Form Ct-8508 - Request For Waiver From Filing Informational Returns Electronically - Connecticut

ADVERTISEMENT

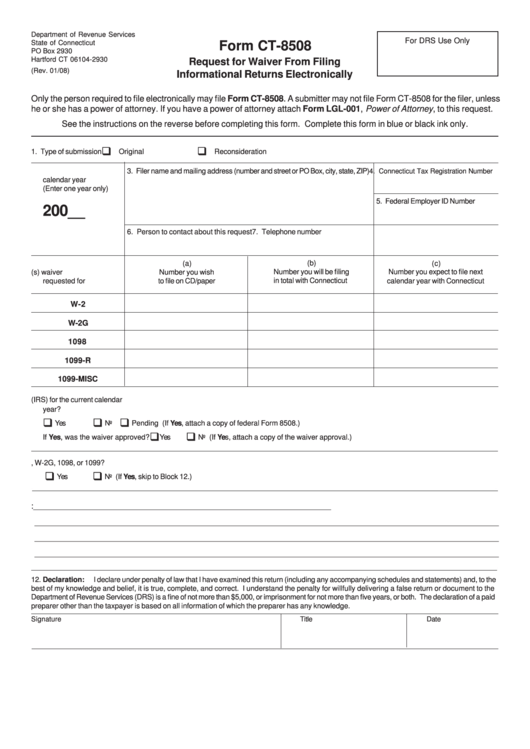

Department of Revenue Services

For DRS Use Only

State of Connecticut

Form CT-8508

PO Box 2930

Hartford CT 06104-2930

Request for Waiver From Filing

(Rev. 01/08)

Informational Returns Electronically

Only the person required to file electronically may file Form CT-8508. A submitter may not file Form CT-8508 for the filer, unless

he or she has a power of attorney. If you have a power of attorney attach Form LGL-001, Power of Attorney, to this request.

See the instructions on the reverse before completing this form. Complete this form in blue or black ink only.

1. Type of submission

Original

Reconsideration

2. Waiver request for

3. Filer name and mailing address (number and street or PO Box, city, state, ZIP)

4. Connecticut Tax Registration Number

calendar year

(Enter one year only)

5. Federal Employer ID Number

200__

6. Person to contact about this request

7. Telephone number

(a)

(b)

(c)

8. Form type(s) waiver

Number you wish

Number you will be filing

Number you expect to file next

requested for

to file on CD/paper

in total with Connecticut

calendar year with Connecticut

W-2

W-2G

1098

1099-R

1099-MISC

9. Have you applied for a waiver from filing on magnetic media or electronically with the Internal Revenue Service (IRS) for the current calendar

year?

Yes

No

Pending (If Yes, attach a copy of federal Form 8508.)

If Yes, was the waiver approved?

Yes

No (If Yes, attach a copy of the waiver approval.)

10. Is this the first time you have requested a waiver from Connecticut electronic filing requirements for Forms W-2, W-2G, 1098, or 1099?

Yes

No (If Yes, skip to Block 12.)

11. Provide a brief explanation of the hardship: ____________________________________________________________________

________________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________________

12. Declaration:

I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the

best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the

Department of Revenue Services (DRS) is a fine of not more than $5,000, or imprisonment for not more than five years, or both. The declaration of a paid

preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1