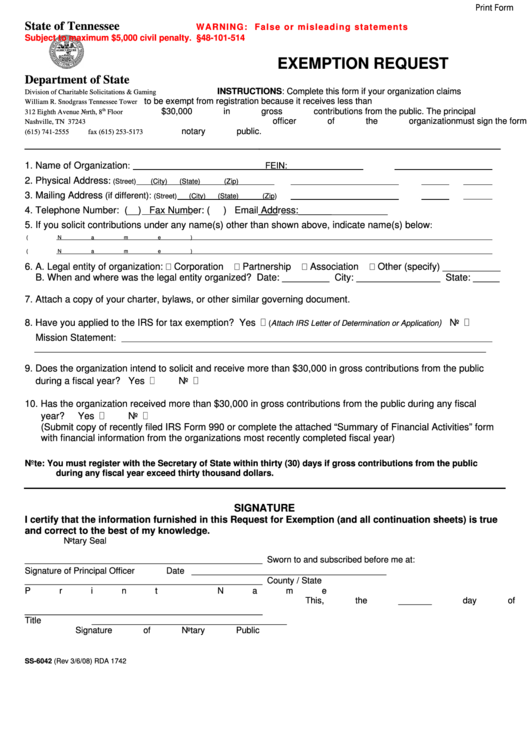

Print Form

State of Tennessee

WARNING: False or misleading st atement s

Subject to maximum $5,000 civil penalty. T.C.A. §48-101-514

EXEMPTION REQUEST

Department of State

INSTRUCTIONS: Complete this form if your organization claims

Division of Charitable Solicitations & Gaming

to be exempt from registration because it receives less than

William R. Snodgrass Tennessee Tower

$30,000 in gross contributions from the public. The principal

th

312 Eighth Avenue North, 8

Floor

officer of the organization must sign the form in the presence of a

Nashville, TN 37243

notary public.

(615) 741-2555

fax (615) 253-5173

_______________________________________________________________________

1. Name of Organization

:

FEIN:

2. Physical Address

:

(Street)

(City)

(State)

(Zip)

3. Mailing Address

(if different):

(Street)

(City)

(State)

(Zip)

4. Telephone Number: (__)

Fax Number: (

)

Email Address:_________________

5. If you solicit contributions under any name(s) other than shown above, indicate name(s) below

:

(Name)

(Name)

6. A. Legal entity of organization:

Corporation

Partnership

Association

Other (specify) ___________

B. When and where was the legal entity organized? Date: _________ City: ________________ State: _____

7. Attach a copy of your charter, bylaws, or other similar governing document.

8. Have you applied to the IRS for tax exemption? Yes

No

)

(Attach IRS Letter of Determination or Application

Mission Statement

:

_______________________________________________________________________________________________

9. Does the organization intend to solicit and receive more than $30,000 in gross contributions from the public

during a fiscal year? Yes

No

10. Has the organization received more than $30,000 in gross contributions from the public during any fiscal

year?

Yes

No

(Submit copy of recently filed IRS Form 990 or complete the attached “Summary of Financial Activities” form

with financial information from the organizations most recently completed fiscal year)

Note: You must register with the Secretary of State within thirty (30) days if gross contributions from the public

during any fiscal year exceed thirty thousand dollars.

SIGNATURE

I certify that the information furnished in this Request for Exemption (and all continuation sheets) is true

and correct to the best of my knowledge.

Notary Seal

__________________________________________________

Sworn to and subscribed before me at:

Signature of Principal Officer

Date

_________________________________________

__________________________________________________

County / State

Print Name

This, the _______ day of _______________, 20 __.

__________________________________________________

Title

_________________________________________

Signature of Notary Public

SS-6042 (Rev 3/6/08)

RDA 1742

1

1