Income Tax Return Form - The Village Of Deshler

ADVERTISEMENT

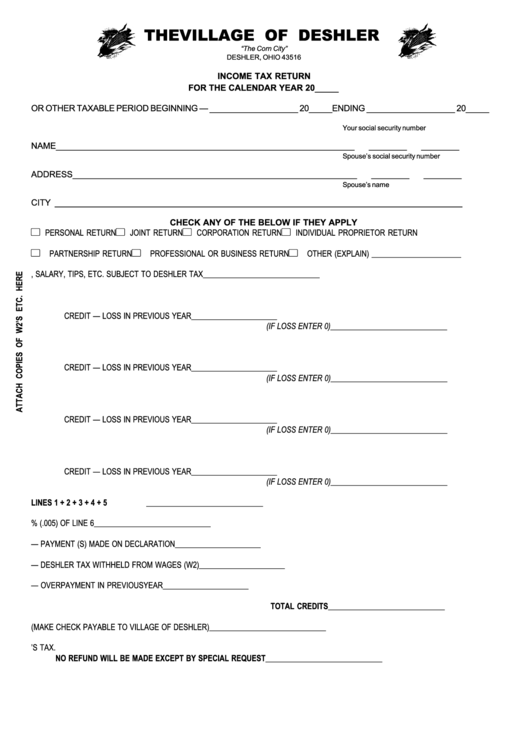

THE VILLAGE OF DESHLER

“The Corn City”

DESHLER, OHIO 43516

INCOME TAX RETURN

FOR THE CALENDAR YEAR 20_____

OR OTHER TAXABLE PERIOD BEGINNING — ___________________ 20_____ ENDING ___________________ 20_____

Your social security number

NAME _______________________________________________________

________

________

________

Spouse’s social security number

ADDRESS ____________________________________________________

________

________

________

Spouse’s name

CITY ________________________________________________________

______________________________

CHECK ANY OF THE BELOW IF THEY APPLY

L PERSONAL RETURN

L JOINT RETURN

L CORPORATION RETURN

L INDIVIDUAL PROPRIETOR RETURN

L PARTNERSHIP RETURN

L PROFESSIONAL OR BUSINESS RETURN

L OTHER (EXPLAIN) _______________________

1.

WAGES, SALARY, TIPS, ETC. SUBJECT TO DESHLER TAX

______________________________

2.

NET PROFIT FROM RENTALS

______________________

CREDIT — LOSS IN PREVIOUS YEAR

______________________

(IF LOSS ENTER 0)

______________________________

3.

NET PROFIT FROM FARMING

______________________

CREDIT — LOSS IN PREVIOUS YEAR

______________________

(IF LOSS ENTER 0)

______________________________

4.

NET PROFIT FROM BUSINESS OR PROFESSION

______________________

CREDIT — LOSS IN PREVIOUS YEAR

______________________

(IF LOSS ENTER 0)

______________________________

5.

NET PROFIT FROM PARTNERSHIPS ETC.

______________________

CREDIT — LOSS IN PREVIOUS YEAR

______________________

(IF LOSS ENTER 0)

______________________________

6.

TOTAL INCOME SUBJECT TO DESHLER INCOME TAX

LINES 1 + 2 + 3 + 4 + 5

______________________________

7.

DESHLER TAX 1/2% (.005) OF LINE 6

______________________________

8.

CREDIT — PAYMENT (S) MADE ON DECLARATION

______________________

9.

CREDIT — DESHLER TAX WITHHELD FROM WAGES (W2) ______________________

10. CREDIT — OVERPAYMENT IN PREVIOUS YEAR

______________________

TOTAL CREDITS

______________________________

11. BALANCE OF TAX DUE (MAKE CHECK PAYABLE TO VILLAGE OF DESHLER)

______________________________

12. ENTER OVERPAYMENT HERE FOR CREDIT ON NEXT YEAR’S TAX.

NO REFUND WILL BE MADE EXCEPT BY SPECIAL REQUEST

______________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2