Form Dr 0074 - Certification Of Qualified Enterprise Zone Business

ADVERTISEMENT

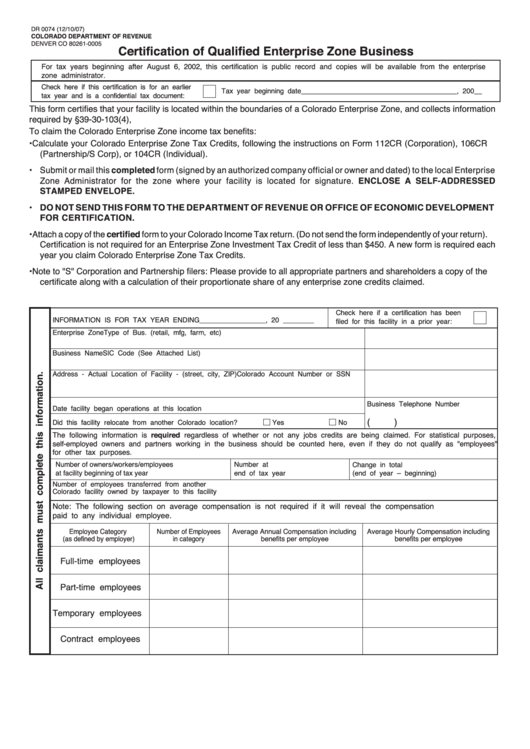

DR 0074 (12/10/07)

COLORADO DEPARTMENT OF REVENUE

DENVER CO 80261-0005

Certification of Qualified Enterprise Zone Business

For tax years beginning after August 6, 2002, this certification is public record and copies will be available from the enterprise

zone administrator.

Check here if this certification is for an earlier

Tax year beginning date ________________________________________ , 200 __

tax year and is a confidential tax document:

This form certifies that your facility is located within the boundaries of a Colorado Enterprise Zone, and collects information

required by §39-30-103(4), C.R.S.

To claim the Colorado Enterprise Zone income tax benefits:

• Calculate your Colorado Enterprise Zone Tax Credits, following the instructions on Form 112CR (Corporation), 106CR

(Partnership/S Corp), or 104CR (Individual).

• Submit or mail this completed form (signed by an authorized company official or owner and dated) to the local Enterprise

Zone Administrator for the zone where your facility is located for signature. ENCLOSE A SELF-ADDRESSED

STAMPED ENVELOPE.

• DO NOT SEND THIS FORM TO THE DEPARTMENT OF REVENUE OR OFFICE OF ECONOMIC DEVELOPMENT

FOR CERTIFICATION.

• Attach a copy of the certified form to your Colorado Income Tax return. (Do not send the form independently of your return).

Certification is not required for an Enterprise Zone Investment Tax Credit of less than $450. A new form is required each

year you claim Colorado Enterprise Zone Tax Credits.

• Note to "S" Corporation and Partnership filers: Please provide to all appropriate partners and shareholders a copy of the

certificate along with a calculation of their proportionate share of any enterprise zone credits claimed.

Check here if a certification has been

INFORMATION IS FOR TAX YEAR ENDING _________________ , 20 ________

filed for this facility in a prior year:

Enterprise Zone

Type of Bus. (retail, mfg, farm, etc)

Business Name

SIC Code (See Attached List)

Address - Actual Location of Facility - (street, city, ZIP)

Colorado Account Number or SSN

Business Telephone Number

Date facility began operations at this location

(

)

Did this facility relocate from another Colorado location?

Yes

No

The following information is required regardless of whether or not any jobs credits are being claimed. For statistical purposes,

self-employed owners and partners working in the business should be counted here, even if they do not qualify as "employees"

for other tax purposes.

Number of owners/workers/employees

Number at

Change in total

at facility beginning of tax year

end of tax year

(end of year – beginning)

Number of employees transferred from another

Colorado facility owned by taxpayer to this facility

Note: The following section on average compensation is not required if it will reveal the compensation

paid to any individual employee.

Employee Category

Number of Employees

Average Annual Compensation including

Average Hourly Compensation including

(as defined by employer)

in category

benefits per employee

benefits per employee

Full-time employees

Part-time employees

Temporary employees

Contract employees

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2