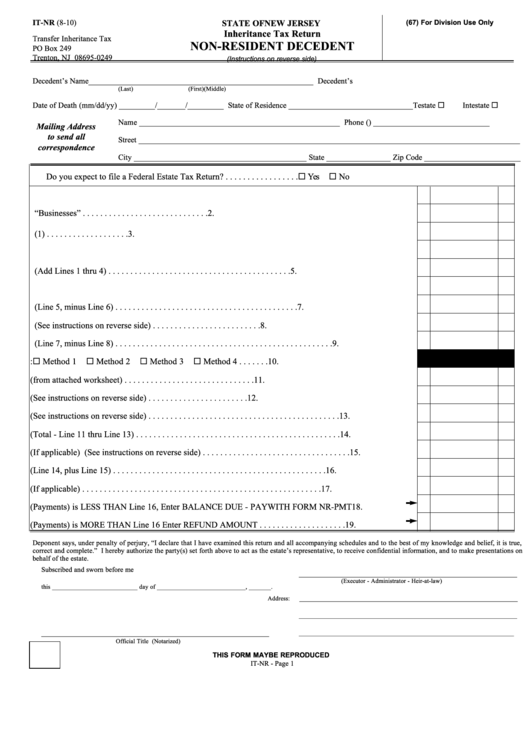

IT-NR (8-10)

(67) For Division Use Only

STATE OF NEW JERSEY

Inheritance Tax Return

Transfer Inheritance Tax

NON-RESIDENT DECEDENT

PO Box 249

Trenton, NJ 08695-0249

(Instructions on reverse side)

Decedent’s Name________________________________________________________ Decedent’s S.S. No. ____________/__________/____________

(Last)

(First)

(Middle)

Date of Death (mm/dd/yy) _________/_______/_________ State of Residence _______________________________

Testate

Intestate

Name __________________________________________________ Phone (

) _____________________________

Mailing Address

to send all

Street _______________________________________________________________________________________________

correspondence

City ___________________________________________ State ________________ Zip Code ________________________

Do you expect to file a Federal Estate Tax Return? . . . . . . . . . . . . . . . . .

Yes

No

1. Schedule A . . . . . . . . . . . . . . . . . . . . . Real Property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2. Schedule B . . . . . . . . . . . . . . . . . . . . . Closely Held “Businesses” . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Schedule B(1) . . . . . . . . . . . . . . . . . . .

3.

4. Schedule E . . . . . . . . . . . . . . . . . . . . . . Transfers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5. Total Estate Wherever Situate (Add Lines 1 thru 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

6. Schedule C . . . . . . . . . . . . . . . . . . . . . Deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

7. Net Estate Wherever Situate (Line 5, minus Line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Contingent Amount Included in Line 7 (See instructions on reverse side) . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9. Balance of Estate (Line 7, minus Line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

10. Method Used for Tax Calculation:

Method 1

Method 2

Method 3

Method 4 . . . . . . .

10.

11. Tax Due Based on Calculation Method (from attached worksheet) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

12. Compromise Tax Due on Line 8 Amount (See instructions on reverse side) . . . . . . . . . . . . . . . . . . . . . . .

12.

13. Contingent Tax (See instructions on reverse side) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13.

14. Total Tax Due (Total - Line 11 thru Line 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

15. Interest Due (If applicable) (See instructions on reverse side) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.

16. Total Amount Due (Line 14, plus Line 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16.

17. Payment on Account (If applicable) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17.

18. If Line 17 (Payments) is LESS THAN Line 16, Enter BALANCE DUE - PAY WITH FORM NR-PMT

18.

19. If Line 17 (Payments) is MORE THAN Line 16 Enter REFUND AMOUNT . . . . . . . . . . . . . . . . . . . .

19.

Deponent says, under penalty of perjury, “I declare that I have examined this return and all accompanying schedules and to the best of my knowledge and belief, it is true,

correct and complete.” I hereby authorize the party(s) set forth above to act as the estate’s representative, to receive confidential information, and to make presentations on

behalf of the estate.

Subscribed and sworn before me

_____________________________________________________________________

(Executor - Administrator - Heir-at-law)

this ___________________________ day of ____________________________, _______.

Address:

_____________________________________________________________________

_____________________________________________________________________

____________________________________________________________________

________________________________________________________________________

Official Title (Notarized)

THIS FORM MAY BE REPRODUCED

IT-NR - Page 1

1

1