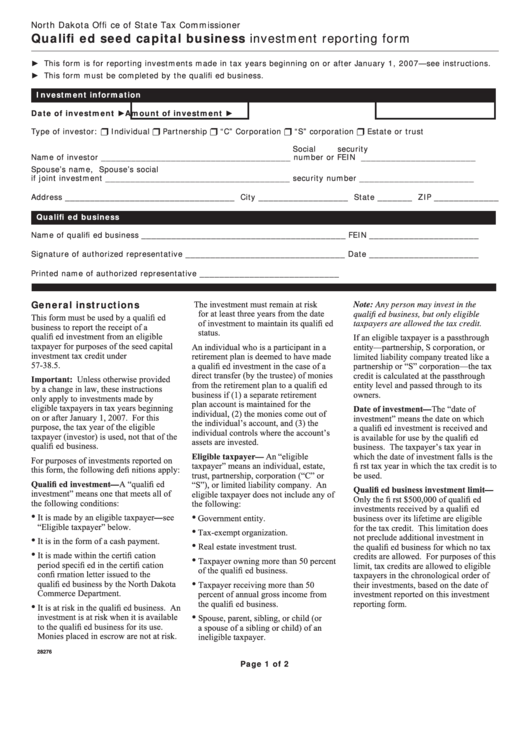

North Dakota Offi ce of State Tax Commissioner

Qualifi ed seed capital business investment reporting form

► This form is for reporting investments made in tax years beginning on or after January 1, 2007—see instructions.

► This form must be completed by the qualifi ed business.

Investment information

Date of investment ►

Amount of investment ►

Type of investor:

Individual

Partnership

“C” Corporation

“S” corporation

Estate or trust

Social security

Name of investor ______________________________________

number or FEIN _______________________

Spouse’s name,

Spouse’s social

if joint investment _____________________________________

security number _______________________

Address __________________________________ City __________________ State _______ ZIP _____________

Qualifi ed business

Name of qualifi ed business _________________________________________

FEIN ______________________

Signature of authorized representative ________________________________

Date ______________________

Printed name of authorized representative ____________________________

General instructions

The investment must remain at risk

Note: Any person may invest in the

for at least three years from the date

qualifi ed business, but only eligible

This form must be used by a qualifi ed

of investment to maintain its qualifi ed

taxpayers are allowed the tax credit.

business to report the receipt of a

status.

qualifi ed investment from an eligible

If an eligible taxpayer is a passthrough

taxpayer for purposes of the seed capital

An individual who is a participant in a

entity—partnership, S corporation, or

investment tax credit under N.D.C.C. ch.

retirement plan is deemed to have made

limited liability company treated like a

57-38.5.

a qualifi ed investment in the case of a

partnership or “S” corporation—the tax

direct transfer (by the trustee) of monies

credit is calculated at the passthrough

Important: Unless otherwise provided

from the retirement plan to a qualifi ed

entity level and passed through to its

by a change in law, these instructions

business if (1) a separate retirement

owners.

only apply to investments made by

plan account is maintained for the

eligible taxpayers in tax years beginning

Date of investment—The “date of

individual, (2) the monies come out of

on or after January 1, 2007. For this

investment” means the date on which

the individual’s account, and (3) the

purpose, the tax year of the eligible

a qualifi ed investment is received and

individual controls where the account’s

taxpayer (investor) is used, not that of the

is available for use by the qualifi ed

assets are invested.

qualifi ed business.

business. The taxpayer’s tax year in

Eligible taxpayer— An “eligible

which the date of investment falls is the

For purposes of investments reported on

taxpayer” means an individual, estate,

fi rst tax year in which the tax credit is to

this form, the following defi nitions apply:

trust, partnership, corporation (“C” or

be used.

Qualifi ed investment—A “qualifi ed

“S”), or limited liability company. An

Qualifi ed business investment limit—

investment” means one that meets all of

eligible taxpayer does not include any of

Only the fi rst $500,000 of qualifi ed

the following conditions:

the following:

investments received by a qualifi ed

•

•

It is made by an eligible taxpayer—see

Government entity.

business over its lifetime are eligible

“Eligible taxpayer” below.

for the tax credit. This limitation does

•

Tax-exempt organization.

not preclude additional investment in

•

It is in the form of a cash payment.

•

Real estate investment trust.

the qualifi ed business for which no tax

•

It is made within the certifi cation

credits are allowed. For purposes of this

•

Taxpayer owning more than 50 percent

period specifi ed in the certifi cation

limit, tax credits are allowed to eligible

of the qualifi ed business.

confi rmation letter issued to the

taxpayers in the chronological order of

•

qualifi ed business by the North Dakota

Taxpayer receiving more than 50

their investments, based on the date of

Commerce Department.

percent of annual gross income from

investment reported on this investment

the qualifi ed business.

reporting form.

•

It is at risk in the qualifi ed business. An

•

investment is at risk when it is available

Spouse, parent, sibling, or child (or

to the qualifi ed business for its use.

a spouse of a sibling or child) of an

Monies placed in escrow are not at risk.

ineligible taxpayer.

28276

Page 1 of 2

1

1 2

2