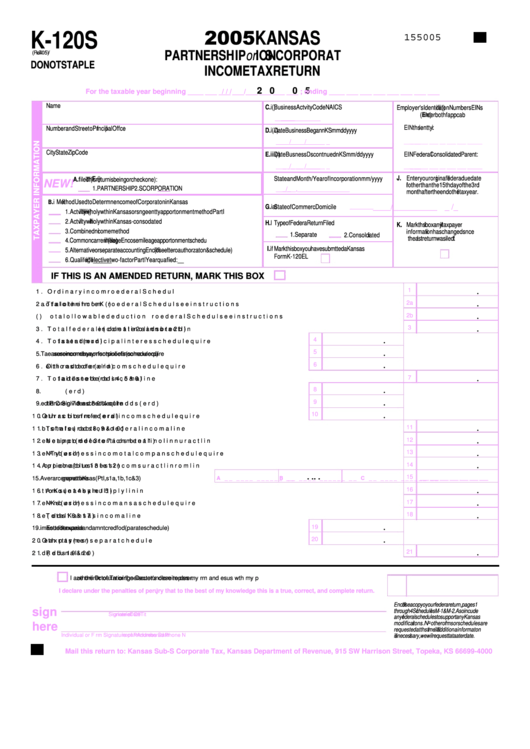

Form K-120s Partnership Of S Corporation Income Tax Return 2005 Kansas

ADVERTISEMENT

2005 KANSAS

K-120S

155005

(R . 7 05)

ev

/

PARTNERSH

IP or

S CORPORAT

ION

DO NOT STAPLE

INCOME TAX RETURN

2 0 0 5

For the taxable year beginning ____ ___ ___ ___/___ ___ ___ ___ ; ending ____ ___ ___ ___ ___ ___ ___ ___

/

/

/

Name

C.

Business Act vity Code NAICS

i

(

)

Employer's Ident cat on Numbers EINs

ifi

i

(

)

(

Enter both f app cab

i

li

le)

__

_ _ _ _ _ ___ ___ _

_

_

__

EIN th s ent ty:

i

i

Number and Street o Pr ncipal Off ce

f i

i

D.

Date Business Began n KS mm dd yyyy

i

(

/ /

)

__

_ _

__ / __

_ _

__/__

_ ___ ___ _

__

__

_ _ _ _ _ ___ _ _ ___ ___ ___ __

_

_

_

_

City

State

Zip Code

E.

Date Bus ness D scont nued n KS mm/dd yyyy

i

i

i

i

(

/

)

EI

N Federa Consolidated Parent:

l

__

_ _

__ / __

_ _

__/__

_ ___ ___ _

__

__

_ _ _ _ _ ___ _ _ ___ ___ ___ __

_

_

_

_

J.

Enter your or gina federa due date

i

l

l

F.

State and Month/Year of Incorporation mm/yyyy

(

)

A.

This return is being

filed f (

or check one):

NEW!

i

f other than the 15th day of the 3rd

1. PARTNERSHIP

2. S CORPORATION

__

_ ___ , ___ __

_ /

___ ___ ___ __

_

month after the end o the tax year.

f

B

.

Method Used to Determ ne ncome of Corporat on in Kansas

i

I

i

___ ___

G.

State of Commerc Domicile

ial

__ __ /__ _

_ /_

_ __ __ __

1. Act vity whol y w thin Kansas or s ng e ent ty apport onment method Part I

i

l

i

i l

i

i

(

)

2. Act vity whol y w thin Kansas - conso dated

i

l

i

li

H.

Type of Federa Return Filed

l

Mark th s box any taxpayer

i

if

K.

3. Combined ncome method

i

i

nformat on has changed s nce

i

i

1. Separate

2. Consol dated

i

the ast return was iled.

l

f

4. Common carr er m eage Enc ose mileage apport onment schedu

i

il

(

l

i

le)

I.

Mark this box you have subm tted a Kansas

if

i

5. Alternative or separate accounting Enclose etter o author zat on & schedule)

(

l

f

i

i

Form K-120EL

6. Qualif ed elective two-factor Part I Year qua fied:

i

(

)

li

__ __

__

__

IF THIS IS AN AMENDED RETURN, MARK THIS BOX

.

