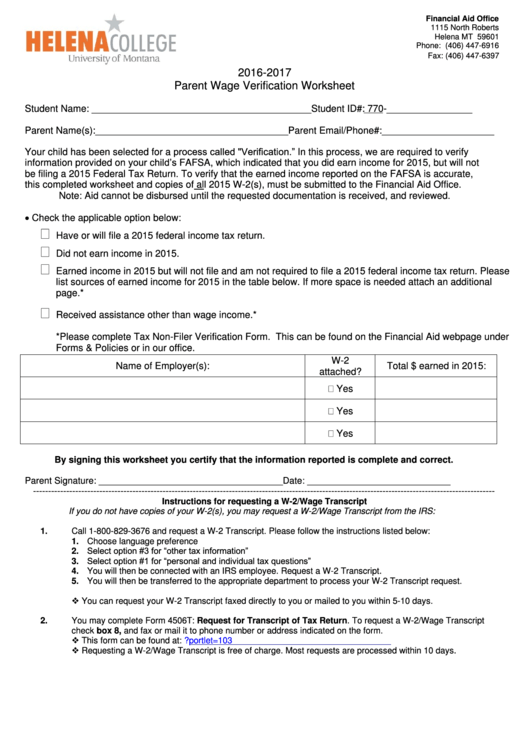

Parent Wage Verification Worksheet

ADVERTISEMENT

Financial Aid Office

1115 North Roberts

Helena MT 59601

Phone: (406) 447-6916

Fax: (406) 447-6397

Financialaid@umhelena.edu

2016-2017

Parent Wage Verification Worksheet

Student Name: _________________________________________Student ID#: 770-________________

Parent Name(s):____________________________________Parent Email/Phone#:_____________________

Your child has been selected for a process called "Verification.” In this process, we are required to verify

information provided on your child’s FAFSA, which indicated that you did earn income for 2015, but will not

be filing a 2015 Federal Tax Return. To verify that the earned income reported on the FAFSA is accurate,

this completed worksheet and copies of all 2015 W-2(s), must be submitted to the Financial Aid Office.

Note: Aid cannot be disbursed until the requested documentation is received, and reviewed.

Check the applicable option below:

Have or will file a 2015 federal income tax return.

Did not earn income in 2015.

Earned income in 2015 but will not file and am not required to file a 2015 federal income tax return. Please

list sources of earned income for 2015 in the table below. If more space is needed attach an additional

page.*

Received assistance other than wage income.*

*Please complete Tax Non-Filer Verification Form. This can be found on the Financial Aid webpage under

Forms & Policies or in our office.

W-2

Name of Employer(s):

Total $ earned in 2015:

attached?

Yes

Yes

Yes

By signing this worksheet you certify that the information reported is complete and correct.

Parent Signature: ____________________________________ Date: ____________________________

---------------------------------------------------------------------------------------------------------------------------------------------------------

Instructions for requesting a W-2/Wage Transcript

If you do not have copies of your W-2(s), you may request a W-2/Wage Transcript from the IRS:

1.

Call 1-800-829-3676 and request a W-2 Transcript. Please follow the instructions listed below:

1. Choose language preference

2. Select option #3 for “other tax information”

3. Select option #1 for “personal and individual tax questions”

4. You will then be connected with an IRS employee. Request a W-2 Transcript.

5. You will then be transferred to the appropriate department to process your W-2 Transcript request.

You can request your W-2 Transcript faxed directly to you or mailed to you within 5-10 days.

2.

You may complete Form 4506T: Request for Transcript of Tax Return. To request a W-2/Wage Transcript

check box 8, and fax or mail it to phone number or address indicated on the form.

This form can be found at:

Requesting a W-2/Wage Transcript is free of charge. Most requests are processed within 10 days.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1