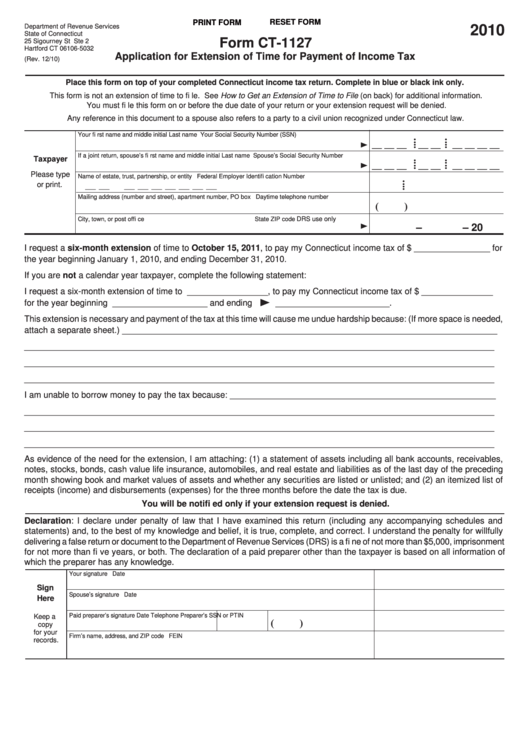

RESET FORM

PRINT FORM

Department of Revenue Services

2010

State of Connecticut

Form CT-1127

25 Sigourney St Ste 2

Hartford CT 06106-5032

Application for Extension of Time for Payment of Income Tax

(Rev. 12/10)

Place this form on top of your completed Connecticut income tax return. Complete in blue or black ink only.

This form is not an extension of time to fi le. See How to Get an Extension of Time to File (on back) for additional information.

You must fi le this form on or before the due date of your return or your extension request will be denied.

Any reference in this document to a spouse also refers to a party to a civil union recognized under Connecticut law.

Your fi rst name and middle initial

Last name

Your Social Security Number (SSN)

__ __ __

__ __ __ __ __ __

• •

• •

• •

• •

If a joint return, spouse’s fi rst name and middle initial

Last name

Spouse’s Social Security Number

Taxpayer

__ __ __

__ __ __ __ __ __

• •

• •

• •

• •

Please type

Name of estate, trust, partnership, or entity

Federal Employer Identifi cation Number

• •

or print.

__ __

__ __ __ __ __ __ __

• •

Mailing address (number and street), apartment number, PO box

Daytime telephone number

(

)

DRS use only

City, town, or post offi ce

State

ZIP code

–

– 20

I request a six-month extension of time to October 15, 2011, to pay my Connecticut income tax of $ ________________ for

the year beginning January 1, 2010, and ending December 31, 2010.

If you are not a calendar year taxpayer, complete the following statement:

I request a six-month extension of time to _________________ , to pay my Connecticut income tax of $ _______________

for the year beginning ____________________ and ending ________________________.

This extension is necessary and payment of the tax at this time will cause me undue hardship because: (If more space is needed,

attach a separate sheet.) _______________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

I am unable to borrow money to pay the tax because: ________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

As evidence of the need for the extension, I am attaching: (1) a statement of assets including all bank accounts, receivables,

notes, stocks, bonds, cash value life insurance, automobiles, and real estate and liabilities as of the last day of the preceding

month showing book and market values of assets and whether any securities are listed or unlisted; and (2) an itemized list of

receipts (income) and disbursements (expenses) for the three months before the date the tax is due.

You will be notifi ed only if your extension request is denied.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and

statements) and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully

delivering a false return or document to the Department of Revenue Services (DRS) is a fi ne of not more than $5,000, imprisonment

for not more than fi ve years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of

which the preparer has any knowledge.

Your signature

Date

Sign

Spouse’s signature

Date

Here

Paid preparer’s signature

Date

Telephone

Preparer’s SSN or PTIN

Keep a

(

)

copy

for your

Firm’s name, address, and ZIP code

FEIN

records.

1

1