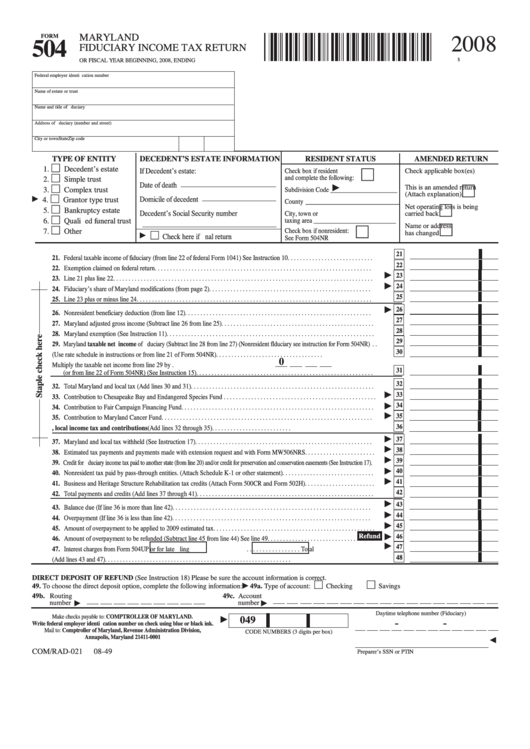

MARYLAND

FORM

2008

504

FIDUCIARY INCOME TAX RETURN

OR FISCAL YEAR BEGINNING

, 2008, ENDING

$

Federal employer identification number

Name of estate or trust

Name and title of fiduciary

Address of fiduciary (number and street)

City or town

State

Zip code

TYPE OF ENTITY

DECEDENT’S ESTATE INFORMATION

RESIDENT STATUS

AMENDED RETURN

1.

Decedent’s estate

If Decedent’s estate:

Check box if resident

Check applicable box(es)

and complete the following:

2.

Simple trust

Date of death

This is an amended return

3.

Complex trust

Subdivision Code __________________________________

(Attach explanation)

Domicile of decedent

4.

Grantor type trust

County ________________________________________________

Net operating loss is being

5.

Bankruptcy estate

Decedent’s Social Security number

City, town or

carried back

taxing area __________________________________________

6.

Qualified funeral trust

Name or address

7.

Other

Check box if nonresident:

has changed

Check here if final return

See Form 504NR

21

21. Federal taxable income of fiduciary (from line 22 of federal Form 1041) See Instruction 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

22. Exemption claimed on federal return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

23. Line 21 plus line 22 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

24. Fiduciary’s share of Maryland modifications (from page 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

25. Line 23 plus or minus line 24 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

26. Nonresident beneficiary deduction (from line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

27. Maryland adjusted gross income (Subtract line 26 from line 25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

28. Maryland exemption (See Instruction 11). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

29. Maryland taxable net income of fiduciary (Subtract line 28 from line 27) (Nonresident fIduciary see instruction for Form 504NR). .

30

30. Maryland tax (Use rate schedule in instructions or from line 21 of Form 504NR) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

0

31. Local or special nonresident tax Multiply the taxable net income from line 29 by .

31

(or from line 22 of Form 504NR) (See Instruction 15). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32

32. Total Maryland and local tax (Add lines 30 and 31). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33

33. Contribution to Chesapeake Bay and Endangered Species Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34

34. Contribution to Fair Campaign Financing Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

35

35. Contribution to Maryland Cancer Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

36

36. Total Maryland income tax, local income tax and contributions (Add lines 32 through 35). . . . . . . . . . . . . . . . . . . . . . . . . .

37

37. Maryland and local tax withheld (See Instruction 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

38

38. Estimated tax payments and payments made with extension request and with Form MW506NRS . . . . . . . . . . . . . . . . . . . . . . .

39

39. Credit for fiduciary income tax paid to another state (from line 20) and/or credit for preservation and conservation easements (See Instruction 17) .

40

40. Nonresident tax paid by pass-through entities. (Attach Schedule K-1 or other statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

41

41. Business and Heritage Structure Rehabilitation tax credits (Attach Form 500CR and Form 502H) . . . . . . . . . . . . . . . . . . . . . . .

42

42. Total payments and credits (Add lines 37 through 41) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

43

43. Balance due (If line 36 is more than line 42) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

44

44. Overpayment (If line 36 is less than line 42) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

45

45. Amount of overpayment to be applied to 2009 estimated tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Refund

46

46. Amount of overpayment to be refunded (Subtract line 45 from line 44) See line 49 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

47

47. Interest charges from Form 504UP

or for late filing

. . . . . . . . . . . . . . . . . Total

48

48. TOTAL AMOUNT DUE (Add lines 43 and 47) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

DIRECT DEPOSIT OF REFUND (See Instruction 18) Please be sure the account information is correct.

49. To choose the direct deposit option, complete the following information:

49a. Type of account:

Checking

Savings

49b. Routing

49c. Account

number

number

Daytime telephone number

(Fiduciary)

Make checks payable to: COMPTROLLER OF MARYLAND.

049

-

-

Write federal employer identification number on check using blue or black ink.

Mail to: Comptroller of Maryland, Revenue Administration Division,

CODE NUMBERS (3 digits per box)

Annapolis, Maryland 21411-0001

COM/RAD-021

08-49

Preparer’s SSN or PTIN

1

1 2

2 3

3