2005 City Of Falls Church Monthly Meals Tax Report Form

ADVERTISEMENT

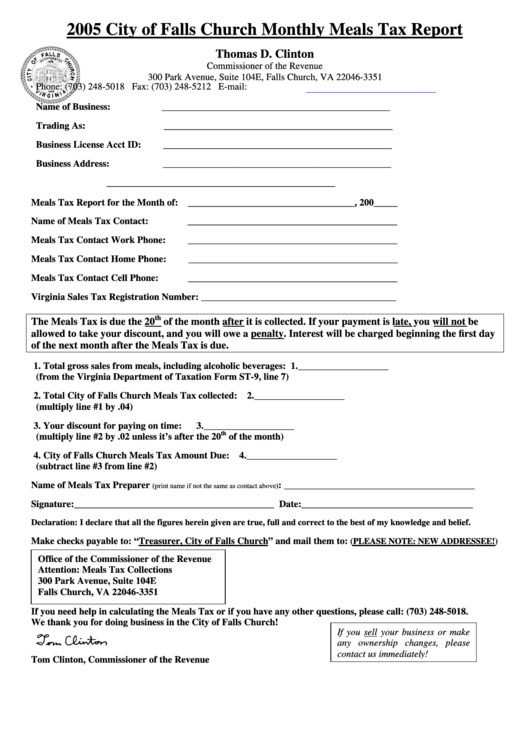

2005 City of Falls Church Monthly Meals Tax Report

Thomas D. Clinton

Commissioner of the Revenue

300 Park Avenue, Suite 104E, Falls Church, VA 22046-3351

Phone: (703) 248-5018 Fax: (703) 248-5212 E-mail:

commissioner@fallschurchva.gov

Name of Business:

________________________________________________

Trading As:

________________________________________________

Business License Acct ID:

________________________________________________

Business Address:

________________________________________________

________________________________________________

Meals Tax Report for the Month of: ___________________________________, 200_____

Name of Meals Tax Contact:

____________________________________________

Meals Tax Contact Work Phone:

____________________________________________

Meals Tax Contact Home Phone:

____________________________________________

Meals Tax Contact Cell Phone:

____________________________________________

Virginia Sales Tax Registration Number: _________________________________________

th

The Meals Tax is due the 20

of the month after it is collected. If your payment is late, you will not be

allowed to take your discount, and you will owe a penalty. Interest will be charged beginning the first day

of the next month after the Meals Tax is due.

1. Total gross sales from meals, including alcoholic beverages:

1.___________________

(from the Virginia Department of Taxation Form ST-9, line 7)

2. Total City of Falls Church Meals Tax collected:

2.___________________

(multiply line #1 by .04)

3. Your discount for paying on time:

3.___________________

th

(multiply line #2 by .02 unless it’s after the 20

of the month)

4. City of Falls Church Meals Tax Amount Due:

4.___________________

(subtract line #3 from line #2)

Name of Meals Tax Preparer

: ________________________________________

(print name if not the same as contact above)

Signature:__________________________________________ Date:____________________________________

Declaration: I declare that all the figures herein given are true, full and correct to the best of my knowledge and belief.

Make checks payable to: “Treasurer, City of Falls Church” and mail them to:

(PLEASE NOTE: NEW ADDRESSEE!)

Office of the Commissioner of the Revenue

Attention: Meals Tax Collections

300 Park Avenue, Suite 104E

Falls Church, VA 22046-3351

If you need help in calculating the Meals Tax or if you have any other questions, please call: (703) 248-5018.

We thank you for doing business in the City of Falls Church!

If you sell your business or make

any ownership changes, please

contact us immediately!

Tom Clinton, Commissioner of the Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1