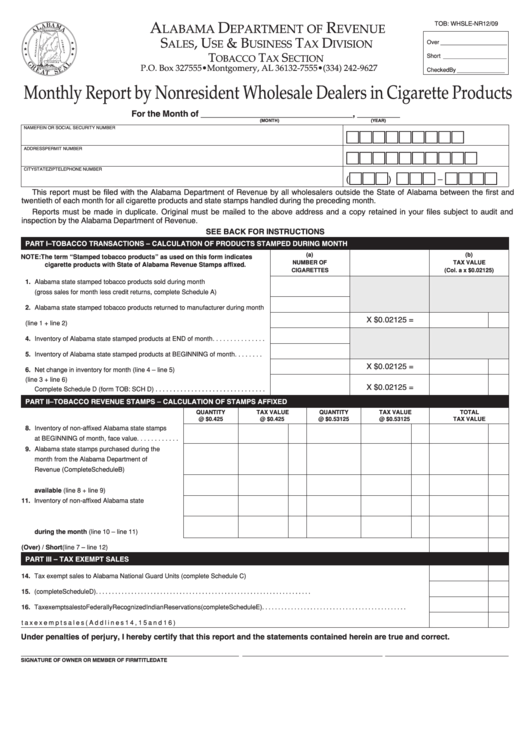

A

D

R

TOB: WHSLE-NR

12/09

LABAMA

EPARTMENT OF

EVENUE

S

, U

& B

T

D

Over _____________________

ALES

SE

USINESS

AX

IVISION

Reset

T

T

S

Short ____________________

OBACCO

AX

ECTION

P.O. Box 327555 • Montgomery, AL 36132-7555 • (334) 242-9627

Checked By _______________

Monthly Report by Nonresident Wholesale Dealers in Cigarette Products

For the Month of ________________________________, _________

(MONTH)

(YEAR)

NAME

FEIN OR SOCIAL SECURITY NUMBER

ADDRESS

PERMIT NUMBER

CITY

STATE

ZIP

TELEPHONE NUMBER

(

)

–

This report must be filed with the Alabama Department of Revenue by all wholesalers outside the State of Alabama between the first and

twentieth of each month for all cigarette products and state stamps handled during the preceding month.

Reports must be made in duplicate. Original must be mailed to the above address and a copy retained in your files subject to audit and

inspection by the Alabama Department of Revenue.

SEE BACK FOR INSTRUCTIONS

PART I – TOBACCO TRANSACTIONS – CALCULATION OF PRODUCTS STAMPED DURING MONTH

(a)

(b)

NOTE: The term “Stamped tobacco products” as used on this form indicates

NUMBER OF

TAX VALUE

cigarette products with State of Alabama Revenue Stamps affixed.

CIGARETTES

(Col. a x $0.02125)

1. Alabama state stamped tobacco products sold during month

(gross sales for month less credit returns, complete Schedule A). . . . . . . . . . . . . .

2. Alabama state stamped tobacco products returned to manufacturer during month

X $0.02125 =

3. TOTAL (line 1 + line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Inventory of Alabama state stamped products at END of month. . . . . . . . . . . . . . .

5. Inventory of Alabama state stamped products at BEGINNING of month . . . . . . . .

X $0.02125 =

6. Net change in inventory for month (line 4 – line 5) . . . . . . . . . . . . . . . . . . . . . . . . .

7. TOTAL PRODUCTS STAMPED (line 3 + line 6)

X $0.02125 =

Complete Schedule D (form TOB: SCH D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART II – TOBACCO REVENUE STAMPS – CALCULATION OF STAMPS AFFIXED

QUANTITY

TAX VALUE

QUANTITY

TAX VALUE

TOTAL

@ $0.425

@ $0.425

@ $0.53125

@ $0.53125

TAX VALUE

8. Inventory of non-affixed Alabama state stamps

at BEGINNING of month, face value . . . . . . . . . . . .

9. Alabama state stamps purchased during the

month from the Alabama Department of

Revenue (Complete Schedule B) . . . . . . . . . . . . . . .

10. TOTAL Alabama state stamps

0

0

available (line 8 + line 9) . . . . . . . . . . . . . . . . . . . . .

11. Inventory of non-affixed Alabama state

stamps at END of month. . . . . . . . . . . . . . . . . . . . . .

12. TOTAL Alabama state stamps affixed

0

during the month (line 10 – line 11) . . . . . . . . . . . .

0

13. Net (Over) / Short (line 7 – line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

PART III – TAX EXEMPT SALES

14. Tax exempt sales to Alabama National Guard Units (complete Schedule C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15. Tax exempt sales to U.S. Government (complete Schedule D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16. Tax exempt sales to Federally Recognized Indian Reservations (complete Schedule E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17. TOTAL tax exempt sales (Add lines 14, 15 and 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Under penalties of perjury, I hereby certify that this report and the statements contained herein are true and correct.

SIGNATURE OF OWNER OR MEMBER OF FIRM

TITLE

DATE

1

1 2

2 3

3 4

4