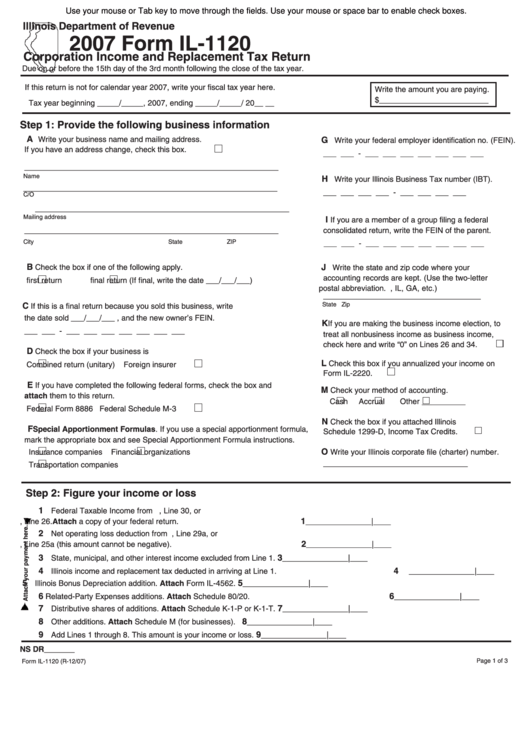

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

2007 Form IL-1120

Corporation Income and Replacement Tax Return

Due on or before the �5th day of the 3rd month following the close of the tax year.

If this return is not for calendar year 2007, write your fiscal tax year here.

Write the amount you are paying.

$_________________________

Tax year beginning _____/_____, 2007, ending _____/_____/ 20__ __

Step 1: Provide the following business information

A

Write your business name and mailing address.

G

Write your federal employer identification no. (FEIN).

If you have an address change, check this box.

___ ___ - ___ ___ ___ ___ ___ ___ ___

__________________________________________________________

Name

H

Write your Illinois Business Tax number (IBT).

__________________________________________________________

___ ___ ___ ___ - ___ ___ ___ ___

C/O

__________________________________________________________

I

If you are a member of a group filing a federal

Mailing address

consolidated return, write the FEIN of the parent.

__________________________________________________________

City

State

ZIP

___ ___ - ___ ___ ___ ___ ___ ___ ___

B

J

Check the box if one of the following apply.

Write the state and zip code where your

accounting records are kept. (Use the two-letter

first return

final return (If final, write the date ___/___/___)

postal abbreviation. E.g., IL, GA, etc.)

____________________________________

C

State

Zip

If this is a final return because you sold this business, write

the date sold ___/___/___ , and the new owner’s FEIN.

K

If you are making the business income election, to

___ ___ - ___ ___ ___ ___ ___ ___ ___

treat all nonbusiness income as business income,

check here and write “0” on Lines 26 and 34.

D

Check the box if your business is

L

Check this box if you annualized your income on

Combined return (unitary)

Foreign insurer

Form IL-2220.

E

If you have completed the following federal forms, check the box and

M

Check your method of accounting.

attach them to this return.

Cash

Accrual

Other __________

Federal Form 8886

Federal Schedule M-3

N

Check the box if you attached Illinois

F

Special Apportionment Formulas. If you use a special apportionment formula,

Schedule �299-D, Income Tax Credits.

mark the appropriate box and see Special Apportionment Formula instructions.

O

Insurance companies

Financial organizations

Write your Illinois corporate file (charter) number.

_________________________________

Transportation companies

S tep 2: Figure your income or loss

1

Federal Taxable Income from U.S. Form ��20, Line 30, or

1

U.S. Form ��20-A, Line 26. Attach a copy of your federal return.

_______________|____

2

Net operating loss deduction from U.S. Form ��20, Line 29a, or

2

U.S. Form ��20-A, Line 25a (this amount cannot be negative).

_______________|____

3

3

State, municipal, and other interest income excluded from Line �.

_______________|____

4

4

Illinois income and replacement tax deducted in arriving at Line �.

_______________|____

5

5

Illinois Bonus Depreciation addition. Attach Form IL-4562.

_______________|____

6

6

Related-Party Expenses additions. Attach Schedule 80/20.

_______________|____

7

7

Distributive shares of additions. Attach Schedule K-�-P or K-�-T.

_______________|____

8

8

Other additions. Attach Schedule M (for businesses).

_______________|____

9

9

Add Lines � through 8. This amount is your income or loss.

_______________|____

NS

DR_______

Page � of 3

Form IL-��20 (R-�2/07)

1

1 2

2 3

3