Request For Letter Ruling Form - New York City Finance

ADVERTISEMENT

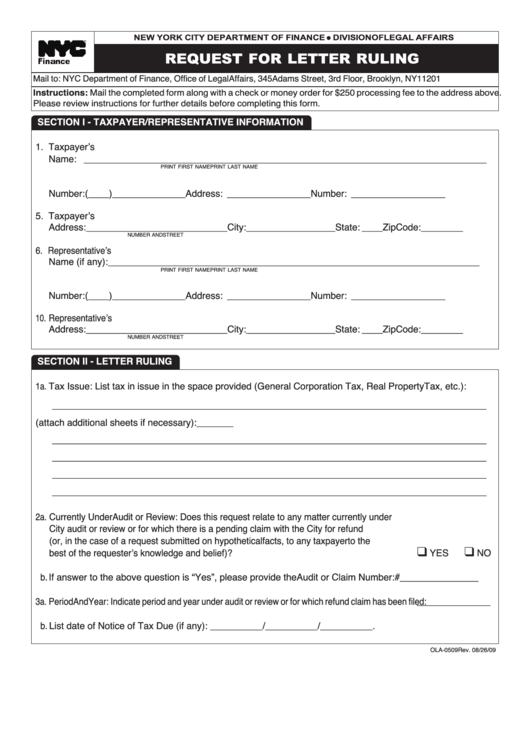

NEW YORK CITY DEPARTMENT OF FINANCE

DIVISION OF LEGAL AFFAIRS

G

REQUEST FOR LETTER RULING

Mail to: NYC Department of Finance, Office of Legal Affairs, 345 Adams Street, 3rd Floor, Brooklyn, NY 11201

Instructions: Mail the completed form along with a check or money order for $250 processing fee to the address above.

Please review instructions for further details before completing this form.

SECTION I - TAXPAYER/REPRESENTATIVE INFORMATION

1. Taxpayerʼs

Name: _____________________________________________________________________________

PRINT FIRST NAME

PRINT LAST NAME

2. Telephone

3. Email

4. Identification

Number: (____) ______________

Address: ________________

Number: __________________

5. Taxpayerʼs

Address:___________________________ City: _________________ State: ____ Zip Code: ________

NUMBER AND STREET

6. Representativeʼs

Name (if any): _______________________________________________________________________

PRINT FIRST NAME

PRINT LAST NAME

7. Telephone

8. Email

9. Identification

Number: (____) ______________

Address: ________________

Number: __________________

10. Representativeʼs

Address:___________________________ City: _________________ State: ____ Zip Code: ________

NUMBER AND STREET

SECTION II - LETTER RULING

1a. Tax Issue: List tax in issue in the space provided (General Corporation Tax, Real Property Tax, etc.):

___________________________________________________________________________________

b. Describe the tax issue regarding the letter ruling request (attach additional sheets if necessary): _______

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

___________________________________________________________________________________

2a. Currently Under Audit or Review: Does this request relate to any matter currently under

City audit or review or for which there is a pending claim with the City for refund

(or, in the case of a request submitted on hypothetical facts, to any taxpayer to the

best of the requesterʼs knowledge and belief)? .....................................................................

YES

NO

K

K

b. If answer to the above question is “Yes”, please provide the Audit or Claim Number: # _______________

3a. Period And Year: Indicate period and year under audit or review or for which refund claim has been filed: ______________

b. List date of Notice of Tax Due (if any): __________/__________/__________.

OLA-0509 Rev. 08/26/09

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2