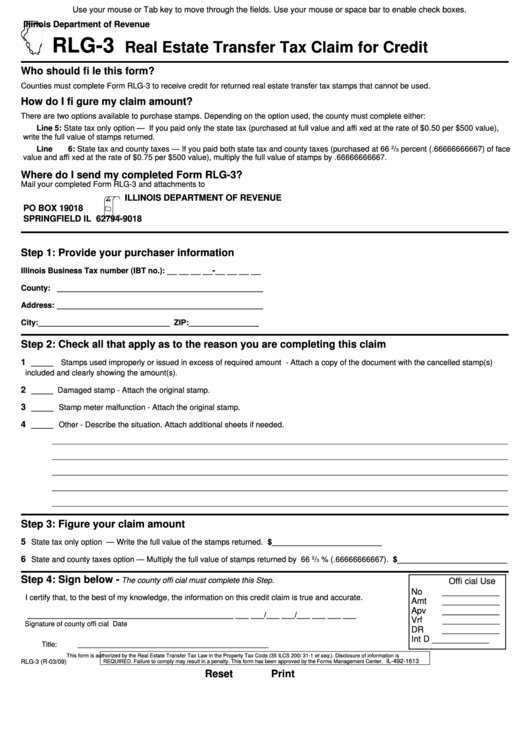

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

RLG-3

Real Estate Transfer Tax Claim for Credit

Who should fi le this form?

Counties must complete Form RLG-3 to receive credit for returned real estate transfer tax stamps that cannot be used.

How do I fi gure my claim amount?

There are two options available to purchase stamps. Depending on the option used, the county must complete either:

Line 5: State tax only option — If you paid only the state tax (purchased at full value and affi xed at the rate of $0.50 per $500 value),

write the full value of stamps returned.

2

Line 6: State tax and county taxes — If you paid both state tax and county taxes (purchased at 66

/

percent (.66666666667) of face

3

value and affi xed at the rate of $0.75 per $500 value), multiply the full value of stamps by .66666666667.

Where do I send my completed Form RLG-3?

Mail your completed Form RLG-3 and attachments to

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19018

SPRINGFIELD IL 62794-9018

Step 1: Provide your purchaser information

__ __ __ __-__ __ __ __

Illinois Business Tax number (IBT no.):

County: _______________________________________________

Address: _______________________________________________

City:______________________________

ZIP:________________

Step 2: Check all that apply as to the reason you are completing this claim

1

_____ Stamps used improperly or issued in excess of required amount - Attach a copy of the document with the cancelled stamp(s)

included and clearly showing the amount(s).

2

_____ Damaged stamp - Attach the original stamp.

3

_____ Stamp meter malfunction - Attach the original stamp.

4

_____ Other - Describe the situation. Attach additional sheets if needed.

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

________________________________________________________________________________________________________

Step 3: Figure your claim amount

5

State tax only option — Write the full value of the stamps returned.

$_________________________

6

2

State and county taxes option — Multiply the full value of stamps returned by 66

/

% (.66666666667).

$_________________________

3

Step 4: Sign below -

The county offi cial must complete this Step.

Offi cial Use

No

____________

I certify that, to the best of my knowledge, the information on this credit claim is true and accurate.

Amt

____________

Apv

____________

_______________________________________________

___ ___/___ ___/___ ___ ___ ___

Vrf

____________

Signature of county offi cial

Date

DR

____________

Int D

____________

Title: _________________________________________________

This form is authorized by the Real Estate Transfer Tax Law in the Property Tax Code (35 ILCS 200/ 31-1 et seq.). Disclosure of information is

IL-492-1613

RLG-3 (R-03/09)

REQUIRED. Failure to comply may result in a penalty. This form has been approved by the Forms Management Center.

Reset

Print

1

1