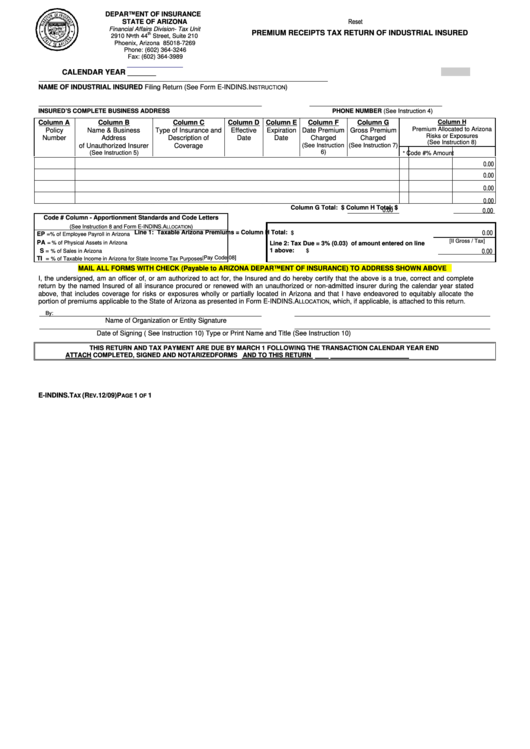

DEPARTMENT OF INSURANCE

Reset

STATE OF ARIZONA

Financial Affairs Division- Tax Unit

PREMIUM RECEIPTS TAX RETURN OF INDUSTRIAL INSURED

th

2910 North 44

Street, Suite 210

Phoenix, Arizona 85018-7269

Phone: (602) 364-3246

Fax: (602) 364-3989

CALENDAR YEAR _______

NAME OF INDUSTRIAL INSURED Filing Return (See Form E-INDINS.I

)

NSTRUCTION

INSURED’S COMPLETE BUSINESS ADDRESS

PHONE NUMBER (See Instruction 4)

Column A

Column B

Column C

Column D

Column E

Column F

Column G

Column H

Premium Allocated to Arizona

Policy

Name & Business

Type of Insurance and

Effective

Expiration

Date Premium

Gross Premium

Risks or Exposures

Number

Address

Description of

Date

Date

Charged

Charged

(See Instruction 8)

(See Instruction

(See Instruction 7)

of Unauthorized Insurer

Coverage

6)

(See Instruction 5)

Code #

%

Amount

*

0.00

0.00

0.00

0.00

0.00

0.00

Column G Total: $

Column H Total: $

Code # Column - Apportionment Standards and Code Letters

(See Instruction 8 and Form E-INDINS.A

)

LLOCATION

0.00

Line 1: Taxable Arizona Premiums = Column H Total:

$

EP =

% of Employee Payroll in Arizona

[II Gross / Tax]

PA =

% of Physical Assets in Arizona

Line 2: Tax Due = 3% (0.03) of amount entered on line

0.00

1 above:

S =

$

% of Sales in Arizona

Pay Code 08]

TI =

[

% of Taxable Income in Arizona for State Income Tax Purposes

MAIL ALL FORMS WITH CHECK (Payable to ARIZONA DEPARTMENT OF INSURANCE) TO ADDRESS SHOWN ABOVE

I, the undersigned, am an officer of, or am authorized to act for, the Insured and do hereby certify that the above is a true, correct and complete

return by the named Insured of all insurance procured or renewed with an unauthorized or non-admitted insurer during the calendar year stated

above, that includes coverage for risks or exposures wholly or partially located in Arizona and that I have endeavored to equitably allocate the

portion of premiums applicable to the State of Arizona as presented in Form E-INDINS.A

, which, if applicable, is attached to this return.

LLOCATION

By:

Name of Organization or Entity

Signature

Date of Signing ( See Instruction 10)

Type or Print Name and Title (See Instruction 10)

THIS RETURN AND TAX PAYMENT ARE DUE BY MARCH 1 FOLLOWING THE TRANSACTION CALENDAR YEAR END

ATTACH COMPLETED, SIGNED AND NOTARIZED FORMS E-INDINS.ALLOCATION AND E-INDINS.CERTIFICATION TO THIS RETURN

E-INDINS.T

(R

. 12/09)

P

1

1

AX

EV

AGE

OF

1

1