Form Rpd-41302 - Bingo And Raffle Tax Return

ADVERTISEMENT

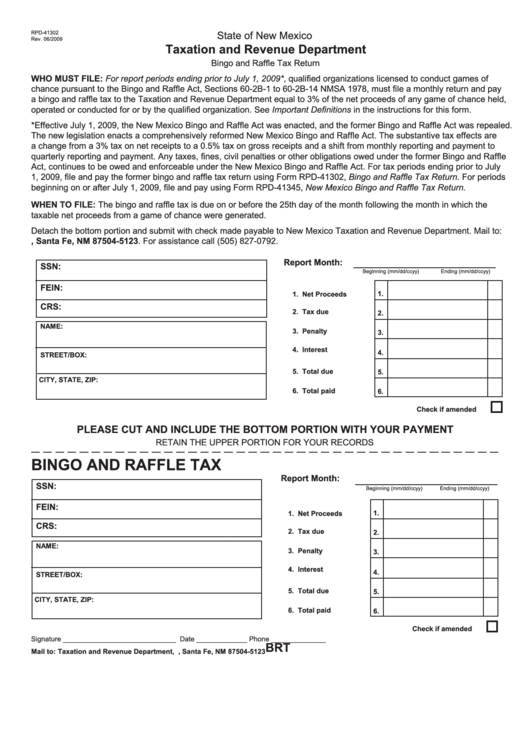

State of New Mexico

RPD-41302

Rev. 06/2009

Taxation and Revenue Department

Bingo and Raffle Tax Return

WHO MUST FILE: For report periods ending prior to July 1, 2009*, qualified organizations licensed to conduct games of

chance pursuant to the Bingo and Raffle Act, Sections 60-2B-1 to 60-2B-14 NMSA 1978, must file a monthly return and pay

a bingo and raffle tax to the Taxation and Revenue Department equal to 3% of the net proceeds of any game of chance held,

operated or conducted for or by the qualified organization. See Important Definitions in the instructions for this form.

*Effective July 1, 2009, the New Mexico Bingo and Raffle Act was enacted, and the former Bingo and Raffle Act was repealed.

The new legislation enacts a comprehensively reformed New Mexico Bingo and Raffle Act. The substantive tax effects are

a change from a 3% tax on net receipts to a 0.5% tax on gross receipts and a shift from monthly reporting and payment to

quarterly reporting and payment. Any taxes, fines, civil penalties or other obligations owed under the former Bingo and Raffle

Act, continues to be owed and enforceable under the New Mexico Bingo and Raffle Act. For tax periods ending prior to July

1, 2009, file and pay the former bingo and raffle tax return using Form RPD-41302, Bingo and Raffle Tax Return. For periods

beginning on or after July 1, 2009, file and pay using Form RPD-41345, New Mexico Bingo and Raffle Tax Return.

WHEN TO FILE: The bingo and raffle tax is due on or before the 25th day of the month following the month in which the

taxable net proceeds from a game of chance were generated.

Detach the bottom portion and submit with check made payable to New Mexico Taxation and Revenue Department. Mail to:

P.O. Box 25123, Santa Fe, NM 87504-5123. For assistance call (505) 827-0792.

Report Month:

SSN:

Beginning (mm/dd/ccyy)

Ending (mm/dd/ccyy)

FEIN:

1.

1. Net Proceeds

CRS:

2. Tax due

2.

NAME:

3. Penalty

3.

4. Interest

4.

STREET/BOX:

5. Total due

5.

CITY, STATE, ZIP:

6. Total paid

6.

Check if amended

PLEASE CUT AND INCLUDE THE BOTTOM PORTION WITH YOUR PAYMENT

RETAIN THE UPPER PORTION FOR YOUR RECORDS

BINGO AND RAFFLE TAX

Report Month:

SSN:

Beginning (mm/dd/ccyy)

Ending (mm/dd/ccyy)

FEIN:

1.

1. Net Proceeds

CRS:

2. Tax due

2.

NAME:

3. Penalty

3.

4. Interest

4.

STREET/BOX:

5. Total due

5.

CITY, STATE, ZIP:

6. Total paid

6.

Check if amended

Signature _____________________________ Date _____________ Phone ______________

BRT

Mail to: Taxation and Revenue Department, P.O. Box 25123, Santa Fe, NM 87504-5123

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2