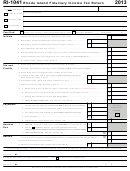

Form Ri-1041 - Rhode Island Fiduciary Income Tax Return - 2008 Page 3

ADVERTISEMENT

RI-1041

2008

FIDUCIARY ALTERNATIVE MINIMUM TAX

Name of Estate or Trust

Federal Identification Number

PART 1

ALTERNATIVE MINIMUM TAX

1.

1.

Federal Alternative Minimum Taxable Income from Federal Form 1041, Schedule I, line 29.........................................................

2.

2.

Exemption - If line 1 is LESS than $84,050; enter $25,200. Otherwise, complete the exemption worksheet on page 12 ...........

3.

Subtract line 2 from line 1................................................................................................................................................................

3.

4.

If you figured the tax on RI-1041, Schedule D, complete part 2 and enter the amount from line 47 here. If you figured the tax

using the fiduciary tax rate schedule and line 3 is less than $175,000 then multiply line 3 by 6.5% (.0650). Otherwise, multi-

ply line 3 by 7% (.0700) and subtract $875 from the result.............................................................................................................

4.

5.

RI tax from RI-1041, page 1, line 8A.................................................................................................................................................

5.

6.

6.

RI Alternative minimum tax - subtract line 5 from line 4

(If zero or less, enter

zero). Enter here and on RI-1041, page 1, line 9.

PART 2

ALTERNATIVE MINIMUM TAX USING MAXIMUM CAPITAL GAINS RATES

PRIMARY TAX CALCULATION

7.

Enter the amount from line 3 above................................................................................................................................................

7.

8.

Enter the amount from RI-1041 Schedule D Tax WORKSHEET, line 34

(refigured for AMT, if necessary)

............................................................

8.

9.

Enter the amount from RI-1041 Schedule D Tax WORKSHEET, line 32

(refigured for AMT, if necessary)

.............................................................

9.

10.

Enter the amount from RI-1041 Schedule D, line 24, column (e)

(refig-

10.

ured for AMT, if necessary)

.....................................................................

11.

Add lines 8, 9 and 10 ... .........................................................................

11.

Enter the amount from RI-1041 Schedule D Tax WORKSHEET, line 29

12.

(refigured for AMT, if necessary)

............................................................. 12.

13.

Enter the SMALLER of line 11 or line 12 ............................................... 13.

14.

14.

Enter the SMALLER of line 7 or line 13 ...............................................

15.

Subtract line 14 from line 7

(If zero or less, enter

zero.)...................................................................

15.

16.

If line 15 is less than $175,000 then multiply line 15 by 6.5% (.0650). Otherwise, multiply line 15 by 7% (.0700) and subtract

$875 from the result........................................................................................................................................................................

16.

2.5% BRACKET

17.

Enter the amount from RI-1041 Schedule D Tax WORKSHEET, line 41

(refigured for AMT, if necessary)

.............................................................

17.

18.

Enter the amount from RI-1041 Schedule D Tax WORKSHEET, line 42

(refigured for AMT, if necessary)

.............................................................

18.

19.

Enter the SMALLER of line 17 or line 18.............................................................................................

19.

20.

Multiply line 19 by .83% (.0083).......................................................................................................................................................

20.

21.

Subtract line 18 from line 17

(If zero or less, enter zero.)

...................................................................

21.

22.

Multiply line 21 by 2.5% (.0250) ......................................................................................................................................................

22.

CONTINUED ON NEXT PAGE

Page 10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5