2010 Sales Tax Reporting Form - The City Of Whittier

ADVERTISEMENT

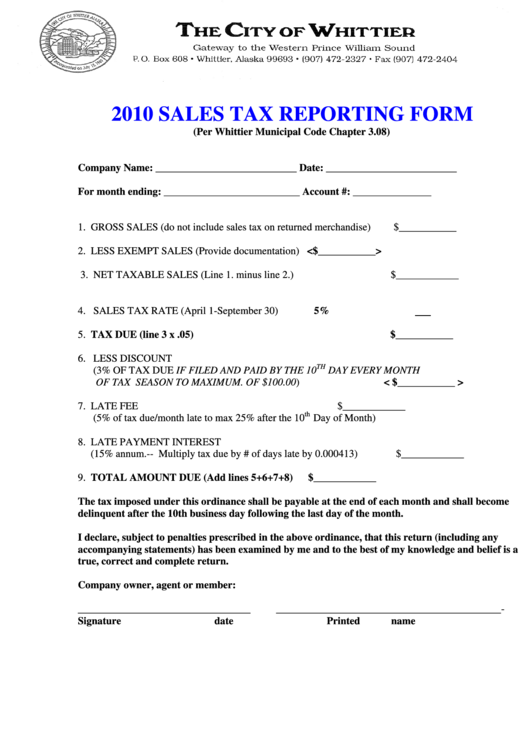

2010 SALES TAX REPORTING FORM

(Per Whittier Municipal Code Chapter 3.08)

Company Name: ___________________________ Date: _________________________

For month ending: __________________________

Account #: _______________

1. GROSS SALES (do not include sales tax on returned merchandise)

$___________

2. LESS EXEMPT SALES (Provide documentation)

<$___________>

3. NET TAXABLE SALES (Line 1. minus line 2.)

$____________

4. SALES TAX RATE (April 1-September 30)

5%

5. TAX DUE (line 3 x .05)

$___________

6. LESS DISCOUNT

TH

(3% OF TAX DUE IF FILED AND PAID BY THE 10

DAY EVERY MONTH

OF TAX SEASON TO MAXIMUM. OF $100.00)

< $___________ >

7. LATE FEE

$____________

th

(5% of tax due/month late to max 25% after the 10

Day of Month)

8. LATE PAYMENT INTEREST

(15% annum.-- Multiply tax due by # of days late by 0.000413)

$____________

9. TOTAL AMOUNT DUE (Add lines 5+6+7+8)

$____________

The tax imposed under this ordinance shall be payable at the end of each month and shall become

delinquent after the 10th business day following the last day of the month.

I declare, subject to penalties prescribed in the above ordinance, that this return (including any

accompanying statements) has been examined by me and to the best of my knowledge and belief is a

true, correct and complete return.

Company owner, agent or member:

_________________________________

___________________________________________-

Signature

date

Printed name

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1