1

1. Ordinary incom

e f m f

ro

ederal Schedul

e K. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

2a

2a

. T

otal o

f a l oth

l

er incom

e f m f

ro

ederal Schedul

e K (

see instructions

) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

2b

2b. T

otal o

f a

llowable deduction

s f m f

ro

ederal Schedul

e K (

see instructions

) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

3

3. Total federal incom

e ( dd

a

lin

e 1 t

o lin

e 2a a d s bt

n

u ract lin

e 2b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

4

4. Tota

l st e a

at

nd municipal interes schedul

t (

e r

equire

d). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

5

5. Ta

xes on or m

easure

d by

incom

e or f

ee

s or p

ayments in lie

u o

f incom

e t

axe

s (schedule r

equire

d)

.

6

6.

Oth r add

e

itions t

o f

ederal incom

e (

schedul

e r

equire

d). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

7

7. Tota

l add

ition

s to f

ederal incom

e ( dd

a

line

s 4, 5 & 6). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

8

8. Interes

t on U . g

.S

overnmen

t o

bligation

s (

schedul

e r

equire

d). . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

9

9.

IRC S

ectio

n 78 a d 80% of f

n

oreig

n d

ividen

ds (

schedul

e r

equire

d) . . . . . . . . . . . . . . . . . . . . . . . . .

.

10

10

.

Oth r s bt

e

u raction ro

s f m f

ederal incom

e (

schedul

e r

equire

d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

11

11

. Total su raction

bt

s f m f

ro

ederal incom

e ( dd

a

line

s 8, 9 & 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

12

12

. Net incom

e b

efor

e app

ortionmen a

t ( dd

lin

e 3 t

o lin

e 7 a d s bt

n

u ract lin

e 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

13

13

. Nonbusiness incom

e - T

otal compan

y (

schedul

e r

equire

d). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

14

14

.

App

ortionabl

e b

usiness incom

e (

su ract lin

bt

e 13 f

rom lin

e 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

.

.

.

15

___ ___ ___

___ ___ ___ ___

15. Avera

ge pe

rcen

t to K

an

sas (P t I,

ar

line

s 1a, 1b, 1c & 3) . . . . .

A __ __ __

__ __ __ __

B __ __ __

__ __ __ __ C __ __ __

__ __ __ __

.

16

16

. Amoun

t to K

ansa

s (

multiply lin

e 14 by l e 15). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

in

.

17

17

. Nonbusiness incom

e - K

ansa

s (

schedul

e r

equire

d). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

18

18

. Total Kansas incom

e ( dd

a

line

s 16 & 17). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

19

19.

Est

ima

ted tax paid and am

ou

nt cre

dite

d fo

rwar

d (

se

parate schedule) . . . . . . . . . . . . . . . . . . . . . .

.

20

20

.

Oth r t

e ax paymen

ts (

separat

e s

chedule

) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

21

21

. Refun

d ( dd

a

line

s 19 & 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I a

uthori

ze the D

irecto

r of T

axatio

n or the D ector's des

ir

igne

e to d

iscu

ss my r

etu

rn and e

nclo

su s w th my p

re

i

reparer.

I declare under the penalties of per ury that to the best of my knowledge this is a true, correct, and complete return.

j

Enc ose a copy o your federa return, pages 1

l

f

l

sign

through 4 Schedules M-1 & M-2. A so inc ude

l

l

Si

gnat e of Off

ur

icer

Tit

le

Date

any ederal schedules to support any Kansas

f

modificat ons. No other orms or schedules are

i

f

here

requested at th s t me.

i i

If

additiona informat on

l

i

Individual or F rm Signature of P

i

reparer

Address a d Phone N

n

umber

Date

i

s necessary, we wil request t at a ater date.

l

i

l

Mail this return to: Kansas Sub-S Corporate Tax, Kansas Department of Revenue, 915 SW Harrison Street, Topeka, KS 66699-4000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2