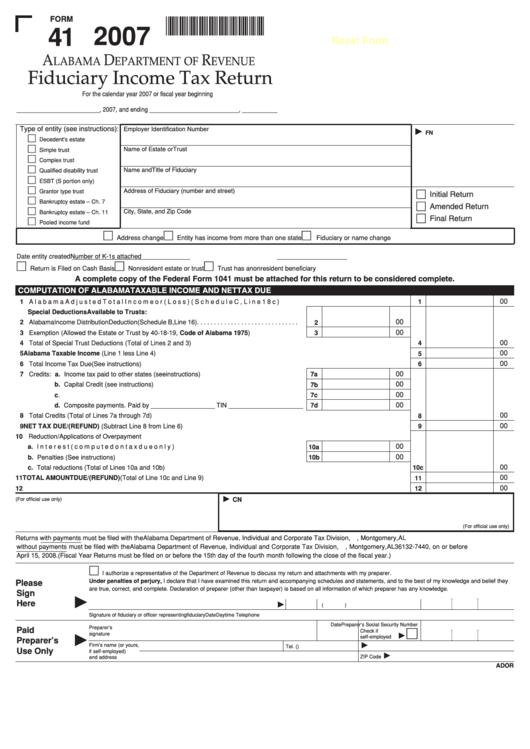

FORM

07000141

41 2007

Reset Form

A

D

R

LABAMA

EPARTMENT OF

EVENUE

Fiduciary Income Tax Return

For the calendar year 2007 or fiscal year beginning

__________________________, 2007, and ending ____________________________, ___________

Type of entity (see instructions):

Employer Identification Number

FN

Decedent’s estate

Simple trust

Name of Estate or Trust

Complex trust

Qualified disability trust

Name and Title of Fiduciary

ESBT (S portion only)

Grantor type trust

Address of Fiduciary (number and street)

Initial Return

Bankruptcy estate – Ch. 7

Amended Return

Bankruptcy estate – Ch. 11

City, State, and Zip Code

Final Return

Pooled income fund

Address change

Entity has income from more than one state

Fiduciary or name change

Date entity created

Number of K-1s attached

Return is Filed on Cash Basis

Nonresident estate or trust

Trust has a nonresident beneficiary

A complete copy of the Federal Form 1041 must be attached for this return to be considered complete.

COMPUTATION OF ALABAMA TAXABLE INCOME AND NET TAX DUE

00

1 Alabama Adjusted Total Income or (Loss) (Schedule C, Line 18c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

Special Deductions Available to Trusts:

00

2 Alabama Income Distribution Deduction (Schedule B, Line 16). . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3 Exemption (Allowed the Estate or Trust by 40-18-19, Code of Alabama 1975) . . . . . . . . . . . . . . . .

3

00

4 Total of Special Trust Deductions (Total of Lines 2 and 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5 Alabama Taxable Income (Line 1 less Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6 Total Income Tax Due (See instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Credits: a. Income tax paid to other states (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7a

00

b. Capital Credit (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7b

00

c. Amount paid with Form 4868A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7c

00

d. Composite payments. Paid by __________________ TIN _____________________

7d

00

8 Total Credits (Total of Lines 7a through 7d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9 NET TAX DUE/(REFUND) (Subtract Line 8 from Line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Reduction/Applications of Overpayment

00

a. Interest (computed on tax due only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10a

00

b. Penalties (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10b

00

c. Total reductions (Total of Lines 10a and 10b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10c

00

11 TOTAL AMOUNT DUE/(REFUND) (Total of Line 10c and Line 9). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

12 Amount Remitted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

(For official use only)

CN

(For official use only)

Returns with payments must be filed with the Alabama Department of Revenue, Individual and Corporate Tax Division, P.O. Box 327444, Montgomery, AL 36132-7444. Returns

without payments must be filed with the Alabama Department of Revenue, Individual and Corporate Tax Division, P.O. Box 327440, Montgomery, AL 36132-7440, on or before

April 15, 2008. (Fiscal Year Returns must be filed on or before the 15th day of the fourth month following the close of the fiscal year.)

I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Please

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief they

are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Sign

Here

(

)

Signature of fiduciary or officer representing fiduciary

Date

Daytime Telephone No.

Social Security Number

Date

Preparer’s Social Security Number

Preparer’s

Paid

Check if

signature

self-employed

Preparer’s

Firm’s name (or yours,

Tel. (

)

E.I. No.

Use Only

if self-employed)

ZIP Code

and address

ADOR

1

1 2

2 3

3 4

4 5

5