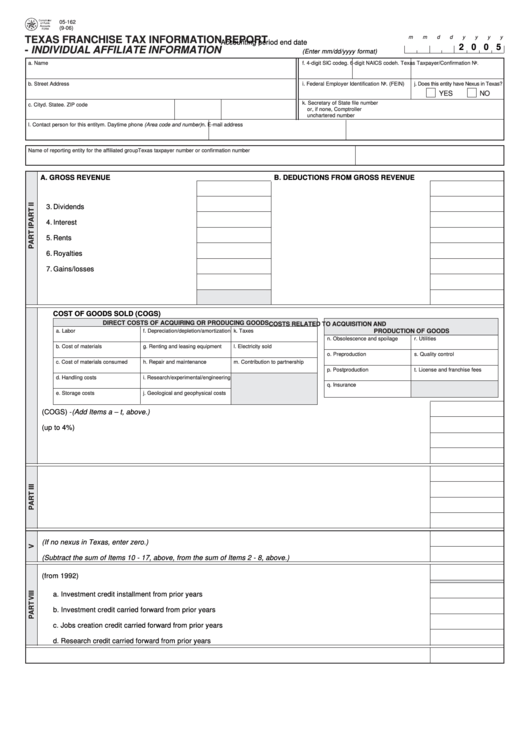

05-162

PRINT

RESET FORM

(9-06)

m

m

d

d

y

y

y

y

TEXAS FRANCHISE TAX INFORMATION REPORT

Accounting period end date

2 0 0 5

- INDIVIDUAL AFFILIATE INFORMATION

...........

(Enter mm/dd/yyyy format)

a. Name

f. 4-digit SIC code

g. 6-digit NAICS code

h. Texas Taxpayer/Confirmation No.

b. Street Address

i. Federal Employer Identification No. (FEIN)

j. Does this entity have Nexus in Texas?

YES

NO

k. Secretary of State file number

c. City

d. State

e. ZIP code

or, if none, Comptroller

unchartered number

l. Contact person for this entity

m. Daytime phone (Area code and number)

n. E-mail address

Name of reporting entity for the affiliated group

Texas taxpayer number or confirmation number

A. GROSS REVENUE

B. DEDUCTIONS FROM GROSS REVENUE

2. Gross receipts or sales ....................................

10. Bad debt expense ............................................

3. Dividends ..........................................................

11. Foreign dividends and foreign royalties ..........

4. Interest ..............................................................

12. Net distributive income ....................................

5. Rents ................................................................

13. Schedule C dividends received .......................

6. Royalties ...........................................................

14. Revenue from disregarded entities .................

7. Gains/losses .....................................................

15. Flow-through funds ..........................................

8. Other income ....................................................

16. Federal obligation dividends and interest .......

17. Other deductions ..............................................

COST OF GOODS SOLD (COGS)

DIRECT COSTS OF ACQUIRING OR PRODUCING GOODS

COSTS RELATED TO ACQUISITION AND

a. Labor

f. Depreciation/depletion/amortization

k. Taxes

PRODUCTION OF GOODS

n. Obsolescence and spoilage

r. Utilities

b. Cost of materials

g. Renting and leasing equipment

l. Electricity sold

o. Preproduction

s. Quality control

c. Cost of materials consumed

h. Repair and maintenance

m. Contribution to partnership

p. Postproduction

t. License and franchise fees

d. Handling costs

i. Research/experimental/engineering

q. Insurance

e. Storage costs

j. Geological and geophysical costs

20. Cost of Goods Sold (COGS) - (Add Items a – t, above.) ..........................................................................................................

21. Indirect or administrative overhead costs (up to 4%) ...............................................................................................................

22. Active duty military compensation .............................................................................................................................................

23. Undocumented worker compensation .......................................................................................................................................

25. Wages and cash compensation ................................................................................................................................................

26. Employee benefits .....................................................................................................................................................................

27. Active duty military compensation .............................................................................................................................................

28. Undocumented worker compensation .......................................................................................................................................

34. Gross receipts in Texas (If no nexus in Texas, enter zero.) .....................................................................................................

35. Gross receipts everywhere (Subtract the sum of Items 10 - 17, above, from the sum of Items 2 - 8, above.) ......................

41. Temporary credit (from 1992) ....................................................................................................................................................

42. Economic development credits established

a. Investment credit installment from prior years ......................................................................................................................

b. Investment credit carried forward from prior years ...............................................................................................................

c. Jobs creation credit carried forward from prior years ...........................................................................................................

d. Research credit carried forward from prior years .................................................................................................................

45. TOTAL MAINTENANCE AND OPERATIONS TAX PAID ................................................................................................................

PRINT A COPY FOR YOUR RECORDS

1

1