Form Ct-31 - Cigarette And Unaffixed Stamp Inventory Report For Resident Distributors

ADVERTISEMENT

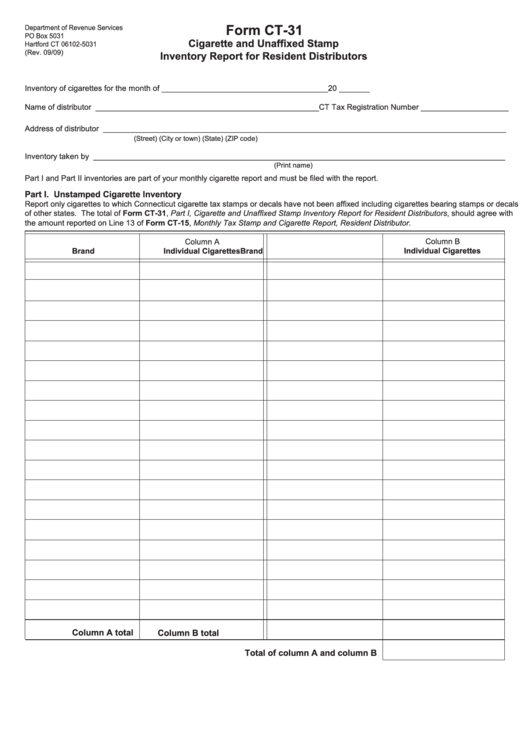

Form CT-31

Department of Revenue Services

PO Box 5031

Cigarette and Unaffixed Stamp

Hartford CT 06102-5031

(Rev. 09/09)

Inventory Report for Resident Distributors

Inventory of cigarettes for the month of ______________________________________ 20 _______

Name of distributor ___________________________________________________ CT Tax Registration Number ____________________

Address of distributor ____________________________________________________________________________________________

(Street)

(City or town)

(State)

(ZIP code)

Inventory taken by ______________________________________________________________________________________________

(Print name)

Part I and Part II inventories are part of your monthly cigarette report and must be filed with the report.

Part I. Unstamped Cigarette Inventory

Report only cigarettes to which Connecticut cigarette tax stamps or decals have not been affixed including cigarettes bearing stamps or decals

of other states. The total of Form CT-31, Part I, Cigarette and Unaffixed Stamp Inventory Report for Resident Distributors, should agree with

the amount reported on Line 13 of Form CT-15, Monthly Tax Stamp and Cigarette Report, Resident Distributor.

Column A

Column B

Brand

Individual Cigarettes

Brand

Individual Cigarettes

Column A total

Column B total

Total of column A and column B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2