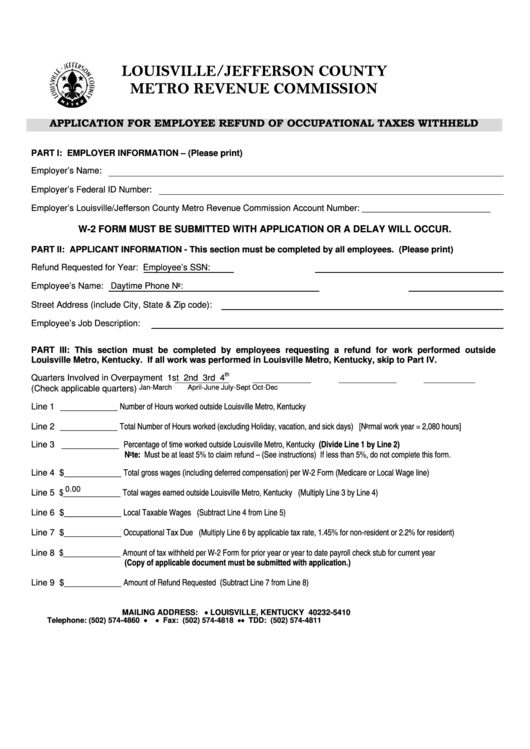

LOUISVILLE/JEFFERSON COUNTY

METRO REVENUE COMMISSION

APPLICATION FOR EMPLOYEE REFUND OF OCCUPATIONAL TAXES WITHHELD

PART I: EMPLOYER INFORMATION – (Please print)

Employer’s Name:

Employer’s Federal ID Number:

Employer’s Louisville/Jefferson County Metro Revenue Commission Account Number: ___________________________

W-2 FORM MUST BE SUBMITTED WITH APPLICATION OR A DELAY WILL OCCUR.

PART II: APPLICANT INFORMATION - This section must be completed by all employees. (Please print)

Refund Requested for Year:

Employee’s SSN:

Employee’s Name:

Daytime Phone No:

Street Address (include City, State & Zip code):

Employee’s Job Description:

PART III: This section must be completed by employees requesting a refund for work performed outside

Louisville Metro, Kentucky. If all work was performed in Louisville Metro, Kentucky, skip to Part IV.

th

Quarters Involved in Overpayment

1st

2nd

3rd

4

(Check applicable quarters)

Jan-March

April-June

July-Sept

Oct-Dec

Line 1 ____________ Number of Hours worked outside Louisville Metro, Kentucky

Line 2 ____________ Total Number of Hours worked (excluding Holiday, vacation, and sick days) [Normal work year = 2,080 hours]

Line 3 ____________ Percentage of time worked outside Louisville Metro, Kentucky (Divide Line 1 by Line 2)

Note: Must be at least 5% to claim refund – (See instructions) If less than 5%, do not complete this form.

Line 4 $____________ Total gross wages (including deferred compensation) per W-2 Form (Medicare or Local Wage line)

0.00

Line 5 $____________ Total wages earned outside Louisville Metro, Kentucky (Multiply Line 3 by Line 4)

Line 6 $____________ Local Taxable Wages (Subtract Line 4 from Line 5)

Line 7 $____________ Occupational Tax Due (Multiply Line 6 by applicable tax rate, 1.45% for non-resident or 2.2% for resident)

Line 8 $____________ Amount of tax withheld per W-2 Form for prior year or year to date payroll check stub for current year

(Copy of applicable document must be submitted with application.)

Line 9 $____________ Amount of Refund Requested (Subtract Line 7 from Line 8)

MAILING ADDRESS: P.O. BOX 35410 • LOUISVILLE, KENTUCKY 40232-5410

Telephone: (502) 574-4860 •

• Fax: (502) 574-4818 • • TDD: (502) 574-4811

1

1 2

2